Key Takeaways

- Today’s 3% fall has pushed Bitcoin (BTC) below the 200 EMA and the key support level of $107,700.

- Price action suggests that BTC may reach the $100,000 mark if it remains below the $109,500 level.

- Traders have built $2.33 billion worth of short positions at $109,458, showing a strong belief that the price won’t cross this level anytime soon.

Today, with a 3% price dip, Bitcoin (BTC) not only continued its bearish streak for the fourth consecutive day but also fell below a key support level of $107,700 and the 200 EMA. The factors driving this downward momentum appear to be the ongoing trade war between China and the US, along with mass institutional dumping recorded today.

Here’s Why Bitcoin Price is Falling

Recently, crypto experts shared posts on X revealing Bitcoin transactions by major institutions, including Wintermute and BlackRock.

In a post on X, the expert reported that BlackRock is dumping its holdings and recently sold $1 billion worth of Bitcoin. However, the asset management giant still holds $89 billion worth of BTC.

Another expert noted that Wintermute is sending millions of dollars worth of Bitcoin to exchanges. In the crypto landscape, transferring assets from wallets to exchanges is considered a sign of a potential sell-off.

The expert further mentioned that the last time Wintermute sent Bitcoin to exchanges, the price dropped sharply. This now raises questions about whether the price will continue its bearish trend or if a reversal could be on the horizon.

Another factor strongly influencing the downward momentum is China’s accusation against the United States of causing panic over rare earth metal controls, even though China has expressed readiness for dialogue.

Current Price Momentum

At press time, Bitcoin is trading at $105,700, reflecting a 3% price dip, according to TradingView data. However, during the same period, market participants have shown strong interest, as trading volume surged by 60% to $113.62 billion.

This rising trading volume amid a continuing price decline appears to be a red flag for the asset, as it indicates that market participants are more interested in pushing the price to lower levels.

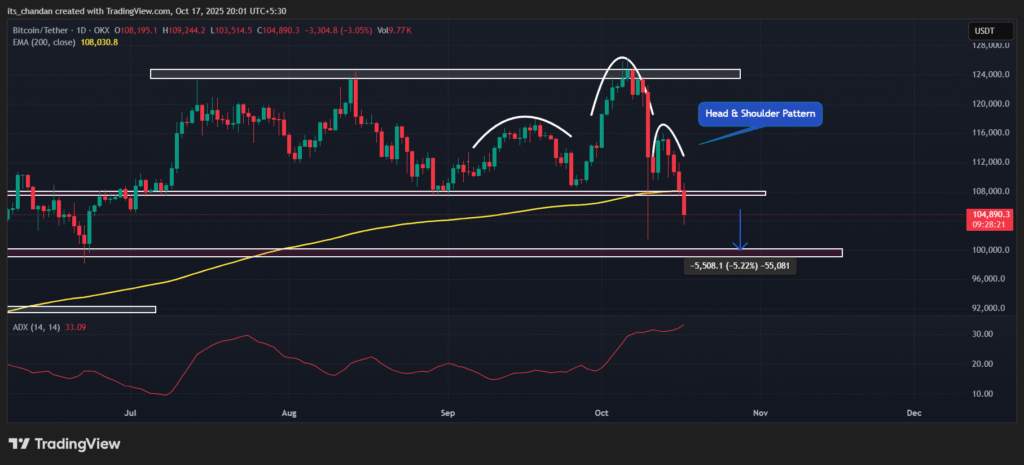

You might be wondering what’s next for Bitcoin, as the price has fallen below the 200 EMA and the key support level of $107,700 for the first time in six months and four months, respectively.

Bitcoin Technical Outlook: Key Levels To Watch

According to TimesCrypto’s technical analysis, Bitcoin has turned bearish and is poised to continue its downward momentum. Along with the breakdown of the 200 EMA and key support, BTC has also broken out of a Head and Shoulders pattern, which appears on the daily chart.

Adding to the bearish strength, BTC’s Average Directional Index (ADX) has reached 33 (values above 25 typically indicate a strong trend), indicating strong downward momentum and further reinforcing the bearish outlook.

Based on the current price action, following the breakdown, there is a strong possibility that Bitcoin could decline by 5.35% and may reach the psychological level of $100,000.

This bearish outlook remains valid as long as BTC stays below the $109,500 level; if it breaks above, the outlook would be invalidated.

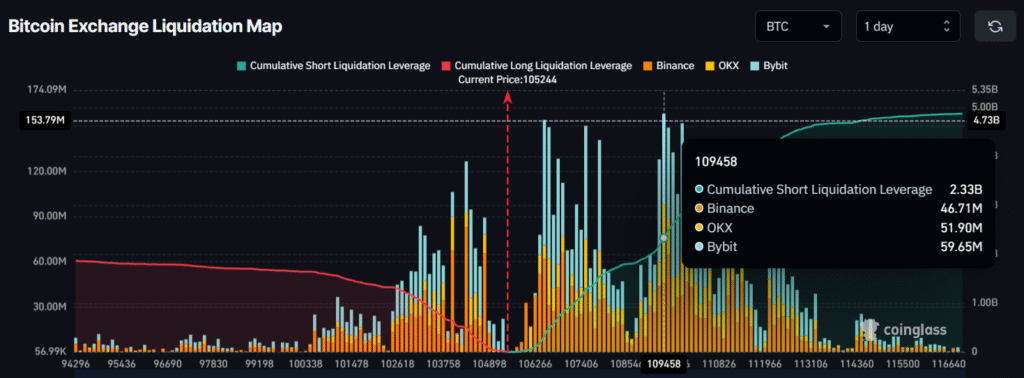

Bitcoin’s Major Liquidation Levels

Derivative analytics platform Coinglass reveals that traders are following the same trend, betting billions on short positions. According to the latest data, BTC’s major liquidation levels stand at $104,328 on the lower side and $109,458 on the upper side.

At these levels, traders have built $525 million worth of long positions and $2.33 billion worth of short positions. These metrics indicate that bears are dominating Bitcoin while bulls appear to be exhausted.