Key Takeaways

- The Bitcoin price might crash again, as whales who made millions in profits during the previous crash have begun shorting BTC.

- Price action suggests that if BTC fails to close above $117K, it could either decline or enter a period of sideways movement.

- An expert made a bold prediction, noting that Bitcoin’s weekly chart is flashing a bearish divergence, signaling the potential end of the current run.

It seems that the Bitcoin price might crash again, as the whales who made $160 million and $190 million in profits on Friday during the historic crash have once again begun betting on the short side. On X, a crypto transaction tracker, Lookonchain and CryptoRover reported that the Bitcoin OGs are increasing their bets on BTC shorts.

Bitcoin Whale Activity and Surge In Short Positions

Lookonchain data reveals that a whale recently deposited 40 million USDC into Hyperliquid and increased its short position to 1,823 BTC, worth $208 million, with liquidation set at the $121,000 level. This indicates that Bitcoin whales are confident that BTC’s price will not surpass the $121,000 mark in the coming days.

Meanwhile, another whale, known as the “Trump Insider Whale,” is currently holding a short position of $342 million on BTC, with a liquidation level at $130,452.64.

Both of these recently shared tweets on X gained widespread attention from crypto enthusiasts and spread like wildfire. An expert commented that this whale might either have insider information or could simply be farming liquidations at this point.

Bitcoin Price Momentum Weakens

It seems that Bitcoin’s price has begun reacting to these short positions, as the price has started to slip. As of writing, Bitcoin has fallen by 0.55% and is currently trading near $114,750. However, during the Asian trading session, it reached an intraday high of $115,960, according to TradingView data. With this decline, market participation increased, and BTC’s trading volume during the same period jumped 16% to $91.15 billion.

Bitcoin’s Long-Term Potential as Institutional Interest Soars

Amid this bearish outlook, MARA Holdings, a Bitcoin mining giant that holds 52,850 BTC worth $6.12 billion, has purchased 400 BTC worth $46.31 million today.

When combining these posts on X, it appears that although the short-term sentiment for BTC is bearish, the long-term outlook remains bullish, as reflected by MARA Holdings’ recent Bitcoin acquisition.

Bitcoin (BTC) Price Action and Key Levels to Watch

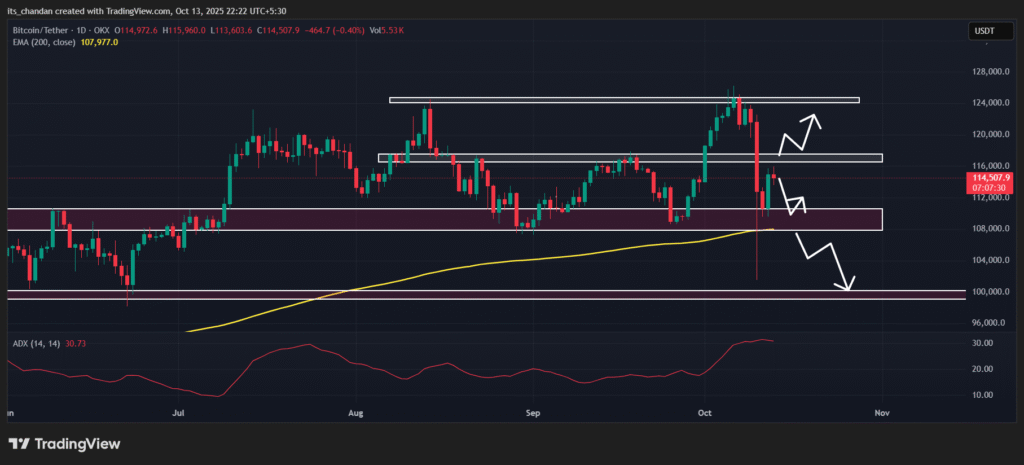

According to TimesCrypto’s technical analysis, the Bitcoin price is still in an uptrend, as it is holding above the 200-day Exponential Moving Average (EMA).

The formation of a bullish engulfing pattern near the key support at $109,400 hints that potential upside is on the horizon. However, the key resistance near the $117,000 level may pose a hurdle for Bitcoin’s upward momentum.

Based on the current price action, Bitcoin’s upside momentum can only continue if it clears the $117,000 level; otherwise, it may continue to consolidate.

However, if the asset fails to hold key support and breaks below the $108,000 level, it could push Bitcoin into a downtrend, potentially causing a strong dip toward the next support at $100,000.

The technical indicator, Average Directional Index (ADX), has reached 30.73, above the key threshold of 25, indicating strong directional momentum.

Expert Insights and Predictions

Given the current market sentiment, an expert shared a post on X, including a visual of BTC’s weekly chart along with the RSI. In the post, he noted that BTC is showing a triple bearish divergence on the weekly RSI.

The chart clearly shows that while Bitcoin’s price is climbing, the momentum is not. The expert concluded by noting that this pattern usually signals the end of a run, rather than the start of a new one.

Also Read: 66% of Investors Plan to Buy More Crypto as Bitcoin Could Reach $200K, Bitget Finds