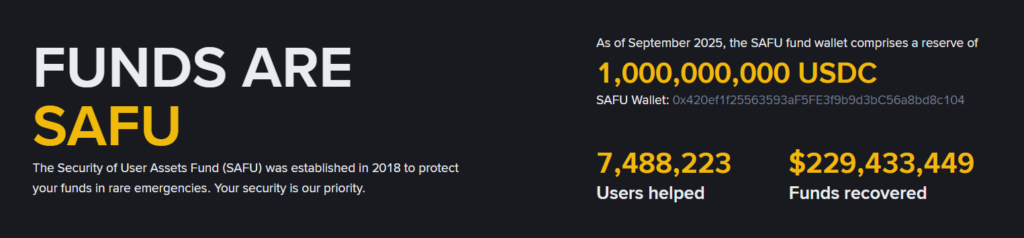

Binance SAFU Fund: Binance has stated through “An Open Letter to the Crypto Community” that it will transfer its entire $1 billion Secure Asset Fund for Users (SAFU) fund (currently held in stablecoins) into a Bitcoin reserve. The conversion is expected to be completed within 30 days, fundamentally shifting the nature of the exchange’s emergency user-protection bitcoin reserves.

Binance Sees Value in Bitcoin

This conversion is not just a treasury management exercise; it reflects Binance’s strong belief in Bitcoin’s status as the “foundational asset of this ecosystem” and the “premier long-term store of value.”

This new structure aligns Binance’s core protection fund with the very asset they feel will provide the greatest long term value through various market cycles. Binance’s conversion also represents a huge public vote of credibility in Bitcoin (despite the risks involved) and demonstrates the type of insurance coverage being offered by the world’s leading crypto exchange.

The Mechanics Behind this Shift and Market Impact

The new plan, including rebalancing the fund to keep the protective balance intact, will result in Binance being able to constantly monitor the value of the new bitcoin reserve (i.e., whether or not the fund’s total value has dropped below USD 800 million) and, as such, regularly top off the fund back to USD 1 billion. This will create an ongoing, structured buy-pressure on Bitcoin.

In addition, the conversion of such a large sum of money from stablecoins (the largest source of liquidity available in the crypto market today) to a very volatile asset such as Bitcoin is an extremely bold “risk-on” move that establishes that Binance believes that Bitcoin will be stable or price up over a period of time, and may thus have an effect on other major Bitcoin hodlers.