U.S. spot bitcoin exchange-traded funds are suffering their sharpest sell-off since launch but have so far avoided a wave of investor selling, according to Bloomberg Intelligence analyst James Seyffart.

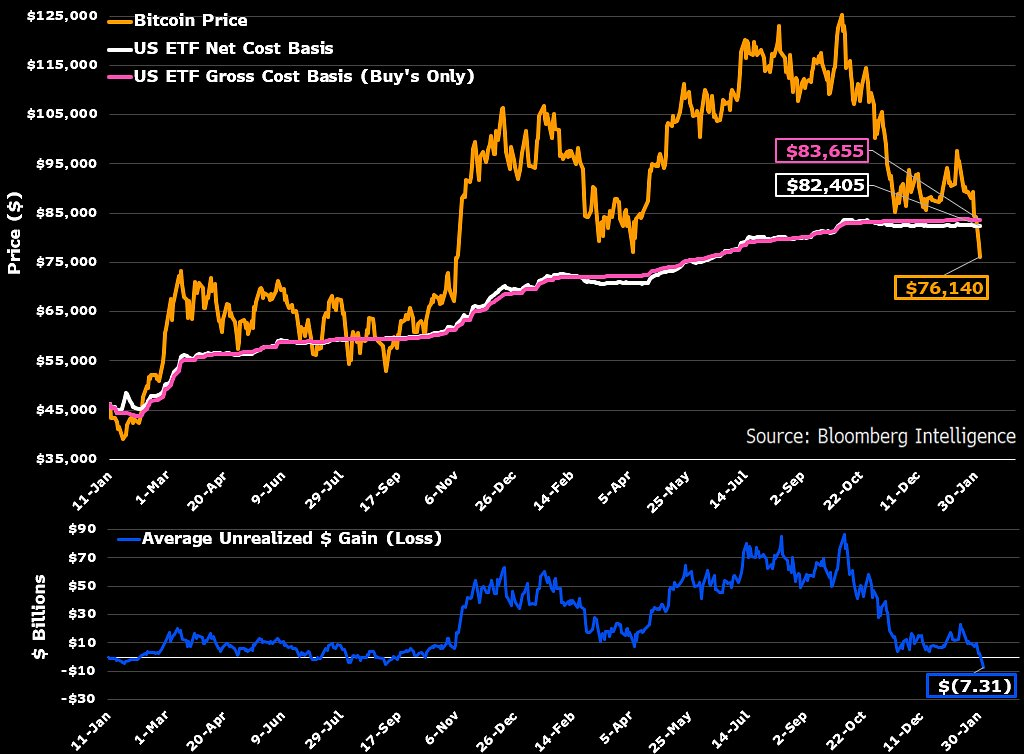

In a series of posts on X, Seyffart said holders of the U.S. spot bitcoin ETFs are sitting on their biggest losses since the products began trading in January 2024, after bitcoin’s price slumped more than 40% from its peak.

One of the charts he shared shows aggregate losses of about $7.3 billion for ETF buyers, as the average cost basis now sits well above the current bitcoin price.

“The ETFs are facing the worst Bitcoin pullback in % terms since their launch,” Seyffart wrote, adding that ETFs are “still hanging in there pretty good” given the size of the decline.

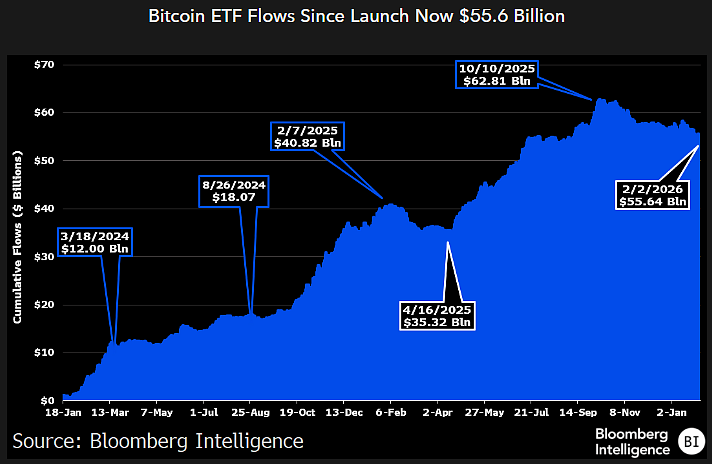

Even so, Seyffart noted that net flows remain strongly positive when viewed over the life of the products. A separate chart shows cumulative net inflows into the U.S. spot bitcoin ETFs at $55.6 billion as of Feb. 2, 2026, compared with a peak of about $63 billion before the market began to weaken in October.

“That’s not too shabby considering these funds took in ~$63 bln at their peak,” he wrote, estimating that roughly $7 billion has left the products since Oct. 10, 2025, when the sell-off accelerated.

ETFs Record Fresh Outflows as Price Slides

Short-term flow data show mounting selling pressure, particularly in recent days, but still not enough to destabilize the structure built up over the past two years.

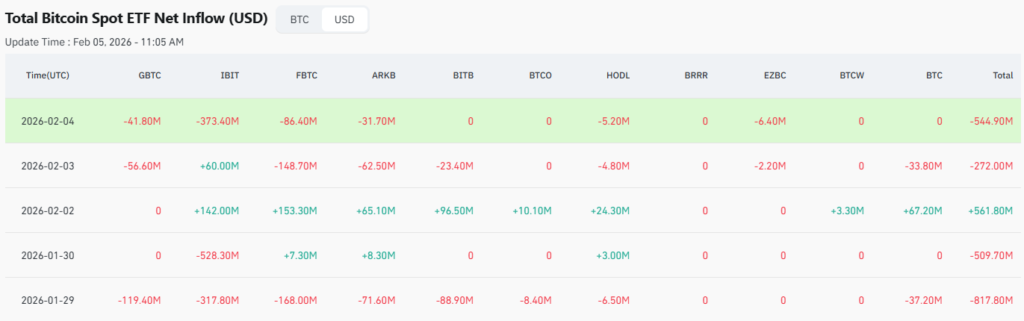

Data from analytics site Coinglass for Feb. 4 showed combined net outflows of about $545 million from U.S. spot bitcoin ETFs, with the largest move coming from the IBIT bitcoin ETF, which saw around $373 million exit in a single day, with additional redemptions from different funds, including FBTC, ARKB, and GBTC.

Coinglass data indicate that bitcoin ETFs have seen several heavy outflow days over the past week, including roughly $818 million on Jan. 29 and about $510 million on Jan. 30. Those flows were reversed by a strong inflow day on Feb. 2, when the group took in about $562 million.

Across crypto ETFs more broadly, funds tracking bitcoin, ether, and solana saw net outflows on Feb. 4, with bitcoin ETFs losing about $544.9 million, ether products $79.4 million, and solana ETFs $6.7 million.

Losses Deepen, But Structure Holds

The combination of falling prices and persistent outflows has left bitcoin ETF investors with sizeable unrealized losses. Seyffart’s analysis suggests that, on average, buyers who entered via the ETFs did so at levels well above the current market, reflecting strong demand near the cycle peak.

Still, the cumulative $55.6 billion that remains in the products underlines how much investor capital the ETFs still hold. Even after recent redemptions, the ETFs have retained the bulk of the money gathered in the surge that followed U.S. regulatory approval of spot bitcoin funds.

While the current pullback is the sharpest in percentage terms since launch and has pushed many holders into the red zone, the majority of investors have not rushed for the exits.

Whether that resilience holds will depend on how bitcoin trades from here. A deeper or more prolonged slide could test the patience of late-cycle buyers, but for the moment, the data suggest that crypto ETFs are, as Seyffart sees it, still “hanging in there” despite the worst price shock they have yet faced.