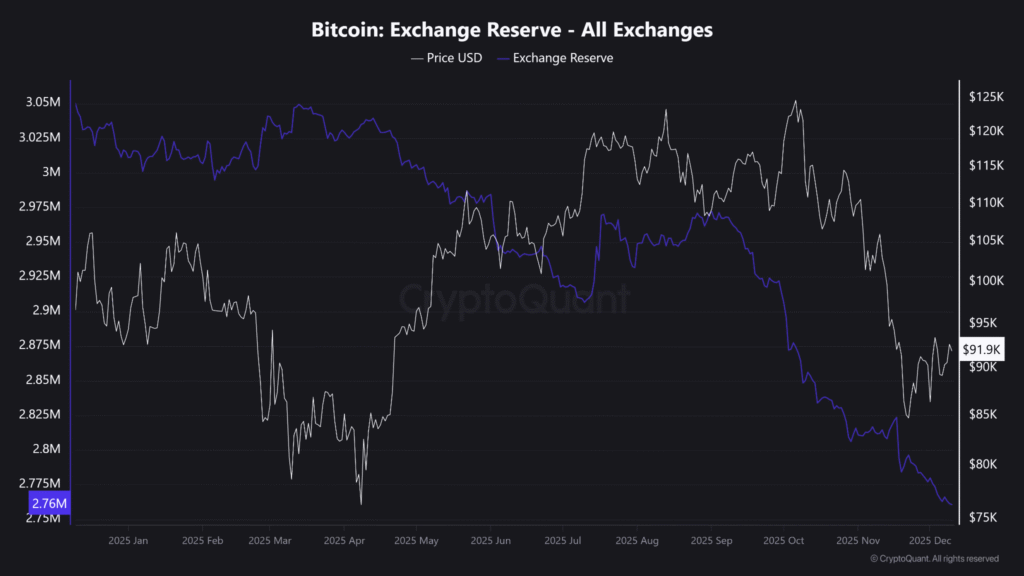

Bitcoin exchange reserves continue to decline, reaching their lowest level in a year. According to the on-chain analytics platform CryptoQuant, reserves have dropped sharply by 290,735 BTC, falling from 3,049,795 BTC on December 10, 2024, to 2,759,060 BTC on December 10, 2025.

A decline in any asset from exchange reserves often suggests purchases. If reserves drop significantly, it points to growing demand for the asset and acts as a bullish signal. But, here in the current scenario, the BTC price remains nearly the same, which points to the asset’s long-term potential.

Despite a substantial decline in BTC reserve, instead of moving upward, its price has remained nearly unchanged. On December 10, 2024, BTC was at the $96,654 level, and after a year, it is currently trading at around $91,900.

However, during this period, BTC has made multiple all-time highs like 111,666 on May 22, 2025, $123,345 on August 13, 2025, and the recent all-time high of $124,709 on October 6, 2025.

Also Read: U.S. XRP Spot ETFs Record 15 Straight Days of Inflows, near $1 billion Mark!

Bitcoin Price and Rising Volume

As of press time, BTC is trading at $91,925, down 0.80%. Whereas, investors and traders’ participation has soared notably, as reflected in the trading volume as it jumped 22% to $65.67 billion.

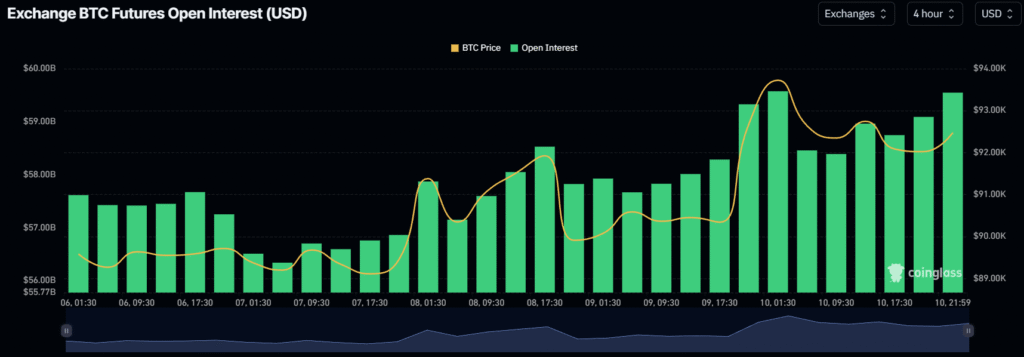

With rising volume, the BTC futures Open Interest (OI) has also jumped 1% to $59.09 billion, as per the derivative tool Coinglass. Meanwhile, this OI value continues to rise since December 6, 2025, as shown in the bar below.

It suggests that capital is gradually flowing into the BTC futures market, suggesting rising trader participation and growing confidence. The continuous uptick in OI since December 6, 2025, signals that more positions are being built.

Industry Expert’s Bullish View on Bitcoin

Despite the price continuing to move sideways, Michael Saylor, chairman and former CEO of Strategy (formerly MicroStrategy), made a bold statement during an ongoing conference in Dubai. At the conference, Saylor stated, “I think BTC will rise about 20% a year for the next 20 years.”

So far, Saylor’s Strategy has accumulated 660,625 BTC and holds its position as a top corporate Bitcoin holder.

Not just Saylor, but Jack Mallers, the CEO of Twenty One Capital, has also shown interest in BTC. In a recent interview with CNBC, Mallers stated, “We are going to buy as much Bitcoin as we possibly can.”

In addition, a JPMorgan analyst predicted that Bitcoin could reach the $170,000 level within 6–12 months, which has further reinforced BTC’s long-term outlook.

Conclusion

Looking at all these details, it appears that both investors and major institutions have strong confidence in Bitcoin, as reflected in exchange reserves, along with the bold statements from Strategy’s chairman, the CEO of Twenty One Capital, and a JPMorgan analyst.

However, Bitcoin’s price at the moment does not align with these factors, as it has been in a downtrend since November 2025. Investors and traders should exercise caution and may choose to follow the current trend if they are not looking for long-term holdings.