Key Takeaways

- Bitcoin surpassed Amazon with a market cap of $2.4 trillion, becoming the fifth-largest global asset.

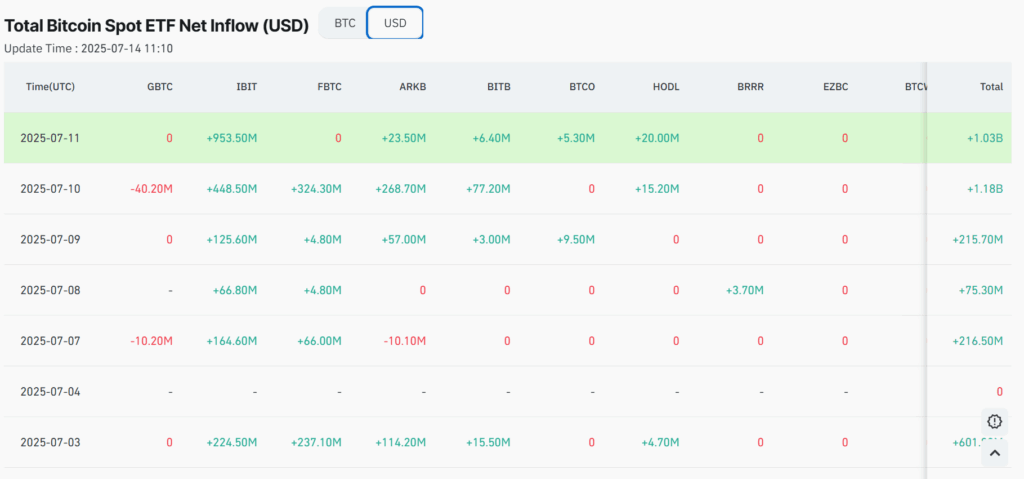

- U.S. spot Bitcoin ETFs see $3.3 billion in weekly inflows, led by BlackRock’s IBIT.

- Fidelity’s FBTC and Ark’s ARKB showed steady gains, reflecting broad institutional participation.

- U.S. lawmakers push crypto bills, signaling a shift toward clearer regulatory frameworks.

Bitcoin has surpassed Amazon in market capitalization, becoming the world’s fifth-largest asset, driven by increased institutional demand, massive inflows into U.S. spot Bitcoin ETFs, and supportive U.S. regulatory policies.

Bitcoin’s market capitalization rose above Amazon’s this week, driven by a sharp rise in institutional demand. U.S. spot Bitcoin ETFs recorded over $3.3 billion in net inflows across five sessions, led by BlackRock’s IBIT, which drew $953.5 million on July 11, marking the largest single-day inflow on record.

Meanwhile, Other major ETFs also recorded strong cumulative inflows over the past week, led by Fidelity’s FBTC with approximately $333.9 million and Ark Invest’s ARKB with $349.2 million.

Institutional Flows Coincide with Evolving U.S. Crypto Policy

Rising Bitcoin ETF inflows are supported by a more favorable environment in the United States, as lawmakers in the House of Representatives are discussing a set of crypto-focused bills, including the CLARITY Act, the Anti CBDC Surveillance State Act, and the GENIUS Act, aimed at formalizing oversight of the digital asset market.

This legislative push highlights a shift in tone from Washington, where digital assets are increasingly being viewed as part of the mainstream financial landscape rather than as speculative assets.

“What is really striking is how the conversation in the United States has evolved,” said Devika Mittal, Regional Head at Ava Labs. “Instead of treating crypto with suspicion, lawmakers are now actively working to help the industry thrive while keeping it transparent. It is a remarkable turnaround that could reshape our understanding of digital assets and blockchain.”

In Conclusion

Bitcoin’s rise above Amazon in market capitalization was fueled by a combination of strong macro factors: increased institutional exposure, consistent ETF inflows, and a shifting regulatory stance in the United States. As these trends continue to develop, digital assets are moving toward a more structured and recognized role within the global financial system.

Read More: Robinhood Crypto Faces Investigation Over Deceptive Marketing Practices