Key Takeaways

- Metaplanet president calls Bitcoin a universal hedge that preserves generational wealth.

- Company targets 210,000 BTC by 2027 through its ¥770.9 billion “555 Million Plan.”

- Bitcoin reserves rise to 17,595 BTC but per-share growth slows as dilution increases.

- Shares fall from $9 to $6.80 amid investor concerns over equity issuance.

Bitcoin (BTC) can serve as a hedge for investors worldwide against inflation pressures, currency volatility and low interest rates, which are undermining traditional stores of value, according to Simon Gerovich, president of Metaplanet.

On Aug 11, Simon Gerovich, president of Metaplanet, one of Tokyo’s largest corporate Bitcoin holders, said in a post on X that Bitcoin offers a universal hedge for investors facing economic headwinds.

Gerovich stated that Bitcoin protects savings in high inflation countries from collapsing currencies and capital controls, while in low inflation economies it helps investors avoid “stealth debasement” and negative real yields that erode purchasing power over time.

“Everyone needs Bitcoin because it is built to endure and preserve wealth for generations,” he wrote, positioning it as a long-term store of value resilient to monetary policy shifts and global market volatility.

Metaplanet’s treasury strategy and 555 Million Plan

Metaplanet Inc., one of Tokyo’s largest corporate Bitcoin holders, has made Bitcoin the core of its corporate treasury strategy and has steadily expanded its holdings since 2024, aiming to mirror and scale the corporate accumulation model pioneered by U.S. software firm MicroStrategy.

With that goal in mind, the company launched its “555 Million Plan,” an ambitious initiative to raise about ¥770.9 billion (roughly $5.4 billion) through the issuance of 555 million equity warrants, with proceeds to be used mainly for Bitcoin purchases. The initiative targets the acquisition of 210,000 BTC by the end of 2027, equivalent to about 1% of the cryptocurrency’s total supply.

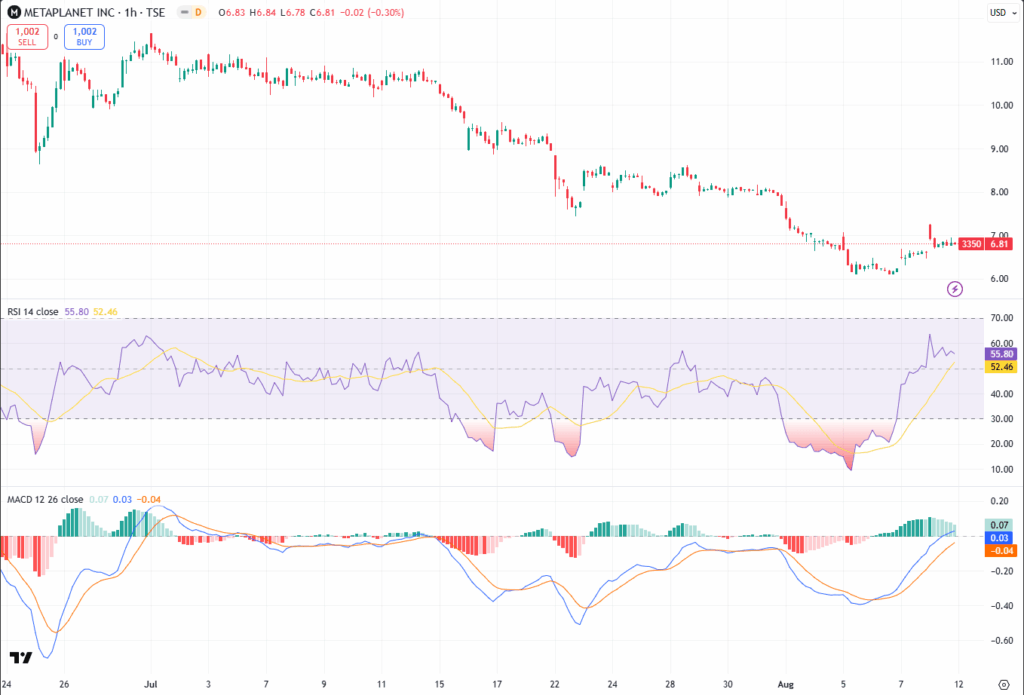

Metaplanet share performance and price action

Despite Metaplanet’s aggressive Bitcoin strategy, the company’s shares have fallen sharply in recent weeks, sliding from around $9 in late July to near $6.80 as investors reacted to a slowdown in growth of Bitcoin per share and a sharp rise in the company’s fully diluted share count.

While the Japnese firm added 3,284 BTC in the quarter to date, lifting total holdings to 17,595 BTC, the increase in BTC Yield, a key metric measuring Bitcoin attributable to each share, has moderated amid the issuance of more than 48 million new shares.

Analysts said the pace of equity issuance may be offsetting the benefits of the company’s aggressive accumulation strategy, even as Bitcoin holdings continue to expand.

Read More: Nasdaq-Listed BNC Becomes Largest Corporate BNB Holder With $160M Purchase