Key Takeaways

- Bitcoin whales were spotted betting long while offloading BTC at the same time, hinting at mixed sentiment.

- Bitcoin price action suggests that $112,200 is a key make-or-break level; if the price fails to cross it, strong downward momentum could follow.

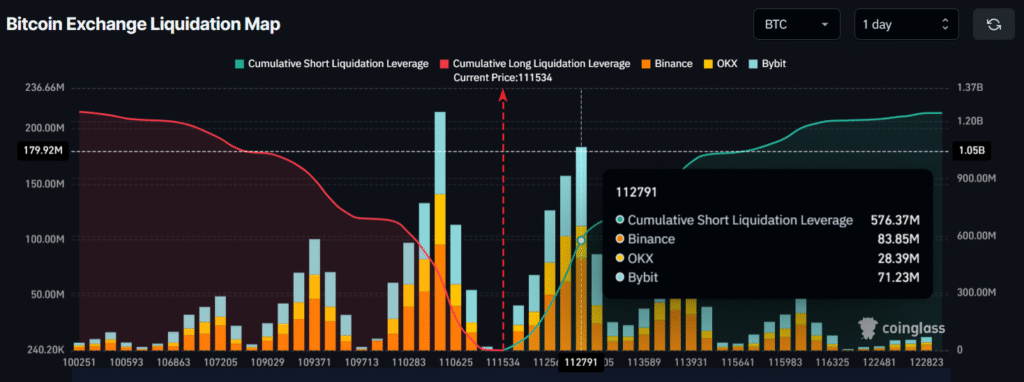

- The derivative tool Coinglass reveals that bears are dominating on the intraday, having built $576.37 million in short positions at the $112,791 level.

As Bitcoin (BTC) approaches the key resistance level of $112,200, the tug-of-war between bulls and bears has intensified. Data from a crypto transaction tracker reveals that Bitcoin whales are showing mixed sentiment, some are opening long positions, anticipating a price surge, while others are offloading their holdings, expecting a potential correction.

Whales Mixed Sentiment: Bulls and Bears Spotted

Lookonchain shared a post on X stating that the whale wallet address 0xc2a3, with a 100% win rate, has continued increasing its long positions. With today’s bet, the whale’s Bitcoin long positions have reached a significant 1,483 BTC, worth $165.5 million.

This growing bet on long positions not only hints that a massive rally could be on the horizon but also appears to be attracting market participants who see this as an ideal level to go long.

However, Onchain Lens, an on-chain platform, shared a report that shifted market sentiment. In the report, the platform noted that a Bitcoin OG continued dumping, as he sold 200 BTC worth $22.32 million to Kraken today. With this, the OG has dumped over 5,603 BTC, worth $627.1 million, over the past two weeks.

Observing such whale activity raises concern among market participants — is this the top for Bitcoin in this cycle, or is the whale simply rotating funds?

Bitcoin (BTC) Current Price Momentum

As per the latest data, BTC is trading at $111,600 and has remained unchanged, as TradingView shows a minor price decline of 0.10%. However, market participation continues to decline, as evident from the drop in trading volume.

According to CoinMarketCap data, BTC’s trading volume has plunged by 45% to $24.46 billion today, indicating that traders and investors are losing interest in the asset.

Bitcoin Price Action and Technical Analysis

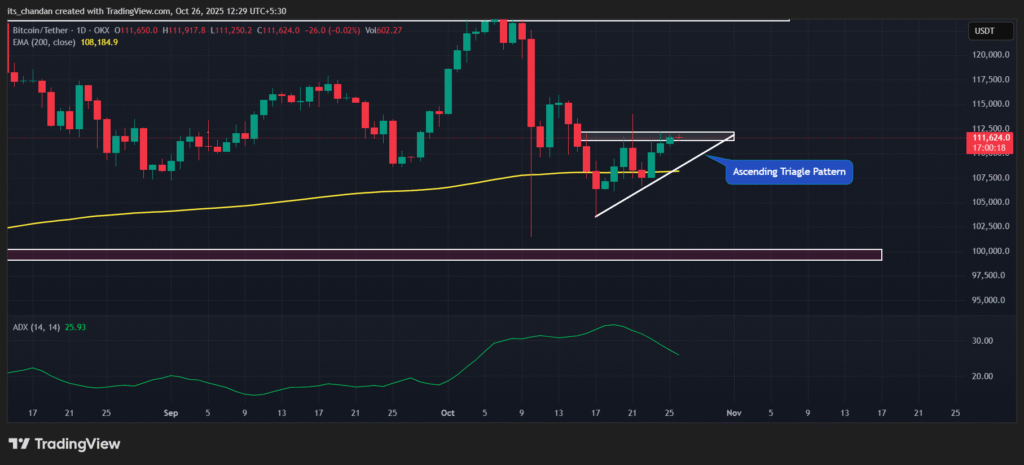

Looking at the Bitcoin daily chart, TimesCrypto’s technical analysis reveals that the asset has formed an ascending triangle pattern, and the price is approaching the neckline at $112,200. Based on the current price action, it is evident that BTC is struggling to break the neckline.

Over the past three trading days, the asset has reached this level more than three times, and each time, it has witnessed a price reversal.

If the Bitcoin price fails to gain momentum and cannot cross the $112,200 level, downside movement could be possible. Conversely, if it does break this level, BTC could experience impressive upward momentum.

However, the asset is trading above the 200-day Exponential Moving Average (EMA), indicating that BTC remains in an uptrend. Meanwhile, the Average Directional Index (ADX) suggests that BTC’s directional momentum is weak, as the value remains below 25, a key threshold level.

Derivative Tool Hints at Bears’ Dominance

Given the current market sentiment, it appears that bears are currently dominating the asset on an intraday level, according to the derivative tool Coinglass. The data further reveals that $110,511 on the lower side and $112,791 on the upper side are the major liquidation levels. At these levels, traders have built $386.82 million in long positions and $576.37 million in short positions.

This metric indicates that bears are dominating the asset on an intraday level, strongly believing that BTC won’t cross the $112,791 level anytime soon.