Key Takeaways

- Bitcoin (BTC) has cleared the $114,000 hurdle and could rally another 3.5% toward $118,000.

- $394 million worth of BTC shorts could be liquidated if the price rises to $114,486.

- An expert predicts that if BTC clears the $114,300–$114,700 range, it could hit $120,000 again.

As the Bitcoin (BTC) price continues its upward momentum, millions in short positions are now at risk. Today, BTC surged 1.55% over the past 24 hours, breaking key resistance levels at $112,000 and $113,500, potentially paving the way for further gains.

Bitcoin (BTC) Price and Trading Volume

At press time, Bitcoin is trading at $114,000, with trading volume up 136% to $60.24 billion, according to CoinMarketCap.

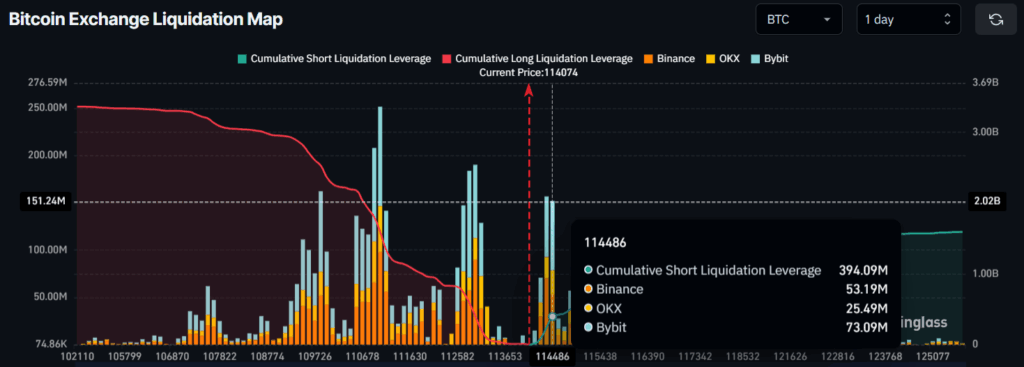

Major Liquidation Levels: $394 Million at Risk

Bitcoin’s bullish momentum appears to be putting pressure on leveraged traders, especially those holding short positions. Coinglass, an on-chain analytics tool, reveals that BTC’s major liquidation levels stand at $110,035 on the lower side and $114,486 on the upper side.

With strong momentum, the next key liquidation level is $114,486; if the price reaches this level, over $394.09 million worth of short positions could be liquidated. Conversely, if sentiment shifts and the price falls below $110,035, approximately $1.59 billion in long positions could be liquidated.

$69 Million Worth of BTC Outflow

Coinglass data also disclosed that investors and long-term holders appear to be accumulating the asset. Over the past 24 hours, more than $69.29 million worth of BTC has flowed out of exchanges, indicating potential accumulation.

BTC Price Action: Key Level to Watch

TimesCrypto technical analysis indicates that BTC is back in an uptrend and is poised to maintain its upside momentum. According to TradingView data, BTC has surged over 4.30%, rising from $109,200 to its current level of $114,000.

On the four-hour chart, BTC has recently cleared a strong resistance at $113,500. Based on the current price action, if it holds above this level, the BTC could see an additional 3.50% rally and may reach $118,000.

On the other hand, if the momentum fails and the price falls below the $113,500 level, BTC may see a strong downside move.

Expert Predictions and Technical Indicators

Given the current market sentiment, several bold predictions have recently surfaced on X. Some suggest that if BTC breaks out of the $114,300–$114,700 range, the market could see $120,000 again.

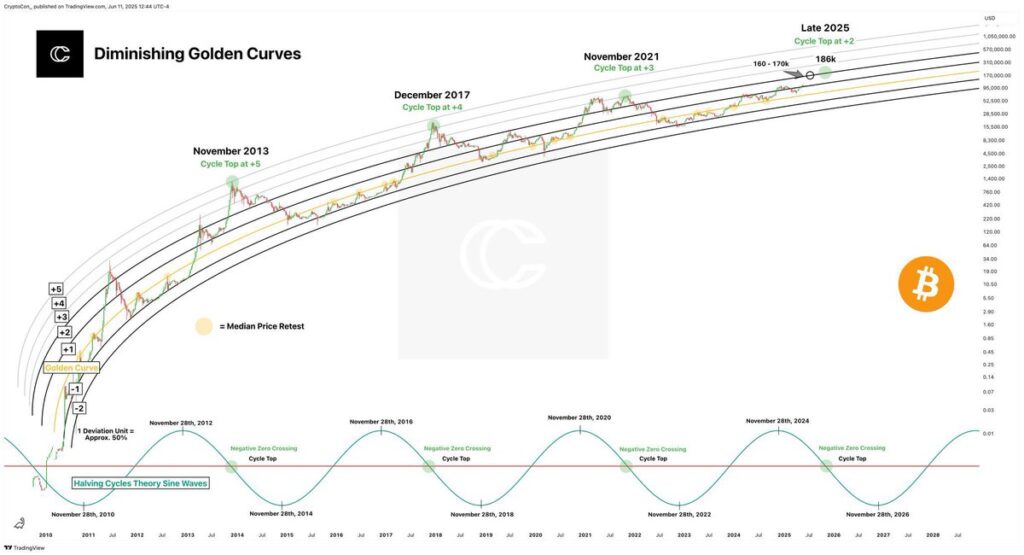

Meanwhile, another crypto expert shared a bold prediction, stating that the next target for Bitcoin is between $160,000 and $170,000.

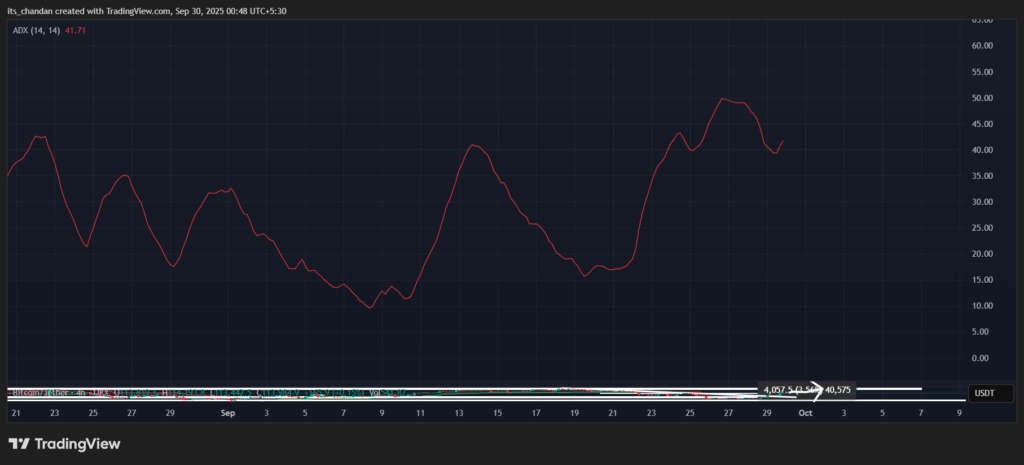

However, technical indicators Supertrend and the Average Directional Index (ADX) are flashing bullish signals.

The chart shows that Bitcoin’s upside rally has shifted the Supertrend into green and below the asset price, suggesting BTC is in an uptrend. Meanwhile, the ADX value has risen above 41, surpassing the threshold of 25, indicating strong directional momentum for Bitcoin.