Bitcoin recovers from its steepest downturn in over a year, stabilizing (for the moment) above the USD 70,000 level after a surprissing 13% bounce from its USD 60,255 low. This sort of “collapse”, observed in the first week of February 2026, is supported by shifting on-chain and derivatives data, though the market remains fragile.

Signals Supporting the Bitcoin Recovery

A variety of indicators supporting a recovery in Bitcoinhas been observed. For example:

- A very large whale removed 1,546 BTC (worth around USD 106.7 million) from Binance and deposited it in cold storage, indicative of Bitcoin accumulation rather than distribution.

- Also, based on the fact that the Bitcoin mining difficulty has just seen its largest adjustment downward since 2021, this provides evidence of miner strain; however, mining costs have also dropped dramatically, which may lead to renewed participation if Bitcoin maintains these price levels.

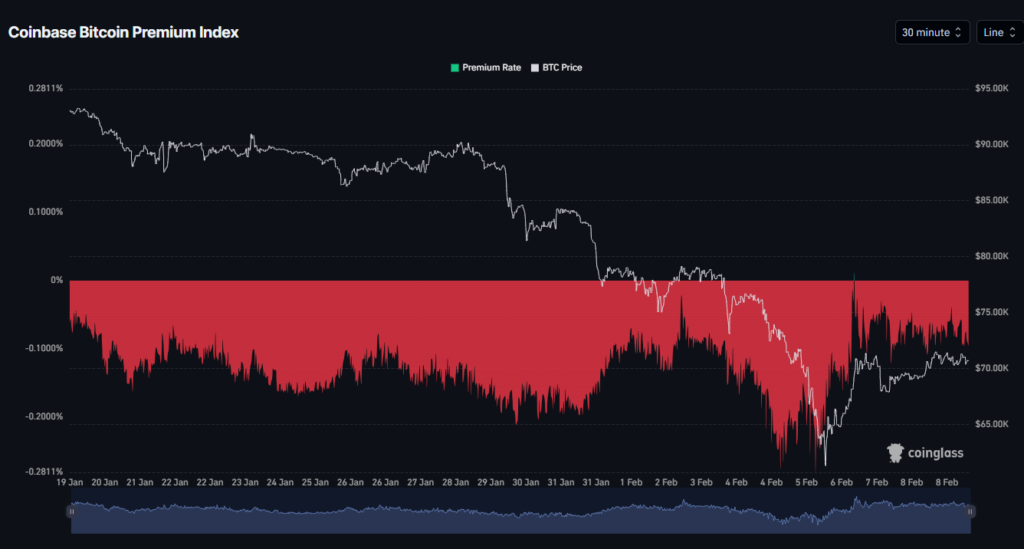

- In addition, the “Coinbase Premium,” the price difference between Coinbase and Binance crypto exchanges, has turned positive, indicating stronger buying pressure from U.S. institutional investors relative to the global market.

The Critical Resistance Ahead

While Bitcoin recovers, its immediate future is binary. The next major technical test will be the USD 83,000 resistance level. If Bitcoin can really break above this mark, it could trigger over USD 5.7 billion in short liquidations, potentially fueling a powerful short squeeze and rally.

On the other hand, if Bitcoin fails to break out above this resistance level, it could see rejection rates that take it back toward its support levels of USD 49,000/53,000, which were last seen in early 2024.

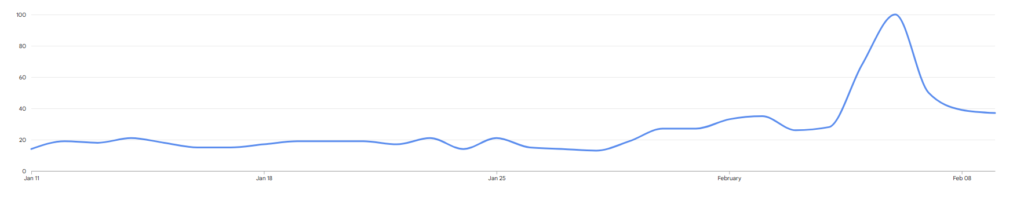

Conversely, Market sentiment has improved since last week (from a score of 5 to a current 9); however, Google Trends data indicates that retail searches for Bitcoin are at a 12-month high and are usually viewed as contrarian signals.

Bitcoin recovers as it demonstrates resilience, but it is not yet a confirmed trend reversal.