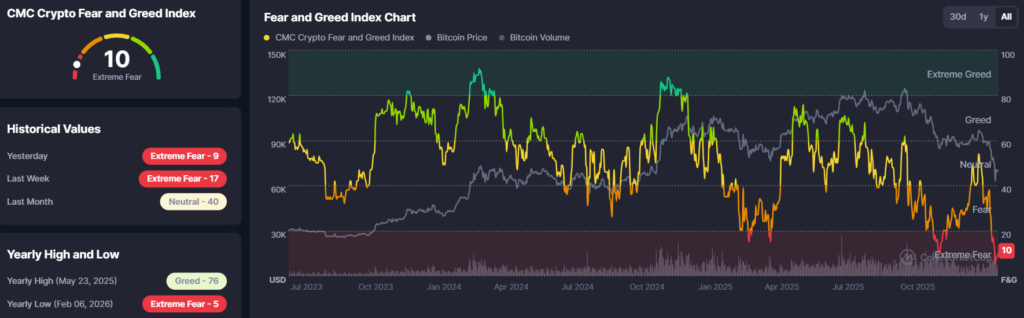

Recently, Bitcoin sentiment has plunged to its most negative level on record, with a score of 5 (in CoinMarketCap). The first week of February 2026 has seen a monumental fear among investors. The Crypto Fear & Greed Index now stands at 10, a small step towards recovery, fighting to move away from the “Extreme Fear” territory. Bitcoin, after dipping to USD 60,000 last week and a 13% surge on Monday (back above USD 70,000), is back below this level again.

What the Record-Low Bitcoin Sentiment Reveals

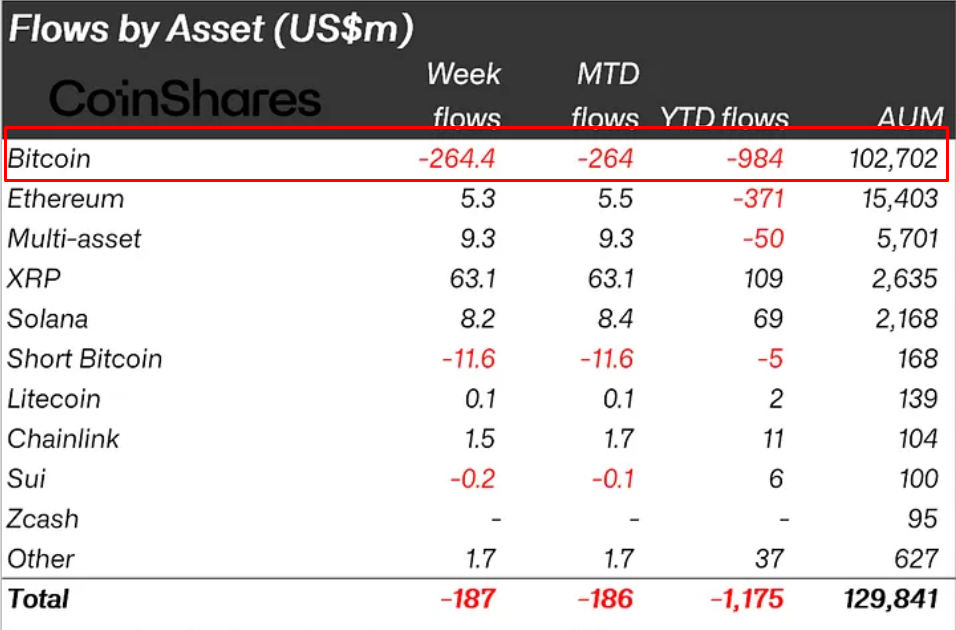

This historic low in Bitcoin sentiment reflects a confluence of retail capitulation and institutional de-risking. U.S. Spot Bitcoin ETFs had their third consecutive week of outflows totaling USD 264 million, though the pace of withdrawals slowed significantly. The decline in the value of BTC is a test of many call “legitimacy” for the number one crypto asset as a board (mainstream) financial instrument, in that many institutions have begun to reallocate their funds that prioritize stability and traditional risk metrics over crypto-native narratives. So far, the selling has been driven more by derivatives and macro rotation than by broad spot market participation.

The Bullish Case Amid the Gloom

Paradoxically, this extreme negativity is fueling a contrarian bullish argument. Several analysts have noted that this extreme fear has coincided with major market bottoms in past instances, including 2018 and March 2020.

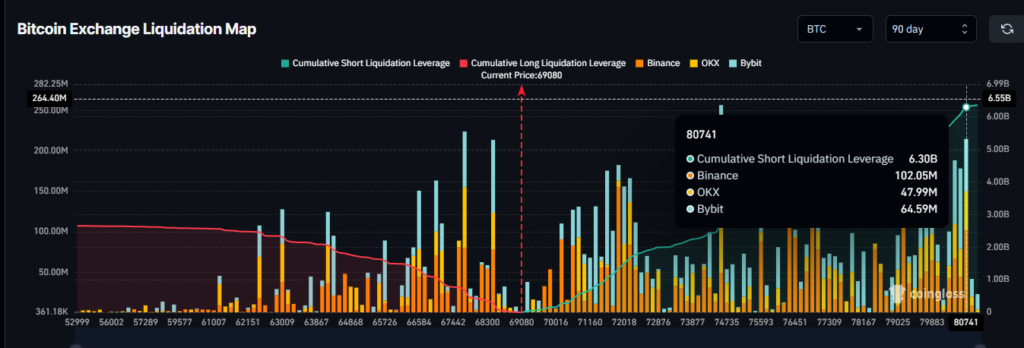

This rally from the USD 60,000 low and the slowing ETF outflows are seen as potential early signs of selling exhaustion. Furthermore, liquidation heatmaps show over USD 6.3 billion in leveraged short positions clustered above current prices, meaning that, as the market transitions into the next phase of a sustained rally, it’ll be very likely to also see a significant short squeeze, accelerating a possible recovery.

Bitcoin Current Price

In the last 24 hours, the Bitcoin price has been dancing between USD 71,000 and USD 68,000, and a break below this level could test even lower prices near USD 57,000 or even worse, at USD 42,000. Although the Bitcoin Sentiment remains in a state of fear, and as with any other market cycle, hopes of a strong recovery are always there.