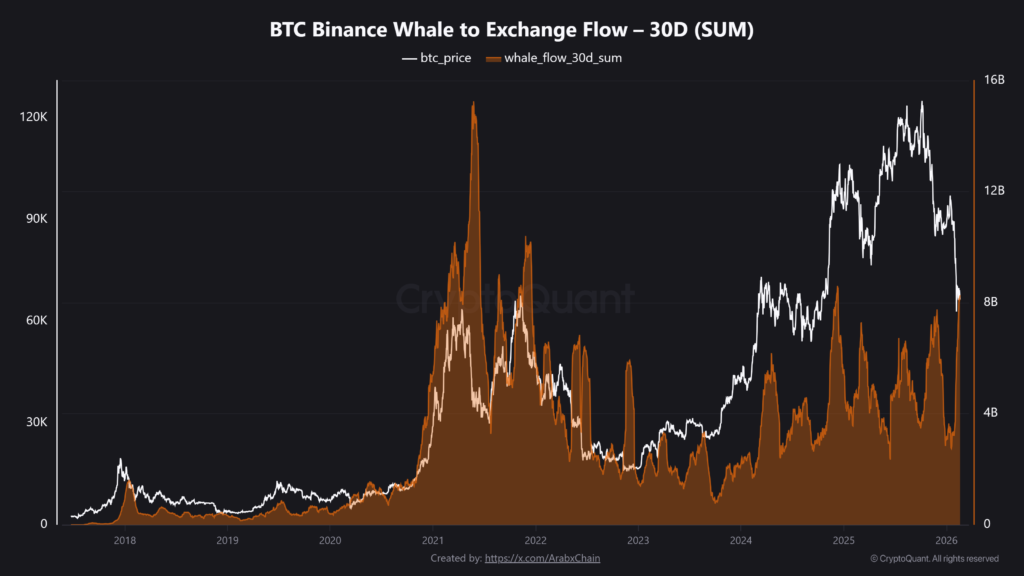

The latest on-chain data shows a big jump in large Bitcoin transfers to Binance. The total amount of whale inflows over the past 30 days has reached about $8.3 billion, the highest level since 2024. Bitcoin is currently trading at near $67,800, which means that this spike comes at a time when it is consolidating after reaching higher levels.

CryptoQuant keeps track of the data, which shows the total value of large Bitcoin deposits made by major holders over a rolling 30-day period. When the large market participants move money to centralized exchanges, it usually means they are getting ready to initiate the position-selling process, rebalance their positions, or trade derivatives. A long-term chart that illustrates this 30-day inflow total with the price history of Bitcoin from 2018. In times of market stress or major updates, the whale deposits tend to rise as people prefer to diversify their positions into less risky assets, conserving the long-term yield.

The activity of whales and the dynamics of exchanges

Whale deposits to Binance have been on the rise since early 2026, after a period of relative calm. This new activity is part of a larger trend of big holders moving more around the network. The whale inflow ratio, which shows how much of the total inflow comes from the top 10 largest deposits, has gone up from about 0.4 to 0.62 in early February. That level hasn’t been reached in more than two years, which shows how concentrated recent deposits have become in major wallets.

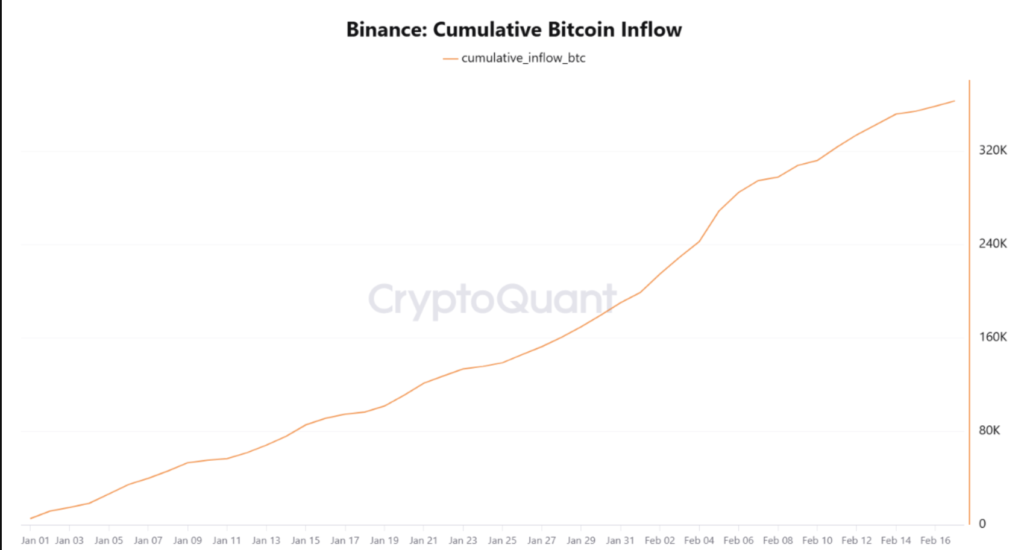

A few big transactions show how big this trend is. In the past few weeks, some long-term holders have sent thousands of BTC to Binance. Since the start of this year, the exchange has experienced a cumulative bitcoin inflow of 363,000 BTC during certain tracked periods, with the large players making up a large portion of that. Short-term selling pressure can be triggered when this much supply hits the order book of exchanges; the low demand can further intensify the relative trend.

Market Trends and Historical Context

Historically, the significant increase in the 30-day whale inflow total has frequently appeared just before or during market pullbacks. At the height of the 2021 bull market, inflows exceeded $12 billion, followed by a notable correction. In 2024, we also witnessed similar, albeit less extreme, spikes, as strong institutional demand from spot ETF inflows mitigated the downside. When compared with the earlier cycle figures, the current figure of $8.3 billion still remains below it when adjusted for the current BTC market cap.

The largest digital asset is exchanging hands in the range of $67,000 to $68,000, considering the market is experiencing increased financial inflow. Bitcoin currently illustrates a consolidation phase involving correction movements followed by the drop from its previous crucial level of $71,000. The current market situation shows important support at $65,000 and resistance at $73,000. The short-term trading range exists between these two price points.

What the Implications Mean for Bitcoin

It’s important to remember that high whale inflows don’t always mean that a sell-off is about to happen. The whales go for the capital rotation practices, which include liquidity management. position hedging and getting ready for the future significant events that can influence the market movement. Since Binance is a big player in the derivatives market, whales may be moving money around to change their leverage or protect their current positions instead of selling their spot holdings right away.

The exchange supply activity will experience a jump with the regular market inflows. The rising supply will increase risk levels when overall market sentiment drops and the market demand also diminishes. The current market pattern shows that long-term investors are increasing their exchange holdings while short-term purchasing activity is slipping. The result has led to losses in some parts of the market. If the flow of money keeps going, it could put more pressure on the market, especially if macroeconomic uncertainty or changes in regulations make people less willing to take risks.

On the other hand, if inflows start to slow down or go the other way, it could mean that the current distribution phase is almost over. In the past, these kinds of turning points have sometimes led to renewed accumulation and price recovery, especially when there were strong fundamentals and institutional participation.

Outlook and Important Things to Think About

As Bitcoin goes through this consolidation phase, it’s still very important to keep a close eye on on-chain metrics and price action. The $8.3 billion 30-day whale inflow number shows a big change in capital flows and a lot of BTC being traded at current price levels. The combination of whale inflow ratio with total exchange balances and market sentiment indicators will show whether the activity represents temporary market shifts or permanent market changes.

Bitcoin’s overall outlook is still strong because more people are using it, the infrastructure is growing, and the network fundamentals are strong. However, there will probably still be short-term volatility. For people in the market, balancing short-term risks from exchange inflows with longer-term structural drivers will be important for getting through the current situation.