Key Takeaways

- Bitcoin reserves reach $428B, with 3.68 million coins held by corporates, ETFs, and governments; Strategy Inc. holds 64% of public company bitcoin.

- Volatility raises treasury concerns, as bitcoin trades nearly five times more unpredictably than the S&P 500, risking capital stability.

- Regulatory gaps persist globally, with fragmented oversight in the US, EU, and Canada complicating compliance for crypto-holding firms.

- Liquidity and custody risks intensify, as thin markets and dual-role exchanges expose companies to delayed trades and counterparty threats.

Companies using bitcoin and other cryptocurrencies as part of their treasury strategy could face elevated credit risks, Morningstar DBRS said in a report on Thursday, pointing to a combination of regulatory gaps, liquidity challenges, and persistent market volatility.

From Payments to Balance Sheets

While bitcoin was initially adopted primarily for transactional purposes, a growing number of firms are now deploying it in a more operational capacity, using it as a corporate reserve asset.

These entities, widely known as “cryptocurrency treasury companies,” which include names like Strategy Inc. and MARA Holdings Inc., have taken substantial digital asset positions on their balance sheets.

However, the report noted that such a strategic shift from traditional treasury management to digital holdings could undermine long-term financial stability, particularly in periods of broader economic stress or company-specific downturns.

Bitcoin Holdings on the Rise

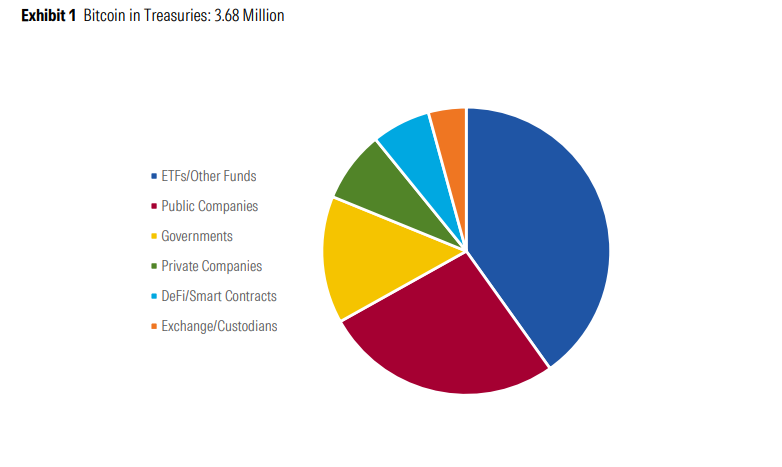

Globally, approximately 3.68 million bitcoins, roughly valued at 428 billion US dollars as of August 2025, are held across a range of entities, including public and private companies, exchange-traded funds, governments, decentralized finance protocols, and custodial platforms.

According to the report, ETFs and similar funds represent 40% of these holdings, followed by public companies accounting for 27%. Notably, Strategy Inc. alone holds over 629,000 bitcoins, which represents 64% of all public company bitcoin holdings, while the top 20 publicly listed companies collectively account for 94% of that total, illustrating a highly concentrated ecosystem.

Regulatory Oversight Remains Patchy

The report emphasized that the global regulatory environment for digital assets remains inconsistent and fragmented.

In the United States, cryptocurrencies, such as bitcoin, are generally classified as commodities and fall under the jurisdiction of the Commodity Futures Trading Commission (CFTC) when it comes to derivatives trading.

However, direct spot market transactions are largely unregulated, and cryptocurrency ETFs fall under the purview of the Securities and Exchange Commission (SEC), creating overlapping regulatory frameworks.

In other jurisdictions, such as the European Union and Canada, regulation is handled by multiple authorities, further complicating compliance and increasing operational risks for corporate treasury departments relying on digital assets.

Liquidity and Exchange Exposure

Morningstar DBRS highlighted liquidity as another area of concern, stating that cryptocurrencies, despite their growing popularity, can still be subject to thin trading volumes, especially in volatile periods or when dealing with large transaction sizes. This could lead to significantly wider bid ask spreads, making it more difficult and costly to execute trades efficiently

Additionally, companies are exposed to counterparty risks associated with major cryptocurrency exchanges that often serve dual roles as both trading platforms and asset custodians.

Treasury Role Under Pressure

Traditionally, corporate treasury functions are structured around principles of liquidity, capital preservation, and risk management. However, Morningstar DBRS warned that a heavy reliance on volatile digital assets could destabilize these foundations, especially given cryptocurrencies’ limited reliability as stable stores of value. “Volatility in cryptocurrency values may hinder their effectiveness as a unit of account or reliable capital reserve,” the report said, adding that such exposure could also complicate cash flow planning and overall balance sheet stability.

Digital Assets: Volatile and Uneven

Bitcoin remains one of the most volatile asset classes globally, with a 2024 study showing it is nearly five times more volatile than the S&P 500 in the short term and four times in the long term.

Additionally, while bitcoin is primarily intended as a medium of exchange, Ethereum, for example, was designed to support smart contracts and decentralized applications, bringing with it a distinct set of technical, governance, and security risks.

Therefore, the report stressed that a detailed understanding of each cryptocurrency’s structure and function is essential for managing risk effectively.

Custodial Complexity

The question of how digital assets are stored is also critical. Companies may choose self custody, which offers full control but comes with heightened risks, such as accidental loss or internal fraud. Alternatively, they may chose third-party custodians, which involve different risk vectors, particularly around operational security and liquidation procedures.

In either scenario, the report advised establishing rigorous protocols around transaction verification, security audits, and exit planning in case of market disruption or the need for rapid asset conversion.

Outlook: Rising Use, Rising Risk

Looking ahead, Morningstar DBRS anticipates continued growth in the corporate adoption of cryptocurrencies, such as bitcoin and Ethereum.

However, the report concluded that this trend introduces a distinct set of risks:

We expect the use and acceptance of cryptocurrencies, such as bitcoin and ethereum, to continue to increase globally. For companies that use cryptocurrencies as their primary corporate reserve currency, there are unique risks related to regulatory oversight, liquidity, counterparties, security, materiality, volatility, technology, and custodial considerations that may increase their credit risk profile.

Read More: New Bitcoin Treasury Joins the Race With 5,743 BTC for $679M