Key Takeaways

- The new Gold and Bitcoin strategy shows DL Holdings and Antalpha joining forces to facilitate a $200 million initiative.

- The strategy will consist of purchasing $100 million in Tether Gold (XAU₮) and reinvesting an additional $100 million in Bitcoin mining.

- This partnership aims to create a comprehensive ecosystem for real-world assets (RWA) and digital infrastructure.

Table of Contents

A Dual-Pronged Digital Asset Offensive

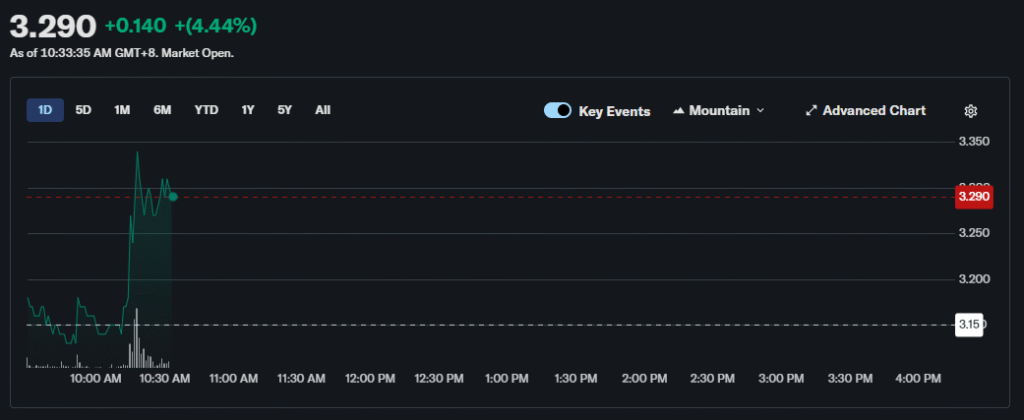

Hong Kong-listed DL Holdings Group Limited (HKEX: 1709) has unveiled a comprehensive Gold and Bitcoin strategy through a partnership with digital asset firm Antalpha. The $200 million plan is a two-pronged assault on the convergence of traditional and digital finance.

On one track, the group will acquire and distribute up to $100 million in Tether Gold (XAU₮), a tokenized representation of physical gold. Simultaneously, it will deploy another $100 million to expand its Bitcoin mining operations, signaling a massive vote of confidence in both established and digital stores of value.

Read also: JPMorgan Confirms Bitcoin and Crypto Trading for Clients in 2026

Constructing a Tokenized Gold Ecosystem

The implementation of this Gold and Bitcoin strategy will entail the development of a full-stack ecosystem for digital assets:

- With regards to the gold piece, DL Holdings will utilize Tether Gold, where each token is backed by physical vaulted gold bar.

- Partner Antalpha will provide liquidity, custody, and lending services through its RWA Hub platform.

This move taps into the booming tokenized gold market, the largest RWA category, providing investors better access to the stability of gold while solving for the hassles of physical ownership, storage, and illiquid.

"We are simultaneously advancing both the value carrier and the infrastructure of the digital financial world. By digitising physical gold, we are reshaping how value is stored and circulated; by investing in large-scale hashrate, we are reinforcing the foundation of digital assets. These two strategies complement each other and together constitute DL's core advantage in the evolving global financial landscape." - Mr. Andy Chen, Chairman of DL Holdings Group and NeuralFinRead also: Crypto Market Crash Triggers Record $19B Liquidations Amid Tariff Panic & Insider Trading Suspicion

A Plan For Modern Finance

This Gold and Bitcoin strategy is not just an investment but a plan for the future of finance. We are seeing this transformation and evolution every day. By mixturing gold’s enduring value and the innovative potential of Bitcoin mining, DL Holdings is pushing itself at the intersection of two extremely powerful financial narratives.

To this point, this strategy not only represents the asset-tokenisation trend but is also the infrastructure that will underpin the digital economy, highlighting a sophisticated understanding of how value will be stored and transferred in the years to come.

FAQs

What is the objective of this Gold and Bitcoin Strategy partnership between DL and Antalpha?

The goal is to bridge traditional and digital finance by creating a comprehensive ecosystem for tokenized real-world assets (RWA) like gold while simultaneously strengthening the foundational infrastructure of the Bitcoin network through mining activities.

What is Tether Gold (XAU₮)?

Tether Gold (XAU₮) is a digital token where each one is backed by one troy ounce of physical gold stored in a London vault, combining gold’s value with blockchain’s efficiency.

How much Bitcoin will the mining operation produce?

With its current and planned infrastructure, DL Holdings aims to eventually produce approximately 1,500 BTC annually, starting with an initial capacity of around 350 BTC per year.

For more bitcoin strategy stories, read: French Chipmaker Sequans Plans $200M Raise to Boost Bitcoin Treasury Strategy