Key Takeaways:

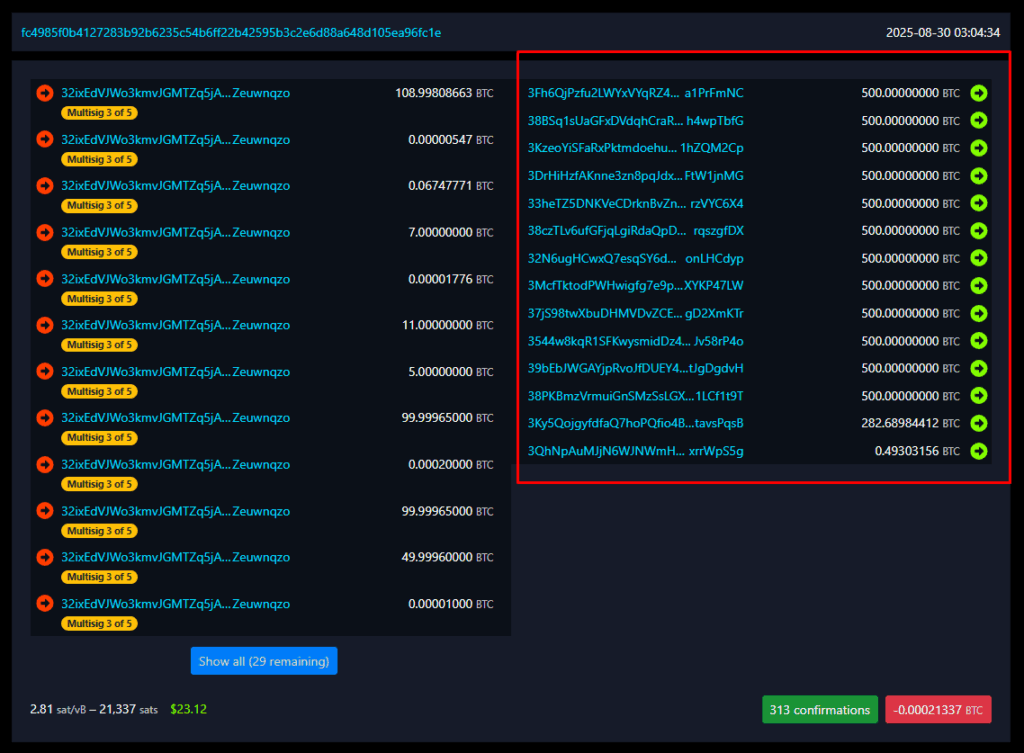

- The country of El Salvador has completed a major Bitcoin wallet split into 14 new addresses with a total reserve of 6,274 Bitcoin (BTC).

- This will also help mitigate a future threat involving quantum computing.

- Each new wallet was allocated 500 BTC or less to limit significant exposure.

Table of Contents

A Preventive Smart Move

In a smart step forward in protecting national crypto assets, El Salvador executed a strategic Bitcoin wallet split, redistributing its entire $678 million Bitcoin treasury into 14 separate and highly sophisticated wallets.

El Salvador sent its 6,274 BTC from a single address into 14 new addresses. This is not a reaction to an immediate threat, but a proactive long-term strategy to harden assets against the risk of future cyber-related attacks from quantum computing.

The Bitcoin Wallet Split Strategy

This strategy is beautifully straightforward but very important. The primary risk comes from the fact that when a Bitcoin transaction is broadcast on the blockchain, the public key is exposed. If, at some point, a sufficiently powerful quantum computer were able to make use of that exposed public key, it could then reverse-engineer the private key and take the funds. By splitting the hoard into smaller chunks, each new wallet can hodls a limit of 500 BTC (around $54 million); even in the worst-case scenario, an attacker could only gain access to part of the total reserves and not the whole fortune.

Crypto Custody Best Practices

This Bitcoin wallet split is also a way for the nation to distance itself from “address reuse,” which it was doing to promote transparency, but this had the drawback of continually exposing its public key. Instead, a public viewing dashboard will show the aggregate balances of all 14 wallets, fulfilling the government’s commitment to transparency while greatly enhancing its security posture.

Experts have praised the move as a sophisticated embrace of custody best practices for digital assets, demonstrating El Salvador’s growth and evolution as a Bitcoin nation.

Summing Up

Despite the still hypothetical nature of the quantum threat, El Salvador’s response is more precautionary than a panic reaction, showing a serious, proactive commitment to safeguarding national wealth, and could be a model for other countries and big institutions to consider in how to appropriately safeguard their national physical or digital assets over the next decades.

Final Thought: By future-proofing its reserves through a Bitcoin wallet split today, El Salvador is not just protecting its investment; it is establishing itself as a serious and sophisticated crypto-economy leader in the global marketplace.

FAQs

What is the quantum computing threat to Bitcoin?

This scenario is currently hypothetical, but we may be able to imagine a future where quantum computers may have an unimaginable computing power that can break the cryptographic encryption used to secure bitcoin wallets, which may allow a hacker to steal a person/institution’s funds.

Why split assets across multiple Bitcoin wallets?

In short, we split a sum of money into many wallets to limit if any damage occurs due to a compromised key. It is like not storing all your gold in one vault.

Is the crypto community in immediate danger of quantum hacking of crypto wallets?

To date, quantum-based computing is hypothetical. Experts agree that true quantum computing is still far off, at least for these means. El Salvador’s actions are in the best interest of protecting its investment over the long term.

For more crypto stories related to El Salvador, read: El Salvador Doubles Down: World’s First Bitcoin Investment Banks Approved