Key Takeaways

- With a 2.55% dip, Bitcoin’s price is on the verge of a massive fall, price action hints that another 10% decline could be on the horizon.

- Whale sell-offs continue, as crypto whales have dumped 1,200 BTC at a loss in recent hours.

- Derivative data reveals that traders are aggressively betting on short positions, building $643.37 million worth of shorts around the $105,365 level.

Today, Bitcoin plunged 2.55% from a key level that has historically triggered major price declines. As the price continues to fall, whales have begun offloading their holdings, further reinforcing the bearish outlook and raising questions about whether the price is on the verge of a crash or what.

Bitcoin Whales Dump Millions Worth of BTC

In recent hours, crypto tracker Onchain Lens shared multiple posts on X highlighting Bitcoin whale dumping activity. According to one post, a whale wallet address “bc1p9” dumped 500 BTC worth $52.8 million into Gate after holding it for four months, booking a loss of $6.85 million in the process.

Meanwhile, another whale known as Owen Gunden dumped 700 BTC worth $73.23 million into Kraken.

These posts on X highlight growing fear among major crypto holders and raise questions about whether this is an ideal time to sell, as whale activity often influences retail investors.

Looking at the current market sentiment, Bitcoin spot ETFs have also experienced a significant drop in inflows. According to the on-chain analytics platform SoSoValue, today Bitcoin ETFs registered a minor inflow of just $1.15 million, indicating a lack of interest among traditional American investors.

Current Price Momentum

As per the latest TradingView data, Bitcoin has recorded a price drop of over 2.55% and is currently trading around the $103,350 level. However, the continued decline remains a concern for investors.

Along with the price drop, investors and traders appear hesitant to participate, as reflected in the trading volume, which has fallen by 5.8% to $71.55 billion.

Also Read: Square Bitcoin Payments Now Live! 4M U.S. Businesses Now Transact Crypto

Bitcoin Price Action and Technical Analysis

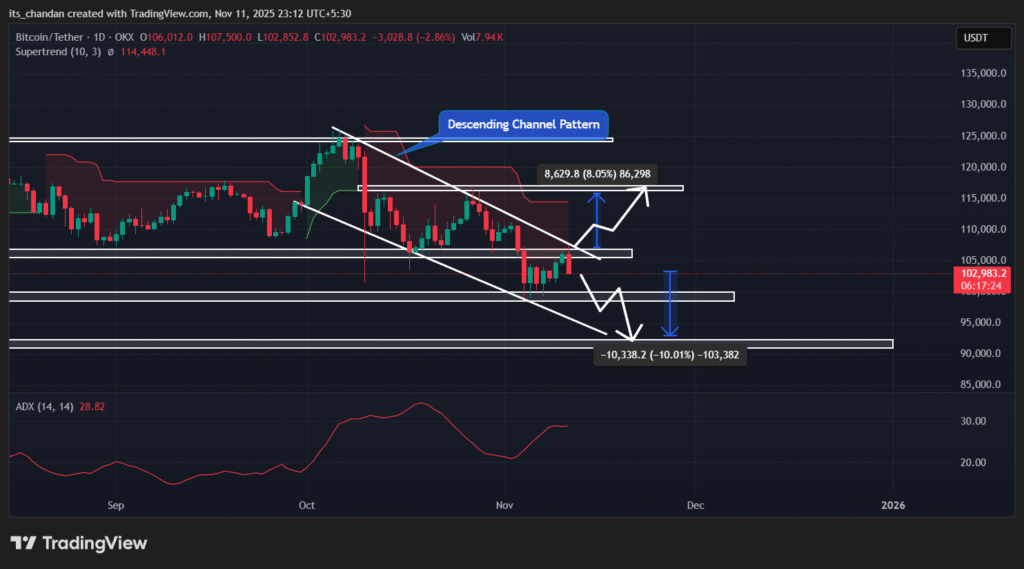

According to TimesCrypto’s technical analysis, Bitcoin is in a clear downtrend and is likely to extend its downward movement. On the daily chart, BTC has been trading within a descending channel pattern between the upper and lower trendlines, a formation that began on October 6, 2025.

This isn’t the only bearish signal, as Bitcoin’s price structure also shows a consistent formation of lower highs and lower lows, confirming weakening momentum. Following the recent short-term rally, Bitcoin reached the upper boundary of the descending channel, but today’s decline from that level seems to be forming another lower high, reinforcing the ongoing bearish outlook.

Based on the current price action, if Bitcoin remains below the $108,200 level, it could continue its downward rally and witness a price decline of around 10%, potentially reaching the $92,500 level — the lower low and the lower boundary of the bearish pattern.

At press time, BTC’s Average Directional Index (ADX) value stands at 28.77, above the key threshold of 25, indicating strong directional momentum in the asset.

Traders Eye Short Positions

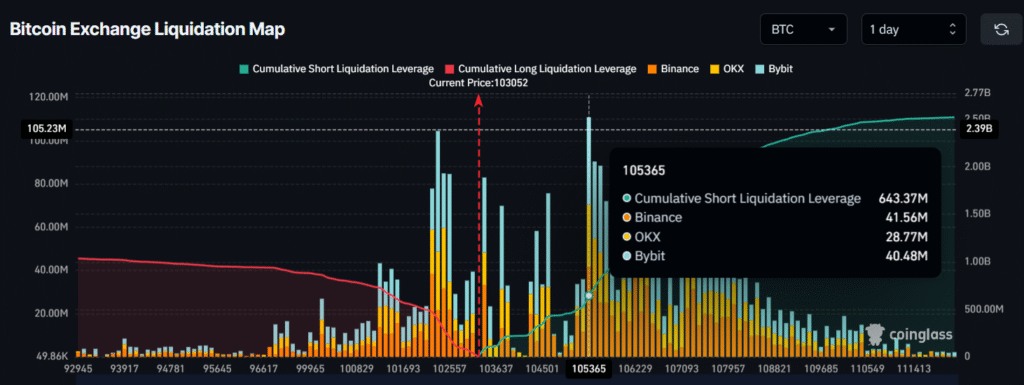

Derivative platform Coinglass is also reinforcing the ongoing bearish outlook. According to the latest data, traders are aggressively betting on the bearish side. The major liquidation levels, where traders are over-leveraged, stand at $102,341 on the lower side and $105,365 on the upper side.

At these levels, traders have built $302.12 million worth of long positions and $643.37 million worth of short positions.

This clearly reflects traders’ bearish outlook and their strong belief that BTC’s price won’t surpass the $105,365 level anytime soon.