Key Takeaways

- CryptoQuant’s Accumulator Addresses reveal that whales who only buy and never sell added 50,000 BTC during Tuesday’s dip.

- Bitcoin’s price action suggests that $100,000 acted as a strong support for the asset, and the price is now poised to reach $105,600.

- Traders have built $1.15 billion in long positions at $100,559, reflecting strong confidence that the price will not fall below this level.

Bitcoin (BTC) has shown an impressive recovery today after plunging 10.5% over the past two trading days. The key catalysts behind this rebound are the current price action, massive whale accumulation, and traders’ heavy positioning on the long side.

Accumulator Addresses Add 50K Bitcoin

According to on-chain analytics firm CryptoQuant, the metric “Accumulator Addresses,” which tracks whales that only buy and never sell, indicates a strong interest in Bitcoin (BTC) as its price fell to the $100,000 mark. Data reveals that these accumulators added 50,000 BTC during Tuesday’s dip.

Observing this massive accumulation by BTC hodlers, a well-followed crypto expert shared a post on X, stating,

Even though overall demand has slowed, that’s not the case for these investors. In less than two months, the monthly average has more than doubled — rising from 130,000 to 262,000 BTC — demonstrating that this trend is accelerating.

Bitcoin (BTC) Current Price and Rising Trading Volume

With this massive acquisition, Bitcoin (BTC) price jumped 1.75% today, reaching the $103,120 level, according to the latest TradingView data.

Earlier in the day, BTC dropped as low as $98,968 but quickly recovered, attracting strong participation from investors and traders. This renewed interest is evident in the trading volume, which surged 26% to $109.50 billion.

However, this impressive recovery and the significant surge in trading volume suggest that market participants are increasingly optimistic about BTC’s upward price movement.

Bitcoin Price Action and Technical Analysis

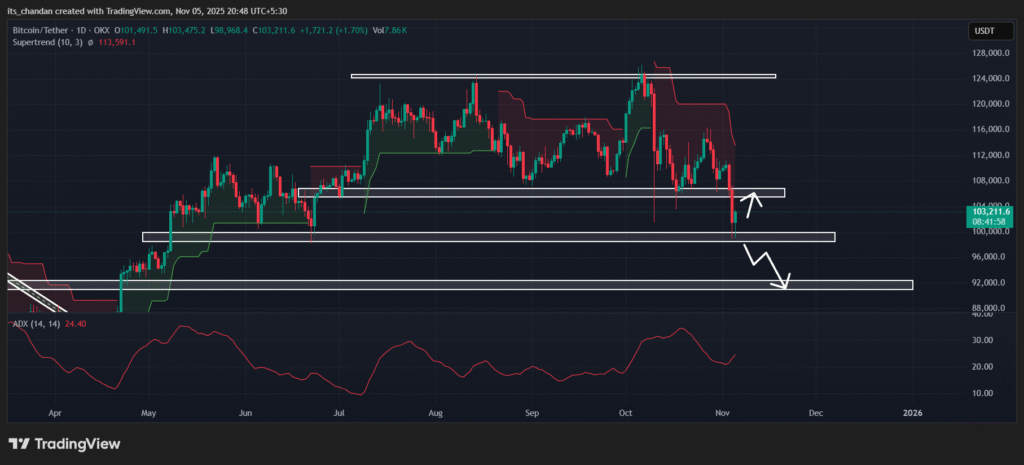

BTC’s price rally from the $100,000 mark is not just a coincidence. TimesCrypto’s technical analysis on the daily chart reveals that $100,000 is a key support level with a strong history of price reversals.

Since May 2025, whenever BTC’s price has reached or approached this level, it has consistently witnessed a rebound, and this time, it followed the same pattern.

Based on the current price action, if BTC holds above the $100,000 level, it could see an impressive recovery and potentially reach $105,600 in the coming days.

On the other hand, if momentum weakens and BTC falls below this key support, closing a daily candle under the $100,000 mark, it could decline toward the next support level at $92,000.

Despite the impressive price recovery, BTC’s Supertrend indicator remains in a red trend and hovers above the price, indicating that the asset is still in a downtrend.

Major Liquidation Levels

Looking at the recovery and BTC’s upside momentum, derivative tool Coinglass reveals that traders are also closely monitoring the current trend, as bets on long positions have skyrocketed.

Data reveals that BTC’s major liquidation levels are $100,559 on the lower side (Support), where high interest is recorded, and $104,175 on the upper side (resistance).

At these levels, traders have built $1.15 billion in long positions and $432.15 million in short positions. These levels indicate that the current trend and trader sentiment are bullish, with bulls currently dominating the asset.