Key Takeaways

- Japanese defunct crypto exchange Mt. Gox moves 10,608 Bitcoin (BTC) from its cold wallet to its hot wallet following the announcement of a new repayment deadline.

- Bitcoin’s price crashed more than 29% in July 2024, when Mt. Gox transferred BTC to rehabilitation creditors.

- Bitcoin’s price could only crash if it falls and closes a daily candle below the $91,000 level.

Amid market uncertainty, the defunct exchange Mt. Gox has made its largest Bitcoin (BTC) move in the past eight months. The transaction, carried out from a Mt. Gox-labeled cold wallet, is raising concerns as it comes at a time when the market is struggling to gain momentum and BTC is hovering at a make-or-break point.

Previously, when Mt. Gox moved BTC for creditor repayments, Bitcoin tanked, a memory that still stays among investors. This latest move now raises the question: will history repeat itself with another massive price crash, or will BTC remain stable?

Mt. Gox Moves $953 Million of Bitcoin

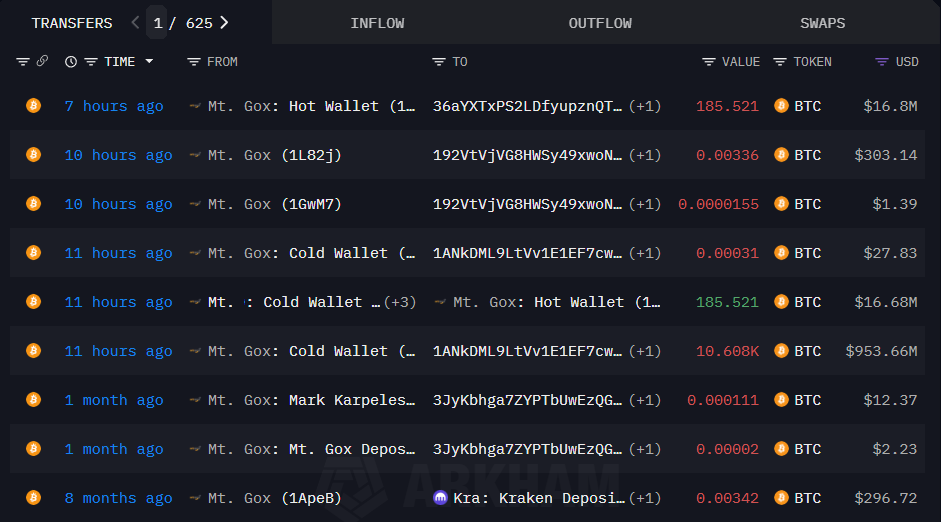

According to the latest update from Arkham, a blockchain-based transaction tracker, Mt. Gox’s cold wallet has transferred a significant 10,608 Bitcoin (BTC), worth $953.66 million, to its hot wallet. Despite this large BTC transfer, the defunct exchange still holds 34,689 BTC, valued at $3.18 billion.

This transaction was recorded as one of the largest in the past eight months and comes after the Rehabilitation Trustee extended the repayment deadline from October 31, 2025, to October 31, 2026.

While announcing the new deadline, Mt. Gox stated, “Many rehabilitation creditors still have not received their repayments because they have not completed the necessary procedures for receiving them. Additionally, a considerable number of rehabilitation creditors have not received their repayments due to various reasons, such as issues arising during the repayment process.”

Bitcoin Price After Mt. Gox Transaction

The last time Mt. Gox initiated BTC repayments to rehabilitation creditors in July 2024, the BTC price crashed more than 29%, falling from $69,800 to $49,000. Since then, the BTC price has surged 60% to its current level of $92,600.

As of press time, Bitcoin is trading at $92,600, showing a mild 0.78% price uptick. However, during the Asian trading session, BTC made a low of $89,300, briefly breaking a key support level but failing to sustain it.

Also Read: Is Crypto Bull Run Over? $1.1 Trillion Wiped Out from the Market!

Bitcoin (BTC) Price Action and Technical Analysis

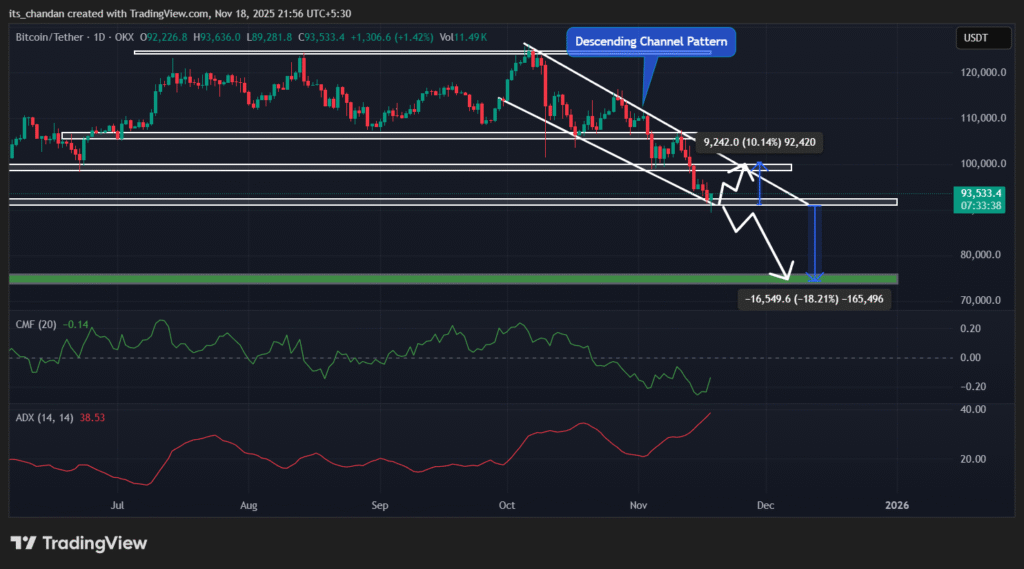

According to TimesCrypto’s technical analysis, Bitcoin (BTC) is in a downtrend, trading within a descending channel pattern between upper and lower boundaries that it has followed since the beginning of October 2025.

As of now, there are two possibilities: a potential reversal or a sharp sell-off.

Based on the current price action, if BTC sustains above the key $91,000 support level, it could see a price reversal, but it will remain in a downtrend until it clears the $101,000 level.

Bitcoin’s price could only crash if the asset falls and closes a daily candle below the $91,000 level. If this happens, it could see a notable 18% drop, potentially reaching the $74,300 level.

At press time, both technical indicators, the Chaikin Money Flow (CMF) and the Average Directional Index (ADX), are flashing bearish signals.

On the daily chart, BTC’s CMF value has reached -0.15, indicating selling pressure in the market, whereas the ADX value has reached 38.53 on the daily chart, indicating strong directional momentum in the asset.