Key Takeaways:

- Crypto expert TechDev believes BTC is still in the early to mid-bull market phase, with additional upside potential before peaking.

- Despite a 241,000 BTC sell-off by long-term holders, increased corporate holdings of more than 1 million BTC are helping to offset the selling pressure.

- Macroeconomic factors such as interest rate cuts and liquidity inflows remain important drivers of BTC’s next move.

The broader crypto market remains in green with positive price movements over the past 24 hours, with Bitcoin (BTC) rising by 0.48% showcasing bullish movement. Moreover, as anticipation continues to build around the FOMC meeting on September 17th, the upcoming inflation data will further influence interest rate expectations.

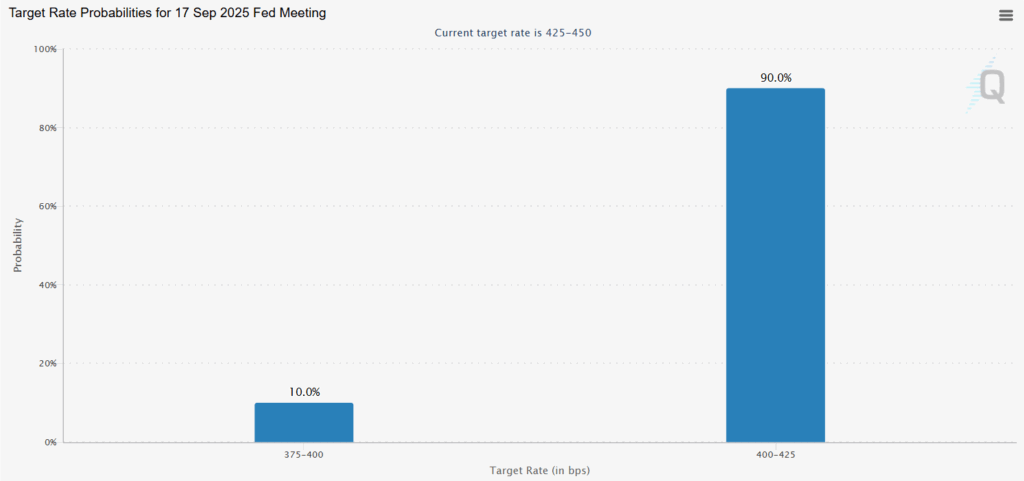

The FOMC decision will drive the next rally for BTC and the major crypto tokens. According to the CME Fed Watch tool, the interest rate cut expectations have shifted to 4-4.25% from 4.25-4.5% and the probability of this has increased to 90%.

Crypto analyst, entrepreneur and key opinion leader (KOL) known as TechDev on X (formerly Twitter) with over 500,000 followers, tweeted about BTC’s price movements, linking them with a macro signal.

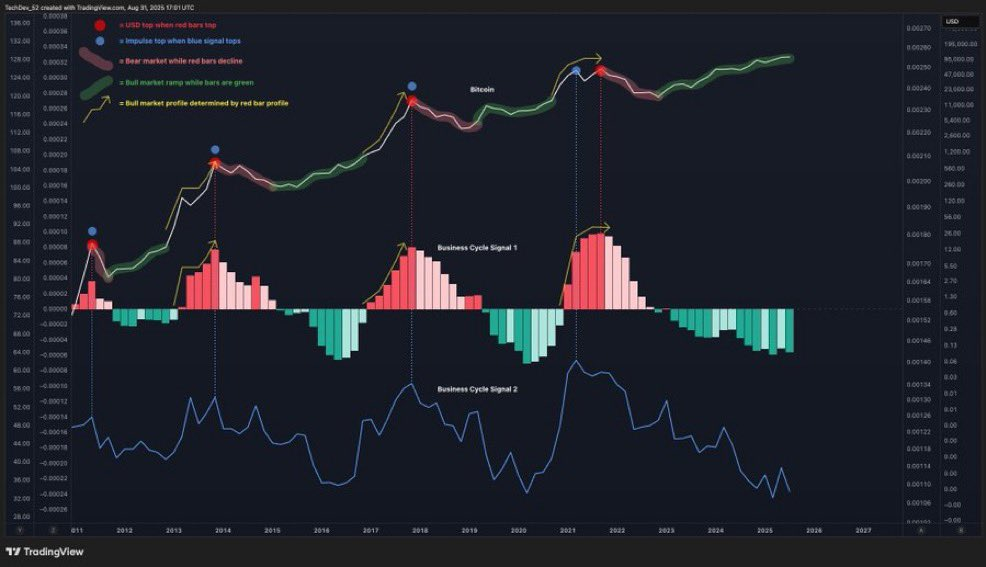

According to the tweet put out by TechDev, we are still in the early to middle stages of a bull market. The analyst showcases the correlations between BTC and the business cycle following the world economy.

The chart shows that when the business cycle indicator turns green, it signals the beginning of gaining momentum for BTC, which is where we are currently. Historically, BTC has seen a gradual climb throughout this green phase, followed by a sharp parabolic spike right before the indications turn red.

The red phase depicts the market’s final, euphoric drive before peaking and then correcting. Because we haven’t reached that red zone yet, the data suggests that BTC hasn’t peaked and still has an opportunity to grow.

The data also reveals that previous BTC cycles have closely tracked the ups and downs of the global business cycle, implying that economic recovery or expansion tends to propel BTC higher. In short, the current signals indicate that the bull market is still active, and the biggest moves may still be ahead.

But Long-Term Holders Are Dumping BTC

Moreover, according to Crypto Quant’s analyst Maartunn, Long-Term Holders (LTHs) have reduced their holdings massively, which is one of the largest drawdowns since early 2025.

Despite the significant outflow, we can observe that short-term holders (yellow region) are accumulating, which may indicate that fresh buyers are entering the market.

However, even though LTHs are offloading their BTC holdings, corporate treasuries are on the rise. According to Bitwise, the top 100 publicly listed companies hold over 1 million BTC. Long-term holder (LTH) selling is being absorbed by rising demand from corporate treasuries.

Technical Analysis on BTC

According to Crypto Express, BTC is currently trading within a descending channel, which means its price has been moving lower over time, bouncing between two downward-sloping lines, one acting as resistance (the ceiling) and the other as support (the floor).

BTC is currently testing the top of this channel, attempting to break over the resistance line. At the same time, it is trading within the Ichimoku Cloud, which is a technical indicator used to evaluate market trends and momentum.

When the price is within the cloud, it indicates a consolidation phase; when the price is above the cloud, it potentially indicates a bullish phase and vice versa. Based on the current chart, the price is currently below the cloud.

However, if BTC can break above the channel and the cloud and then successfully retest the breakout level (confirming it as new support), it will signal a significant shift toward bullish momentum. This setup is notable because such breakouts frequently result in big price movements, indicating the potential conclusion of a downturn and the beginning of a fresh rally.

Conclusion

In a nutshell, BTC is facing volatility from LTHs selling their holdings, but on the other hand, corporate treasury demand is increasing and supportive macro data suggest BTC’s bull market is still intact.

Technical signals could potentially point to a possible breakout that might fuel the next wave higher. However, the upcoming macro data, such as the inflation rate and the FOMC, will determine the next price movements.