Key Takeaways

- Bitcoin (BTC) has plummeted 2.65%, hinting that the asset may continue its current bearish trend and potentially reach the $100,000 level.

- Bitcoin ETFs have recorded outflows for the fourth consecutive day, indicating that participants are withdrawing capital from these investment funds.

- A crypto whale was also found dumping $138.23 million worth of BTC, raising whether this is an ideal time to sell.

Bitcoin has dropped nearly 10% from $114,300 to $103,900 in the past week. With today’s 2.65% dip, the asset has lost its key support at $105,600, signaling extended downside momentum ahead.

Why is Bitcoin Price Falling?

The key catalyst driving this downward momentum appears to be the overall market sentiment, which has turned bearish amid fading institutional interest and mixed whale activity.

These factors have created enough fear among market participants, leading not only to reduced participation but also to increased selling and bearish bets. As a result, the asset continues to register a sustained downward momentum.

Institutions and Whales Show Waning Interest

Recently, on-chain platform WuBlockchain shared a post on X noting that on November 3, 2025, Bitcoin spot ETFs recorded massive outflows totaling $187 million, marking the fourth consecutive day of outflows.

This trend indicates that traditional investors and traders are continuously withdrawing capital from these investment funds — typically a bearish sign for BTC holders.

Meanwhile, a crypto whale named Owen Guden has dumped 1,288.76 BTC worth $138.23 million into Kraken amid the ongoing market uncertainty, further strengthening Bitcoin’s bearish outlook.

BTC Price and Its Rising Trading Volume

The impact of these outflows and sell-offs is already evident in BTC’s price, which has dropped by 2.65% and is currently trading at the $103,900 level, according to TradingView data. Despite the price decline, BTC’s trading volume over the past 24 hours has surged significantly by 78% to $82.25 billion, as per the latest CoinMarketCap data.

This rise in trading volume amid a price decline suggests that traders and investors are aiming to push the price to lower levels.

Bitcoin (BTC) Price Action and Technical Analysis

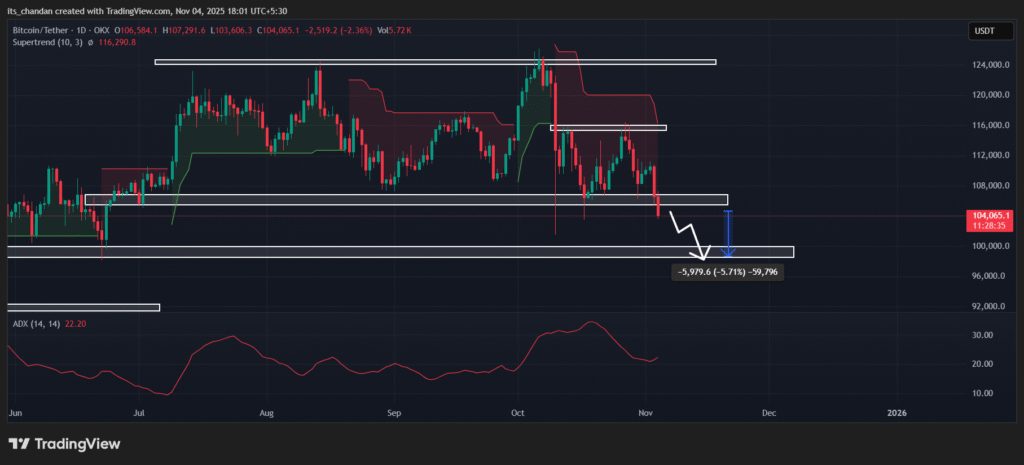

According to TimesCrypto’s technical analysis on the daily chart, Bitcoin is in a bearish trend not only because its Supertrend indicator continues to show a red signal but also because it has lost the key support level of $105,600.

Based on the current price action, if the downside momentum sustains and Bitcoin closes a daily candle below the key support, it could face a further decline of over 5.5% and may reach $100,000 in the coming days. On the other hand, if this bearish momentum fades and the price reclaims the $105,600 level, a potential price reversal could occur.

As of press time, BTC’s Average Directional Index (ADX) value stands at 22.20, below the key threshold of 25, indicating weak directional momentum. This suggests that it may be difficult for Bitcoin to sustain its current downward trend.