According to a new, in-depth CoinShares report on the Quantum computing risk for Bitcoin, they’ve concluded that the threat, as seen now, is ‘manageable’ and not an imminent crisis. This latest analysis claims that only a small amount of Bitcoin’s supply could be vulnerable, but the technology for achieving such an attack is still decades away.

The Scope of Bitcoin’s Quantum Vulnerability

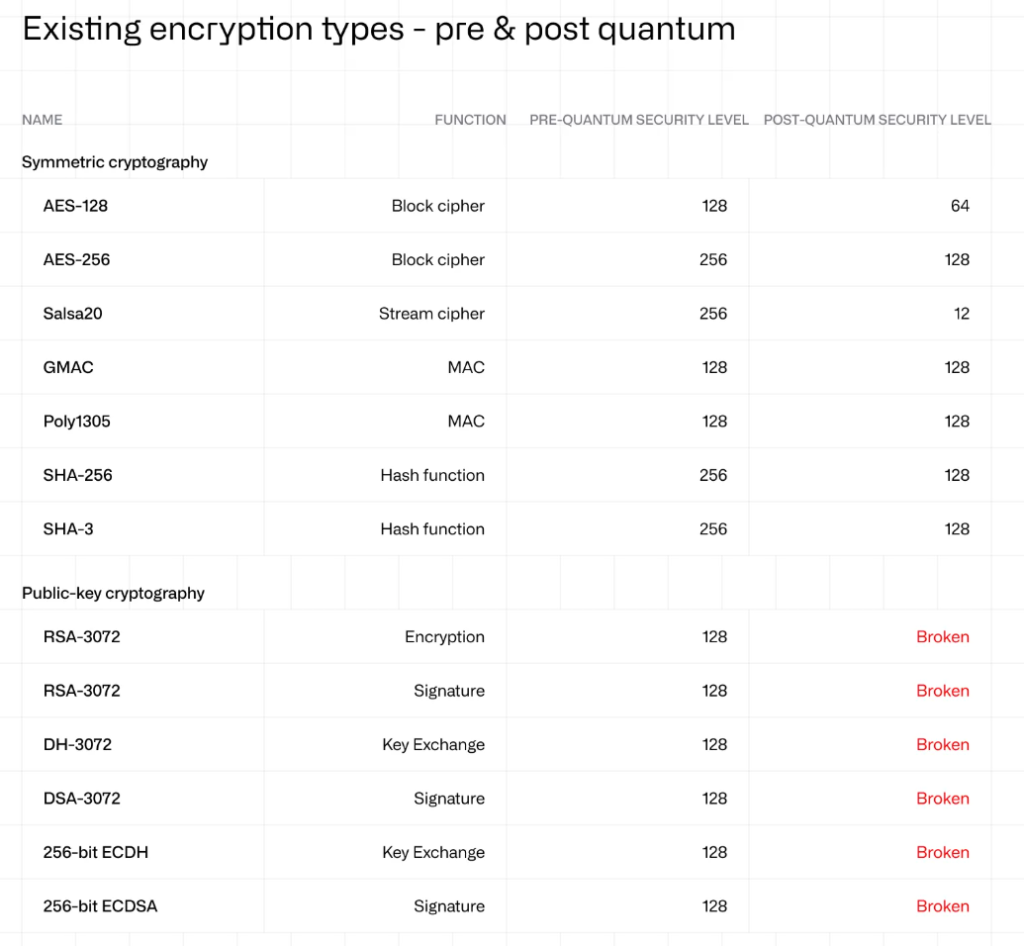

The quantum computing Risk for Bitcoin is primarily related to the way Elliptic Curve Digital Signature Algorithms (ECDSAs) are used for generating private keys. If this technology awakens, then a sufficiently advanced quantum computer running Shor’s algorithm could theoretically derive a private key from its public key. But it only applies when the public key is visible on the blockchain.

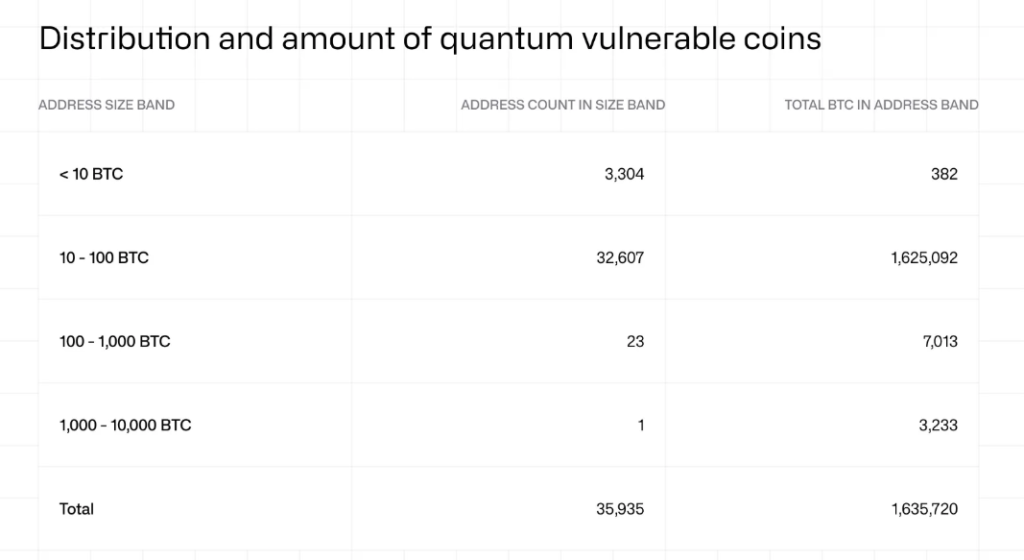

After assessing Bitcoin’s total supply, CoinShares estimates that approximately 1.6 million (or 8% of Bitcoin’s total supply) are stored in “Pay to Public Key” (P2PK) addresses and thus, could be exposed to this risk. More importantly, CoinShares has estimated that only about 10,200 of those Bitcoins are stored in Unspent Transaction Outputs (UTXOs), which could be stolen quickly enough to cause market disruption, as the rest are spread across tens of thousands of addresses that would take impractically long to crack even with advanced quantum systems.

Why the Timeline and Mitigation Matter

The report outlines the absolute scale gap between current quantum technology and what is needed to break Bitcoin’s cryptographic nature. To break the secp256k1 curve (a specific, non-random elliptic curve used in cryptographic systems) used in Bitcoin would require millions of logical qubits, a scale that is approximately 100,000 times larger than the number of logical qubits in the most advanced quantum machines today. Based upon this difference, there is likely to be a timeline of decades until a significant threat would emerge.

This long lead time would allow for an orderly mitigation/solution, such as a future soft-fork, that integrates quantum-resistant signatures into the current Bitcoin network. An additional consideration on the quantum computing risk for Bitcoin and the wallet format is that both Pay-to-Public-Key-Hash (P2PKH) and Pay-to-Script-Hash (P2SH) address formats, used by the vast majority of wallets today, hide the public key behind a hash until the funds are spent. This function provides an inherent level of security to the keys by design.

So far, genuine quantum threats are projected to be at least a decade away, according to a timeline assessment. This report from CoinShares comes as Bitcoin slowly recovers from last week. Today, Feb 9th, 2026, it has been trading above USD 70,000 to deep again under this level to around the USD 68,600, a 2.5% lower in just a couple of hours.

Recently, the number one crypto briefly dipped to USD 60,000, meaning it has lost approximately half of its value since its peak/ATH above $126,000 in October 2025.