Key Takeaways

- Rootstock Institutional BTCFi targets 2.6 million Bitcoin held by institutions that currently generate negative yields due to custody costs.

- The protocol allows institutions to generate yields of up to 7% APY by using Bitcoin-native DeFi protocols without dependence on wrapped tokens.

- Rootstock Institutional BTCFi utilizes merged mining, leveraging 83% of Bitcoin’s hashrate to deliver institutional-grade security.

Table of Contents

Turning Passive Holding into Productive Assets.

Rootstock Labs has launched its Rootstock Institutional BTCFi initiative, targeting approximately $260 billion in institutional Bitcoin (BTC) that currently sits idle across exchange-traded funds (ETFs), corporate treasuries, and mining reserves.

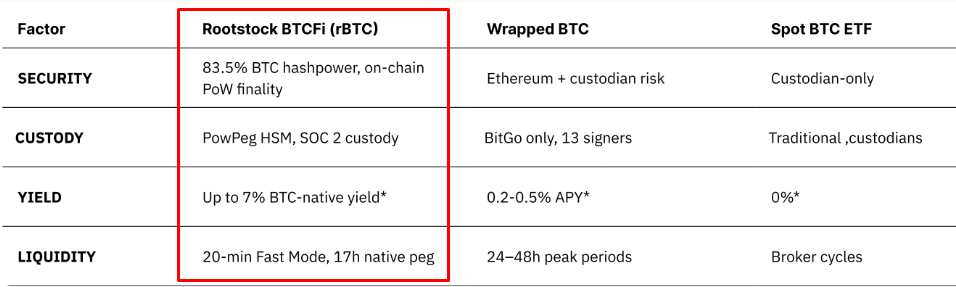

Per the Rootstock’s Institutional BTCFi Report, more than 2.6 million BTC are generating negative returns because of custody costs from 10-50 basis points per annum. The Rootstock Institutional BTCFi platform aims to turn this passive digital gold into productive capital through Bitcoin-native decentralized finance (DeFi) protocols that can generate yield opportunities up to 7% annual percentage yield (APY).

Read also: Bitcoin DeFi: Sui Integrates sBTC and Stacks to Boost Institutional BTCfi Use Cases

Bitcoin-Native Solutions for Institutional Requirements

The Rootstock Institutional BTCFi ecosystem differs from other projects by avoiding wrapped token dependencies that create centralization risks unacceptable to institutional investors. Instead, protocols like Sovryn Lending Pools, SolvBTC, and MoneyOnChain operate natively on Rootstock’s Bitcoin-secured sidechain, while still using Bitcoin directly as collateral.

The platform’s security foundation is based on merged mining with over 83% of Bitcoin’s hashrate, which is strong enough for institutional-level security, while still maintaining full compatibility with Ethereum Virtual Machine (EVM) technology, allowing protocols to be deployed onto Rootstock with ease.

Read also: GOAT Network Launches Bitcoin Yield Dashboard for Native BTC Rewards

Catalysts Driving Institutional Adoption

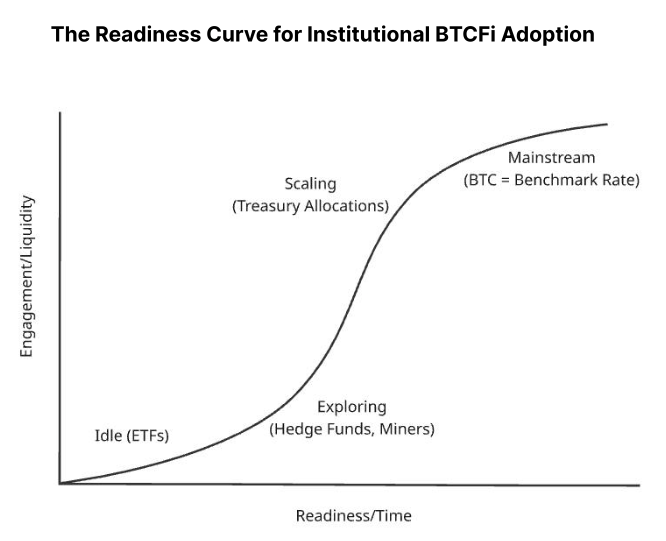

Many converging elements are propelling the Rootstock Institutional BTCFi adoption, including $54 billion in ETF inflows since January 2024 and approximately one million BTC of growing corporate Bitcoin allocations. With Bitcoin-native DeFi growing 2,700% year-over-year (YoY) to $8.6 billion in total value locked, institutions now have the infrastructure to assess yield strategies within existing treasury frameworks.

This transformation from passive storage to productive capital allocation can be considered one of the largest opportunities in all of digital finance, and could provide access to billions of dollars in currently dormant value.

FAQs

What makes Rootstock ideal for institutions?

Rootstock offers Bitcoin-level security through merged mining, EVM compatibility, and integrations with institutional custodians like BitGo and Fireblocks.

How much yield can institutions expect?

Protocols on Rootstock currently offer up to 7% APY through various lending, liquidity provision, and collateral management strategies.

What percent of Bitcoin is currently deployed in DeFi?

Less than 0.8% of Bitcoin’s total supply is currently deployed in DeFi, compared to approximately 50% for Ethereum.

For more Bitcoin innovation stories, read: Quantic Bitcoin ‘BTCQ’ Emerges as Quantum-Resistant Crypto Challenger