Key Takeaways

- Strategy Inc acquired 196 bitcoin last week, spending $22.1 million at an average price of $113,048 per coin.

- Total BTC holdings now stand at 640,031, acquired for approximately $47.35 billion, at an average price of $73,983 per bitcoin.

- The company raised $128.1 million via equity sales, including $116.4 million from MSTR common shares.

- Preferred stock sales under STRF and STRD added $11.7 million, funding the latest bitcoin purchase alongside MSTR proceeds.

Strategy Inc (NASDAQ: MSTR) said on Monday it raised about $128.1 million last week through its at-the-market equity programs and used part of the funds to buy 196 bitcoin.

In a regulatory filing with the U.S. Securities and Exchange Commission, the company said the latest purchase was made between September 22 and September 28, for about $22.1 million, at an average price of $113,048 per Bitcoin. The Bitcoin was acquired using proceeds from the sale of common and preferred stock under the MSTR, STRF, and STRD ATM programs.

The latest purchase brings Strategy’s total bitcoin holdings to 640,031 BTC, with an aggregate purchase price of approximately $47.35 billion and an average cost across all holdings of $73,983 per bitcoin, according to the filing.

The company generated most of its weekly funding by selling 347,352 shares of its class A common stock (MSTR), raising $116.4 million. It also sold 101,713 shares of its 10.00% Series A perpetual strife preferred stock (STRF) for $11.3 million, and 5,000 shares of its 10.00% Series A perpetual stride preferred stock (STRD), bringing in $0.4 million.

Strategy concluded by noting it still has over $46 billion available for future sales under its various at-the-market programs.

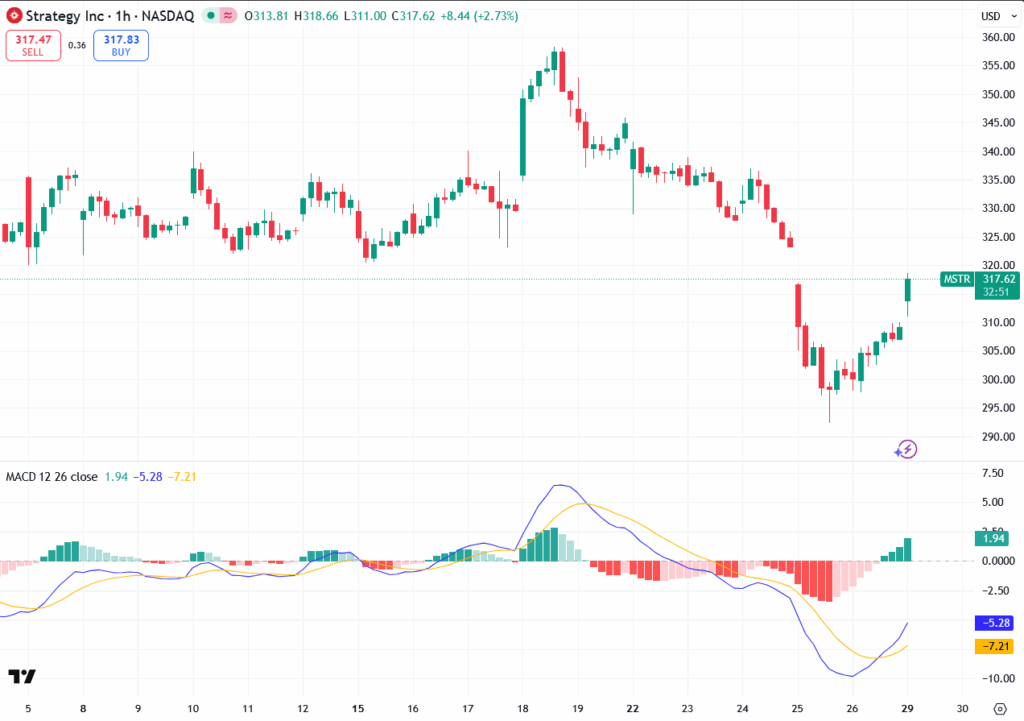

MSTR Charts Hint at Rebound as Bitcoin Strategy Revives Bullish Sentiment

Following the disclosure, shares of Strategy Inc (MSTR) showed a modest recovery from recent lows, with price action turning higher on renewed investor interest. The stock climbed off a steep selloff, carving out a short-term bottom as buyers stepped in near prior support.

Technical indicators reflected the shift: On the MACD, the signal line began to flatten while the MACD line curved upward, suggesting early signs of bullish divergence. Also, histogram bars flipped green, pointing to a possible change in short-term trend as the market began to price in the company’s continued bitcoin accumulation and fresh capital inflow.

While resistance looms near the $320 area, the improving momentum may draw in technical traders anticipating further strength driven by the company’s aggressive bitcoin strategy.

Read More: Hyperdrive Smart Contract Exploit Drained of $782,000 in Funds