Key Takeaways

- Strategy (MSTR) excluded from the S&P 500, with analysts citing its heavy Bitcoin exposure and volatility.

- Robinhood Markets (HOOD) and AppLovin (APP) added to the index, while Emcor Group (EME) was elevated from the S&P MidCap 400.

- Strategy bought 1,955 Bitcoins for $217 million in September, lifting its total holdings to 638,460 BTC worth about $47 billion

Strategy (MSTR), the biggest corporate holder of Bitcoin, was excluded from the S&P 500 in the latest quarterly rebalance, while Robinhood Markets (HOOD) and AppLovin (APP) were added to the benchmark index, S&P Dow Jones Indices said on Friday.

The reshuffle also brings Emcor Group (EME) up from the S&P MidCap 400 into the S&P 500, while dropping MarketAxess Holdings (MKTX), Caesars Entertainment (CZR) and Enphase Energy (ENPH) out of the blue-chip index, with changes set to take effect before the market opens on Sept. 22.

Analysts said Strategy’s rejection may reflect concerns over its heavy exposure to Bitcoin, which makes the stock more volatile than traditional S&P 500 constituents.

With more than 600,000 Bitcoins on its balance sheet, the company’s share price often moves closely with the cryptocurrency, leaving it exposed to sharp swings during market downturns.

That degree of volatility, analysts said, may have weighed against its inclusion in the index despite meeting the standard eligibility criteria.

Critics question S&P process as MSTR dips

The decision drew sharp reactions from market experts. Eric Balchunas, senior ETF analyst at Bloomberg, wrote on X:

Why wasn’t $MSTR allowed into the S&P 500 Index despite meeting all the criteria? Because the committee said no. You have to realize SPX is essentially an active fund run by a secret committee.

His colleague, Bloomberg ETF analyst James Seyffart, backed the point, adding:

The index committee has full discretion to add and remove names as they see fit.

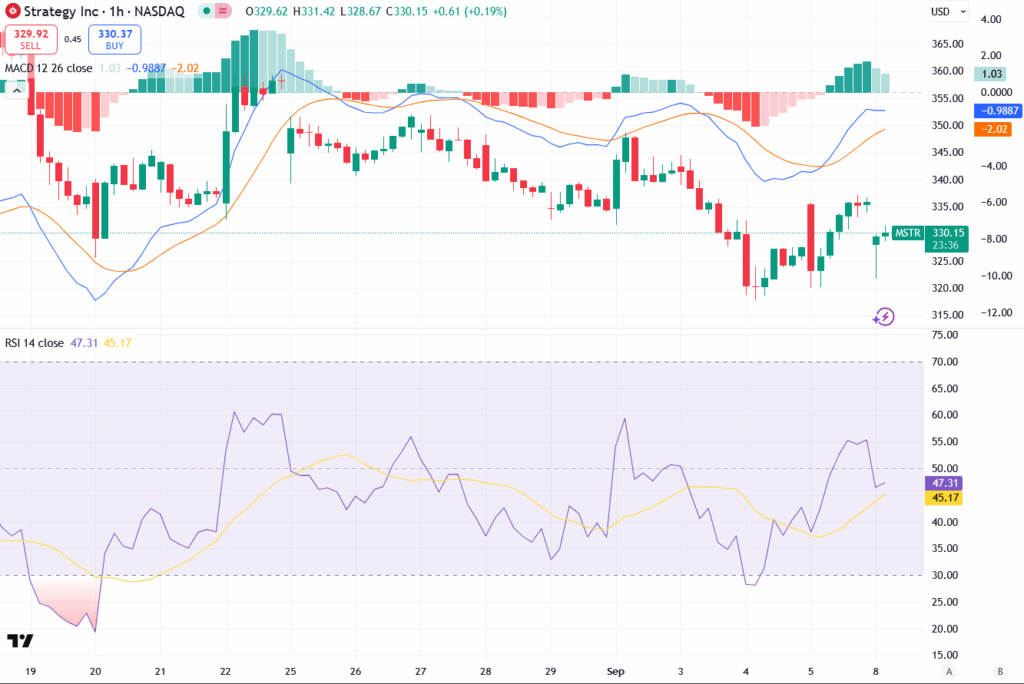

Reacting to the news, Strategy shares slipped to $324.91 on Friday, easing from recent highs.

However, technical indicators point to resilience. The stock remains above its 50-day moving average, with momentum remains in positive territory and relative strength indicators showing stabilization after the drop.

Bitcoin accumulation continues despite exclusion

Strategy kept up its aggressive Bitcoin purchases even as it faced exclusion from the S&P 500.

In a filing on Monday, the company said it acquired 1,955 Bitcoins between Sept. 2 and Sept. 7 for about $217.4 million, at an average price of $111,196 per token.

The purchases, funded through its at-the-market (ATM) stock offering programs, bring its total holdings to 638,460 Bitcoins, acquired for roughly $47.17 billion at an average cost of $73,880 each.

During the same period, the company raised over $217 million through ATM sales of both preferred stock and common shares, including 591,606 MSTR shares worth $200.5 million.

Read More: Is BTC Still in Mid-Bull Market? Read What Market Experts Predict!