Key Takeaways

- Today, Bitcoin (BTC) has cleared multiple hurdles, but resistance at $107K has constrained its upward momentum.

- Price action suggests that if BTC clears the key $107K hurdle, it could open the door to the $115K level.

- The on-chain metric, Liquidity Pressure Index, has reached 0.7221. An expert made a bold prediction that if the index remains above 0.7, BTC could hit the $110K level.

Bitcoin (BTC) appears to be reversing its prolonged downtrend after clearing one of the key hurdles it has faced since October 2025. However, another resistance level continues to challenge its upward momentum.

Despite the uncertain price action and doubts over whether today’s rally will sustain or fade, a crypto expert noted that Bitcoin on Binance is witnessing a decline in supply and a rise in demand.

Expert Bullish Views on Bitcoin (BTC)

Recently, a crypto expert from CryptoQuant shared Liquidity Pressure Index data, which has been gradually rising throughout November and has now reached 0.7221 following today’s upward momentum.

The expert noted that when this on-chain index increases, it indicates growing demand for Bitcoin amid shrinking supply, which typically supports a continued upward trend in the near term.

The Bitcoin market on Binance is experiencing a phase of positive liquidity pressure, meaning that the available supply is decreasing while demand continues to rise.” the expert said.

He further added that if the index remains above 0.70, BTC could potentially push beyond $110,000 in the coming days.

Current Price Momentum

According to the latest TradingView data, BTC is trading at $106,100, up 1.65% today. This surge in the asset’s price has attracted significant participation, as reflected in the trading volume, which has jumped 49% to $70.20 billion.

Also Read: Trent Merrin Denies $140K Bitcoin Theft Allegations from Former Teammate

Bitcoin (BTC) Price Action and Upcoming Levels

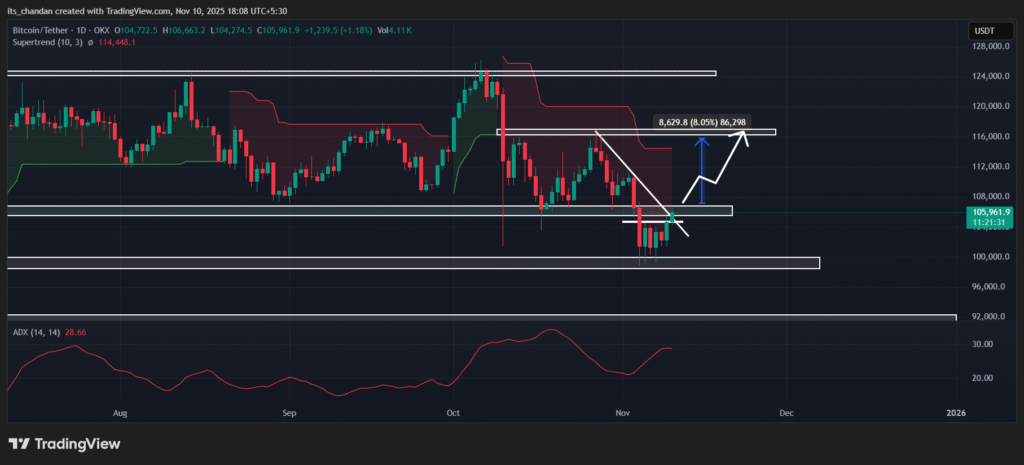

TimesCrypto’s technical analysis on the daily chart reveals that over the past 24 hours, Bitcoin has broken out of a small consolidation pattern that had formed around the key support level of $100,000 and along a descending trendline it has been facing since October 26, 2025.

Following the breakout, BTC experienced strong buying pressure and an upward rally; however, resistance at the $107,000 level has constrained its upward momentum.

Based on the current price action, if BTC continues to move upward and closes the daily candle above the $107,000 level, it could see a price uptick of over 8% and potentially reach $116,000. However, this bullish thesis will remain valid only if the asset’s price stays above the $105,700 level; otherwise, it could be invalidated.

As of now, BTC’s Average Directional Index (ADX) value has reached 28.66 — above the key threshold of 25 — indicating strong directional momentum in the asset. However, the Supertrend indicator continues to display a red trend above the BTC price, suggesting that the asset is still in a downtrend.

Tug-Of-War Between Bulls and Bears

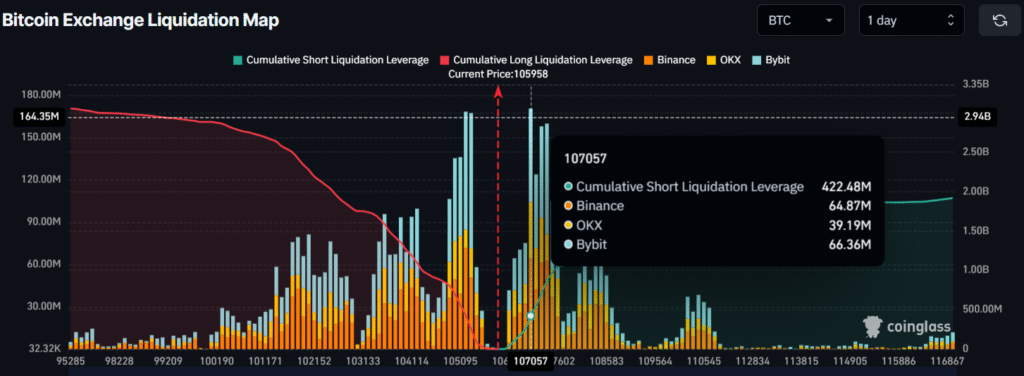

Based on the current price action, derivatives data from Coinglass reveals that bulls and bears appear to be locked in a strong tug-of-war.

At press time, BTC’s major liquidation levels stand at $105,204 on the lower side (support) and $107,057 on the upper side (resistance). At these levels, traders have built $425.59 million in long positions and $422.48 million in short positions.

This clearly indicates that BTC is currently at a decisive level, where a breakout or breakdown on either side could determine the next trend.