Key Takeaways

- BlackRock buys $169.3 million worth of Bitcoin (BTC).

- BTC price action hints at 8.75% upside potential.

- Traders have opened $2.12 billion worth of long positions at the $110,340 level.

The bullish sentiment around Bitcoin (BTC) is heating up as whales, institutions, and price action hint at a potential price reversal. On September 10, 2025, BlackRock, the asset management giant, increased its Bitcoin holdings, as revealed by blockchain-based security firm Arkham.

Institutions and Whales Show Strong Confidence in BTC

In a post on X, Arkham revealed that BlackRock is buying BTC and recently purchased $169.3 million worth of Bitcoin.

In addition, a crypto whale wallet address, 0x6636, has shown strong confidence in BTC by going long with 40x leverage, as shared by the crypto transactions tracker Lookonchain. The post also revealed that this whale is long on 540 BTC worth $60 million.

BTC Current Price and Rising Trading Volume

Looking at whale and institutional activity, questions arise as to whether this is an ideal time to buy BTC or if the price will see a dip in the future.

At press time, BTC jumped 2.75% and is currently trading at the $114,000 level. This notable price increase has attracted massive participation, triggering a 21% surge in overall trading volume compared to the previous day.

This rising trading volume, along with the price increase, shows that participants are more interested in pushing BTC to higher levels. Basically, it’s a bullish sign for BTC holders.

Bitcoin Price Action: Key Levels to Watch

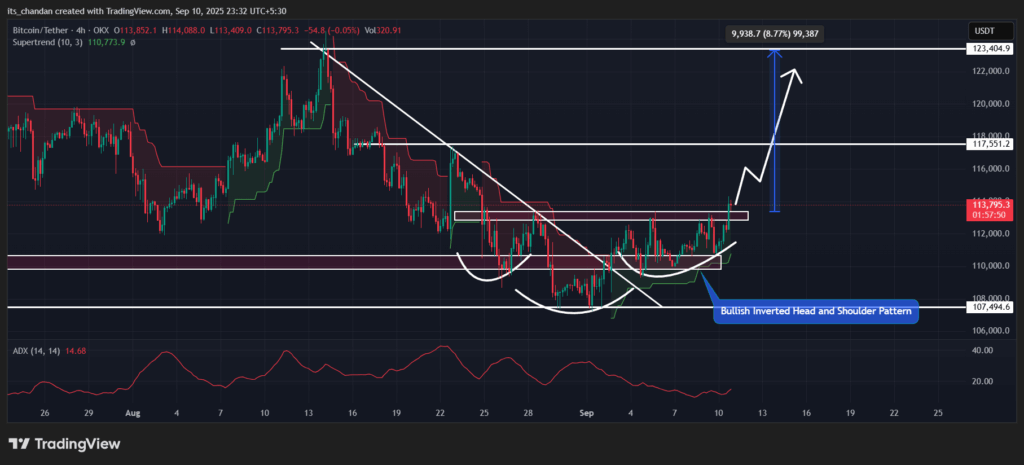

Bitcoin’s 2.75% price uptick triggered a bullish breakout. TimesCrypto’s technical analysis on the four-hour chart reveals that BTC has broken out of a bullish inverted head-and-shoulders pattern, confirmed by a four-hour candle closing above the neckline at $113,400. Currently, BTC appears to be testing the breakout level.

Based on the current price action and historical patterns, if BTC holds above the $113,000 level, it could propel the largest cryptocurrency by 8.75%, pushing the price toward $123,300. However, BTC may face a hurdle at the $117,550 level, which could pause the upside momentum.

This outlook is further strengthened by the Supertrend indicator, which has flipped green and is now hovering below the asset price. This indicates that BTC is in an uptrend with strong buying pressure.

However, the Average Directional Index (ADX) flashes a red flag as its value stands at 14.68, indicating weak momentum and a lack of a strong trend despite the breakout.

Traders Bet $2.12 Billion on BTC Long Positions

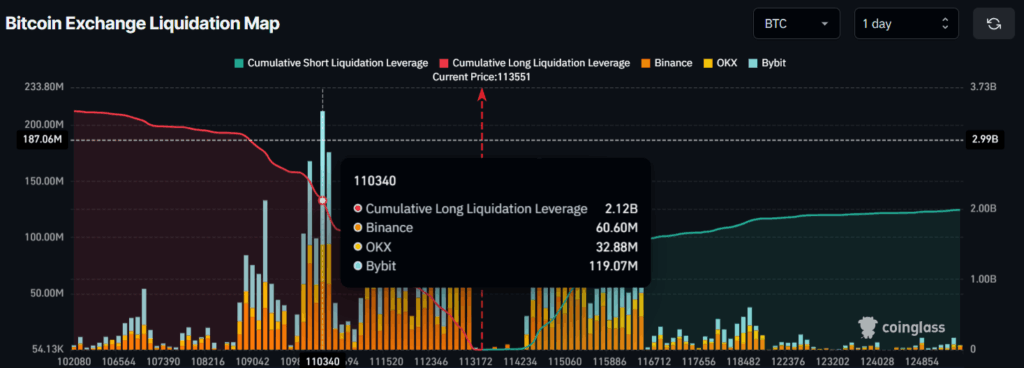

If you see how traders are reacting to this situation, it’s quite surprising. Coinglass’s Bitcoin Exchange Liquidation Map shows that BTC’s major liquidation levels, where traders are over-leveraged, are at $110,340 on the lower side and $115,178 on the upper side.

At these levels, traders have built $2.12 billion worth of long positions and $843.44 million worth of short positions.

This data shows that bets on the long side are more than double those on the short side. It also highlights the bulls’ dominance following the breakout.