Key Takeaways

- The latest Abracadabra smart contract exploit resulted in the loss of at least $1.7 million, and the funds that were taken were laundered using Tornado Cash.

- The hackers exploited a logic bug in the protocol’s “cook” function to overcome essential insolvency checks.

- This incident marks the third significant attack against the protocol since 2024, and helps contribute to cumulative losses of $21 million.

Table of Contents

A Recurrent Vulnerability Re-emerges

The decentralized finance (DeFi) lending protocol Abracadabra has experienced yet another large-scale attack, with hackers using an exploit of a smart contract vulnerability to drain around $1.7 million. To this point, this is the third significant Abracadabra smart contract exploit since 2024, following a $6.5 million loss in January 2024 and a $13 million hack in March 2025. Blockchain security firms Phalcon and Go Security identified the attack, which targeted a fundamental flaw in the protocol’s transaction processing logic.

Read also: SBI Hack: North Korean Hackers Suspected of $21M Crypto Theft

How the “Cook” Function Was Manipulated

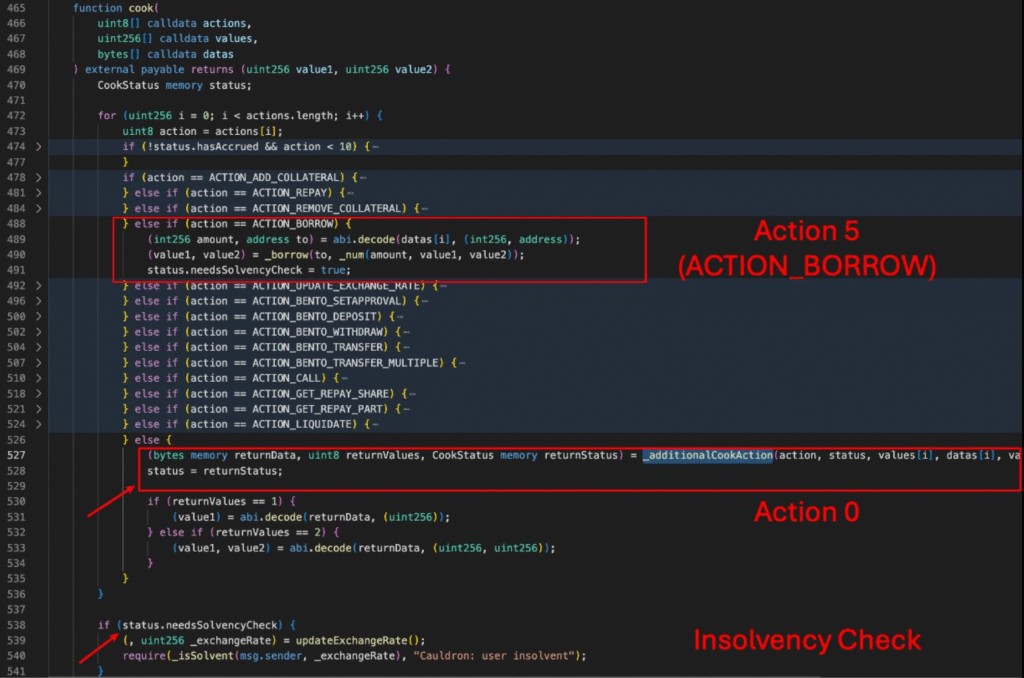

In the Abracadabra smart contract exploit, the attack focused on a single protocol function called “cook” that allows for multiple actions to be performed within a single transaction. Attackers cleverly sequenced two actions:

- First, initiating a borrow operation that triggered a solvency check

- Second, immediately calling an empty update function that resets the check flag to false.

As a result, the attackers were able to borrow 1.79 million MIM tokens from the protocol without legitimate solvency checks across six different addresses, creating debt from thin air.

Read also: Critical WhatsApp 0-Click Vulnerability Exploited via DNG File – Watch Your Crypto!

A Pattern That Undermines Confidence

In response to the Abracadabra smart contract exploit, the project team paused all contracts and is apparently looking to utilize Decentralized Autonomous Organization (DAO) reserves to buy back the exploited MIM tokens. To add a bit more drama to the case, during this time, the protocol failed to mention anything on any of its official social media or other channels, thus raising concerns about the project’s overall transparency. Furthermore, this trendy pattern of similar exploits suggests there are systemic security flaws, which muddy the organization’s ability to secure user funds and remain competitive in the long run.

FAQs

What was the Abracadabra smart contract exploit specific vulnerability?

The attack manipulated a logic error in the “cook” function, where an empty action reset a critical solvency check flag, allowing unlimited borrowing.

How has Abracadabra responded?

The team paused all contracts and plans to use DAO treasury funds to cover losses, though official public communication has been limited.

Is this the first time this has happened?

No, this is the third major exploit since 2024, with previous hacks costing $6.5 million and $13 million, respectively.

For more protocol exploit stories, read: Hyperdrive Smart Contract Exploit Drained of $782,000 in Funds