The BRICS intergovernmental organization announced the launch of the Decentralized Cross-Border Messaging System (DCMS) in Brazil. The DCMS is a blockchain-based payment system that allows for the settlement of international trade without using the U.S. dollar. The system will utilize Brazil’s Pix instant transfer technology to link the central banks of BRICS member nations through a decentralized messaging layer.

How the DCMS Plans to Change Cross-Border Payments

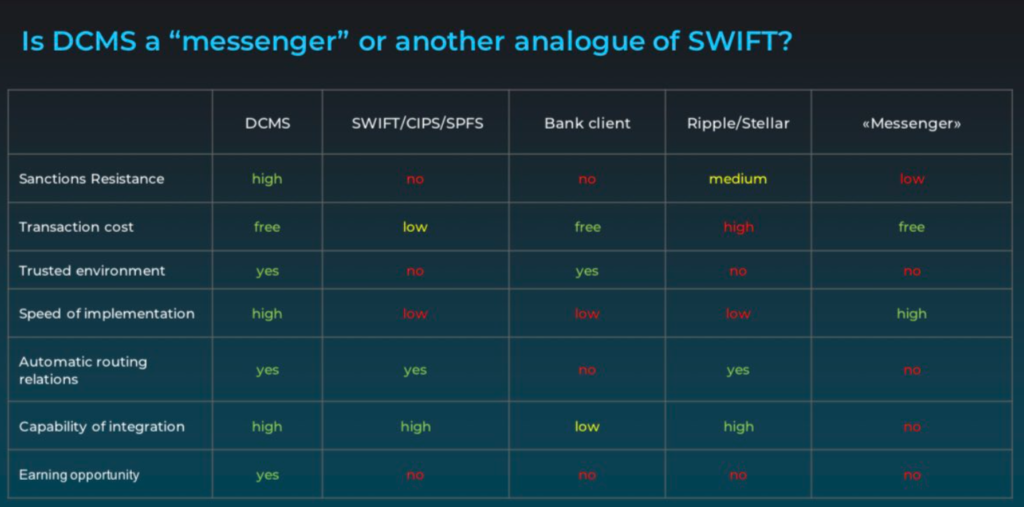

The DCMS created by BRICS will differ fundamentally from the current payment infrastructure in place today. Current payment systems route messages through centralized Worldwide Interbank Financial Telecommunication (SWIFT) server(s), while the DCMS will allow the central banks of BRICS member nations to operate independently using a distributed blockchain network. All BRICS member countries will have their own independent node(s) and will be able to settle payments in their respective national currencies (rubles, yuan, rupees, reais, rand) while integrating their respective national digital currencies (China’s e-CNY, Brazil’s Drex).

Brazilian President Lula da Silva pointed this out perfectly with a statement: “We must work together so the multipolar order we properly established reflects itself in the global financial system.” As for the technical capabilities, the DCMS can handle up to 20,000 messages per second (comparable to the volume of global payment networks).

A BRICS Block with Economic Power

The significance of this initiative can be seen in the supporting statistics. More than 60% of intra-BRICS trade now is conducted in local currencies, and the eleven-member bloc now controls almost one-third of the world’s Economy [29% Global Gross Domestic Product (GDP)]; 43.6% of world oil production, and 72% of world precious metals production.

This tremendous economic power provides a credible and viable alternative infrastructure that connects each member’s current systems (Russia’s SPFS, China’s CIPS, India’s UPI, and Brazil’s Pix) into one integrated network.