Coinbase, a leading crypto exchange, is betting that an all-purpose trading platform, a larger stablecoin and payments arm, and wider use of its Base blockchain can drive growth in 2026 as it tries to become the world’s top financial app.

Brian Armstrong, chief executive of Coinbase, said in a post on X that the company will concentrate on building what he described as an “everything exchange,” which allows customers to trade digital tokens, equities, predictions, and commodities through spot, futures, and options markets.

Armstrong also said that Coinbase plans to expand its stablecoin and payments business and push more activity on-chain by investing in its Coinbase Dev platform, the Base blockchain, and the Base consumer app.

He added that the company is committing substantial spending to improve product quality and automation in support of these priorities and its goal of becoming the leading global financial app.

Charts and Trends Support Armstrong’s Strategy

Armstrong’s announcement comes almost a week after Coinbase said the crypto market is entering a new phase in 2026, one where institutional-grade technology rather than retail boom-and-bust cycles drives how trading works and how digital assets are used.

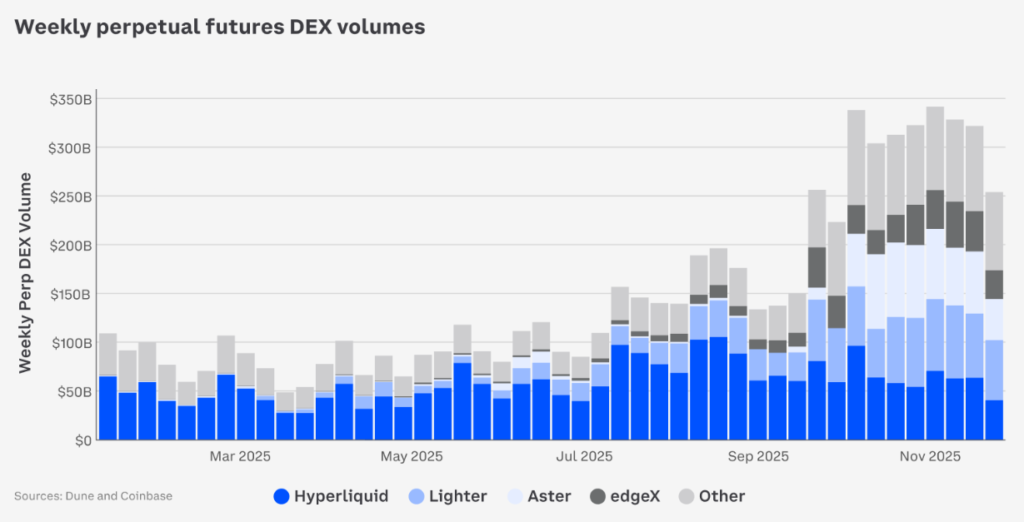

In that earlier outlook, Coinbase explained that the market will be based on three main parts: perpetual futures that help determine future prices and make trading more stable, prediction markets that are becoming important places for finding information with more involvement from big institutions, and stablecoins that are being used more for real payments and transactions instead of just for speculation.

Coinbase said this mix of trends will set the tone for the next phase of crypto. It added that stablecoins now do most of the practical work in the sector, from cross-border transfers to payroll, and their use is growing inside new AI-driven services.

Armstrong’s ‘Everything Exchange’ Plan for Coinbase: Could It Work?

Armstrong’s “everything exchange” idea would make Coinbase a single venue where customers can trade a wide range of assets and move money around the system, rather than using separate platforms for each task. In practical terms, this entails starting with crypto tokens and derivatives, then expanding to include equities, commodity exposure, prediction markets, and stablecoin-based payments, all within a unified account and compliance framework.

The approach is meant to provide Coinbase with deeper and more stable revenue streams if users keep positions in different products and use the platform as a main hub for trading and payments instead of just a place to speculate during bull markets.

However, even if the concept is appealing, every additional product line brings its own set of rules, meaning Coinbase would need to secure and maintain permissions across more markets while tightening controls as the platform grows.

The experience of Revolut, which expanded as an all-in-one finance app, shows how demanding it can be to answer detailed questions from regulators and strengthen internal systems. For Armstrong’s plan to work, Coinbase will need to keep security and compliance at the center of the model and prove that offering a wider range of products and markets does not weaken customer protection.

Read More: Amplify ETFs, Sling Money & BC Card Push Stablecoins Deeper Into U.S., UK, And Korea