In a drastic strategic retreat, the Gemini Exchange exits UK, EU, and Australia markets. The platform that was founded by Tyler and Cameron Winklevoss has also laid off about 200 jobs globally, and for now, will only focus on its U.S. and Singapore locations in an effort to make profitability under the term “Gemini 2.0”.

Under What Terms Gemini Exchange Exits UK, EU & Australia?

Beginning March 5, 2026, the customer accounts from the three regions will be in a “withdraw-only” mode until their full closure on April 6. Customers who have any open perpetual futures contracts are required to close positions by the end of March, or they will be forcibly liquidated. Customers will also have the option to transfer their crypto funds from Gemini to eToro (in a recent partnership), self-custody wallets, or linked bank accounts.

The company forecasts that it will incur approximately USD 11 million in restructuring charges, aiming to complete the layoffs and regional wind-down by mid-2026.

Gemini is Dealing with a Painful Situation

The deep downside is due to the events happening in the broader crypto bear market and to their own financial struggles. Since going public in September 2025 and experiencing a nearly 74% in loss from its high, Gemini has refocused its company away from growth and back to reducing costs to be profitable.

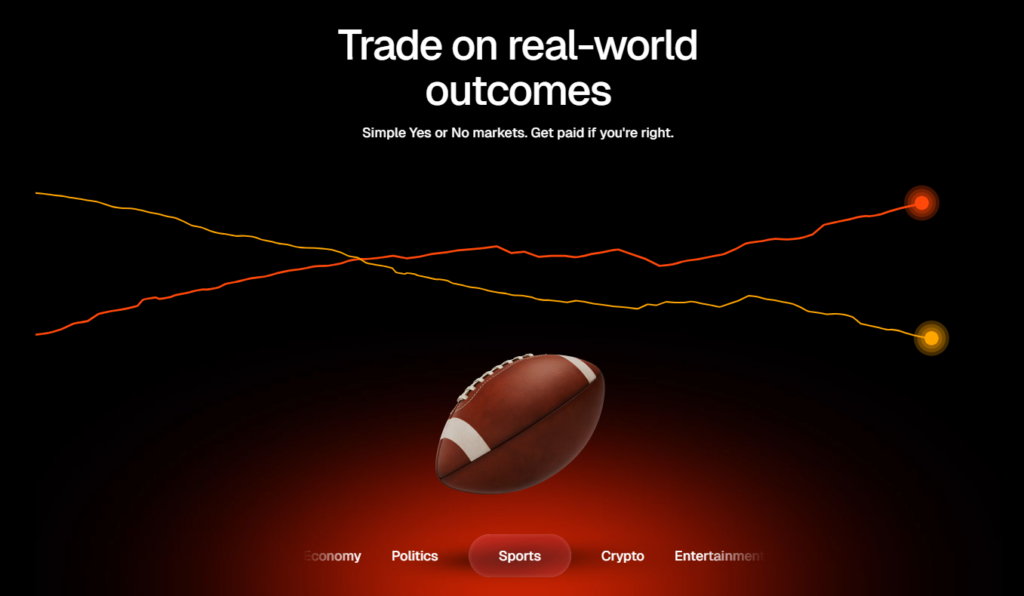

The company now sees its next bet as being its new prediction markets product (Gemini Predictions), which they believe has great long-term potential, while also withdrawing from the costly and high-stakes competition for sharing the global market in spot trading.