Hong Kong is setting out a long-term plan to bring digital assets and tokenized finance into the heart of its capital markets, according to new research released by the Financial Services Development Council on Thursday.

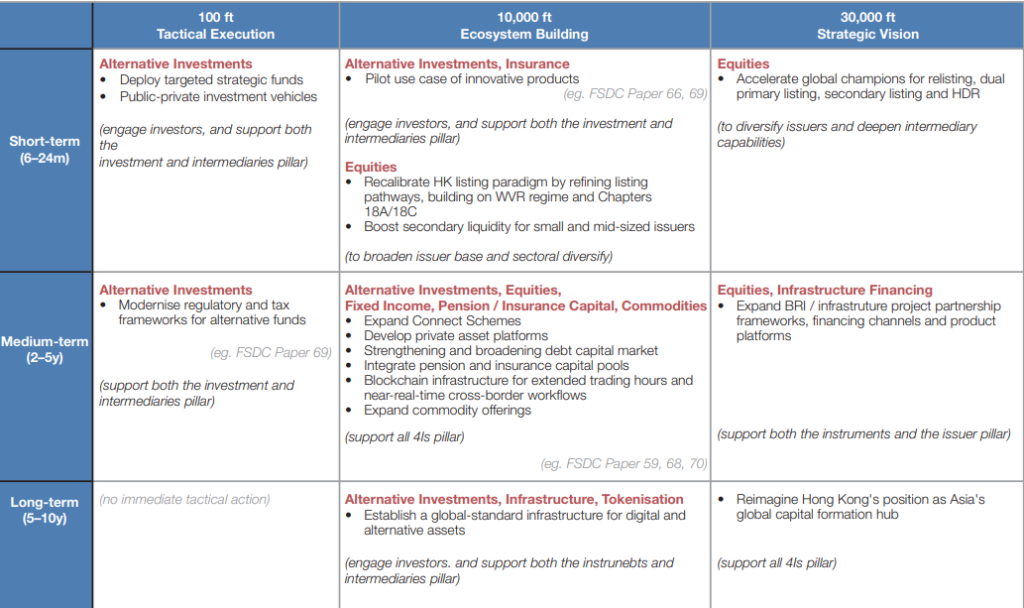

The paper outlines how the city aims to strengthen its role as an international financial center as markets shift toward digital infrastructure and cross-border capital flows become more complex, and draws a roadmap stretching across the next decade. In the early phase, the council suggests tightening the basics. That includes making it easier for young, research-focused companies to come to market, improving day-to-day trading conditions, and running limited trials of new products before rolling them out more widely.

Later on, the emphasis turns outward. The paper argues that Hong Kong should widen its cross-border reach beyond shares and bonds, with more attention on private market deals, higher quality debt products, green financing, and the use of tokenization to bring real-world assets into the market. In the paper, blockchain-based systems are seen as a way to improve settlement efficiency and reduce friction in cross-border transactions.

Looking further ahead, the council envisions tokenization becoming part of mainstream issuance and post-trade processes. Hong Kong is expected to play a larger role in offshore renminbi markets while developing into a multi-asset, multi-currency capital formation center serving the region.

Throughout the paper, governance and market integrity are emphasized as priorities. Digital innovation, the council notes, must sit within a trusted legal and regulatory framework in order to attract long-term global capital.

The message from the research is clear. Hong Kong does not see digital assets as a standalone sector. Instead, it views them as another layer in the evolution of its capital markets, built on existing strengths and rolled out over time rather than rushed into place.

Read More: HashKey IPO: Hong Kong’s Crypto Leader Eyes $500M Public Debut