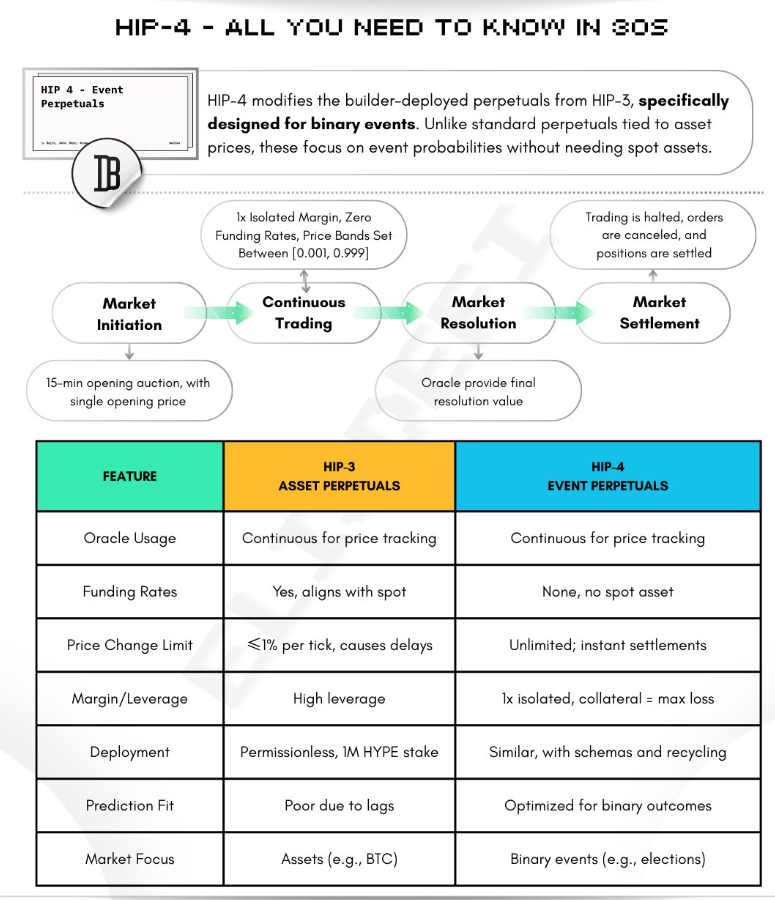

The Hyperliquid community has approved HIP-4, a proposal introducing a novel HIP-4 Outcome Trading primitive to its native exchange, HyperCore. A contract created using HIP-4 will involve 100% collateralization of the underlying and will also settle a value of either 0 or 1 based on the outcome of a specific event (for example, whether or not Candidate X is elected).

How HIP-4 Outcome Trading Functions

Different from traditional perpetual swaps, HIP-4 Outcome Trading does not involve leverage or liquidations. Instead, a builder will create a market for an event by staking 1 million HYPE tokens (similar to HIP-3) and deploying the market, establishing its name, the date/time at which the event will be resolved, and the oracle to be used. Trading occurs with the contract price bounded between 0.001 and 0.999, representing the market’s probability assessment of the event occurring.

When the designated oracle makes its final determination on the event [i.e., provides the final value of the event 0 (No) or 1 (Yes)], all existing positions will be instantly settled to the value provided by the oracle. This new design will provide instantaneous settlement once the outcome is known and will eliminate the limitations of the previous methods.

Reasons Why This Extends Hyperliquid’s Functionality

HIP-4 Outcome Trading significantly expands the expressiveness of the Hyperliquid ecosystem and provides access to advanced prediction markets and contract-like instruments to be built directly on top of Hyperliquid’s high-performance layer 1 (L1). This design greatly improves on previous versions of the product by removing slow settlement times and eliminating the need for continuous external price oracles, both of which were major issues identified by Hyperliquid users.

Additionally, the integration with HyperCore’s portfolio margining, combined with the programming possibilities of HyperEVM, will allow developers to have a composable architecture for creating unique non-linear finance products that go well beyond just spot and perpetual trading.

Following the news, the $HYPE token is rallying today by over 20% despite the market crash this week, trading at USD 36,50 at the time of writing. The community is showing confidence and optimism in the Layer 1 future, as seen in the image above.