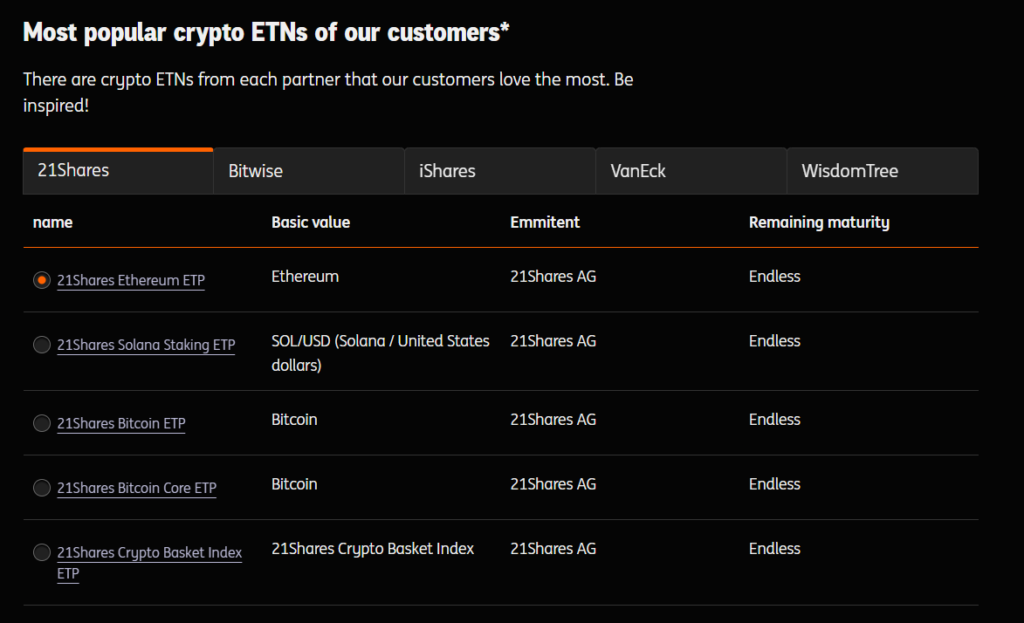

As the European bank ING expands its digital offering into retail crypto, the bank will offer several crypto ETNs or Exchange-Traded Notes in Germany. Investors on ING’s Direct Depository platform can buy physically backed notes of 50 assets, including Bitcoin, Ethereum, and Solana; these notes will be issued by reputable firms such as 21Shares, Bitwise, and VanEck.

How ING’s Crypto ETNs Work for Investing

Crypto ETNs enable clients to access the price movement and with exposure to an underlying market, in this case, crypto, without having to deal with the technical complexity of self-custody. The investor purchases a note through their customer-facing securities account, like all other stocks or exchange-traded funds (ETFs). Each of these products are backed physically, meaning the issuer retains the assets for the note.

Another important benefit for German investors is tax treatment. The notes will be treated for taxation purposes like direct crypto ownership and may enable the potential for capital gain exemptions after holding the note for over a year.

The Significance of a Traditional Bank’s Move

The launch of crypto ETPs by ING marks a great moment in terms of mainstream adoption. This is one of the first times a large, conservative European bank has confirmed the value of crypto as an acceptable investment for its large retail customer base.

By combining crypto services with its existing stock of investment products at ING, customers are spared the need to understand how an exchange or wallet works, something that can open the possibility of significantly large amounts of cautious, first-time capital into the crypto market.