Key Takeaways

- JPMorgan has begun deploying JPM Coin to institutional clients, allowing dollar-denominated transfers on Coinbase’s Base blockchain within seconds.

- Deposit tokens represent traditional deposits on blockchain networks, enabling programmable, real-time settlement while remaining under full regulatory supervision.

- Unlike stablecoins, deposit tokens sit on a bank’s balance sheet and can pass deposit interest directly to holders, preserving both liquidity and yield within the banking system.

- Research conducted by the Bank for International Settlements shows that instant, atomic settlement through tokenized deposits can reduce counterparty risk and improve efficiency across payments and securities markets.

- JPMorgan plans to expand access to clients’ counterparties and additional currencies, signaling growing momentum for deposit tokens as a compliant, institutional-grade alternative to stablecoins.

Table of Contents

JPMorgan Chase has begun deploying a blockchain-based deposit token known as JPM Coin to institutional clients, deepening the U.S. bank’s move into digital finance as demand for faster, round-the-clock payments continues to grow.

The token, which represents U.S. dollar deposits held at JPMorgan, enables clients to send and receive money within seconds over Coinbase Global’s (COIN.O) Base blockchain network, Bloomberg reported, citing Naveen Mallela, global co-head of the bank’s blockchain unit Kinexys.

Following months of trials with Mastercard, Coinbase, and crypto trading firm B2C2, JPMorgan said it will widen access to the token for clients’ counterparties, pursue additional currency versions pending regulatory approval, and has secured the JPME trademark ahead of a potential euro-based rollout.

Stablecoins get a lot of buzz, but deposit-based products offer a compelling alternative for institutional clients,” Mallela said. “These can be yield-bearing.

What Are Deposit Tokens and What Do They Offer

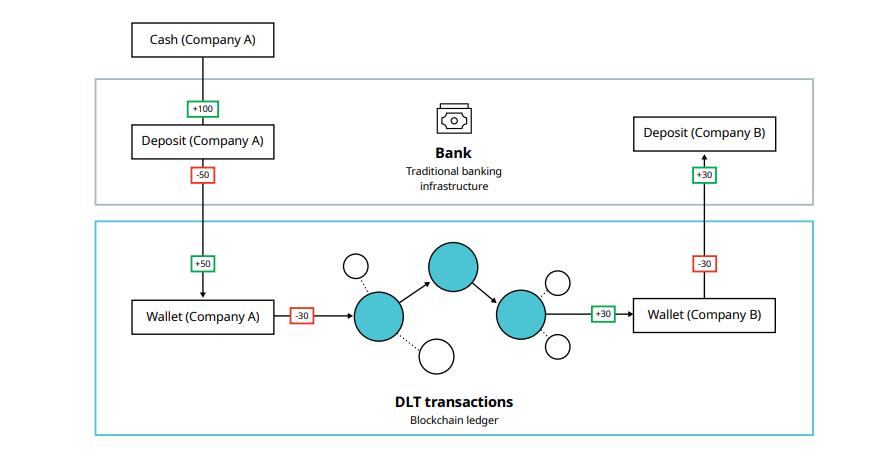

Deposit tokens are emerging as a major innovation in digital finance, serving as digital versions of commercial bank deposits, issued by regulated institutions and recorded on blockchain networks.

Unlike stablecoins, which are backed by reserves such as cash or government securities, deposit tokens represent a direct claim on money already held in a customer’s bank account.

Since the tokens remain part of a bank’s balance sheet, they carry the same protections that apply to ordinary deposits, including capital, liquidity, and risk-management requirements.

This framework keeps the product within the scope of banking supervision and gives institutional users a level of trust not always available with stablecoins.

Programmability and Instant Settlement

Deposit tokens introduce capabilities beyond traditional payment systems, with their blockchain design enabling transactions to be programmed and settled instantly.

Programmability allows payments or asset transfers to execute automatically once conditions are met, while atomic settlement ensures both sides of a trade close simultaneously, eliminating the lag that often creates settlement risk.

In practice, this system enables value to move within seconds rather than days, which can lower counterparty risk and improve efficiency across cross-border payments, repo transactions, and securities markets, according to research by the Bank for International Settlements.

Regulation and Banking Integration

Since deposit tokens are treated as bank liabilities, they remain subject to the same prudential rules as deposits held in traditional accounts. Banks must maintain capital and liquidity buffers for the underlying funds, which preserves the stability of the banking system even as transactions shift onto blockchain rails.

Stablecoins, by contrast, are often issued outside the regulated banking framework and operate under varying oversight, leading to differences in supervision and redemption standards.

Interest and Liquidity Effects

One of the main distinctions between deposit tokens and stablecoins lies in how returns are handled.

Stablecoin issuers typically earn interest on the assets held to back their coins but do not share that yield with users.

On the other hand, deposit tokens can be structured to pass interest directly to holders because the backing asset is a deposit that already earns yield.

This arrangement keeps liquidity inside the banking system rather than moving funds to non-bank entities.

Analysts at the BIS have noted that maintaining deposits within banks helps sustain credit creation and supports overall financial stability as the system digitizes.

Institutional Use and Market Impact

Deposit tokens are being tested for a growing range of uses. They can settle securities trades, provide intraday liquidity, or function as programmable cash for corporate treasury operations.

They are also being explored for cross-border payments, where blockchain technology enables real-time settlement without relying on correspondent banks.

JPMorgan’s JPM Coin is one of the first large-scale examples. It allows institutional clients to transfer funds in real time on Coinbase’s Base blockchain and will be accepted as collateral on trading platforms, signaling the start of a multi-currency network for regulated digital deposits.

Read More: Japan FSA Approves First Megabank-Led Stablecoin Under National Blockchain Initiative