Key Takeaways

- A plaintiff has formally requested arrests in the LIBRA scandal targeting President Javier Milei’s close advisors.

- Investigation reveals over 1,300 Argentines bought the token, contradicting Milei’s claim of “single digit” victims.

- Blockchain analysis shows suspicious USDT transactions between an American investor and presidential advisors before the token launch.

Table of Contents

Mounting Legal Pressure

Argentina’s LIBRA scandal has escalated considerably as plaintiff Martín Romeo requested federal judge Marcelo Martínez de Giorgi to arrest two presidential advisors, Mauricio Novelli and Manuel Terrones Godoy. The request argues the officials pose flight risks due to foreign citizenship and residency status.

This is the most serious legal peril yet to emerge in connection with the inquiry into the token project that triggered massive losses to Argentine investors shortly after launching in February.

Read also: Melania Meme Fraud Allegations Reveal “Pump-and-Dump” Scheme

Contradictory Evidence and Suspicious Transactions

The congressional investigation into the LIBRA scandal has uncovered evidence directly contradicting President Javier Milei’s televised claims that only “five Argentinians” were affected. Data from exchange Ripio confirms that 1,358 Argentine residents purchased the token, and the total is thought to be higher if the unregulated users on decentralized platforms are included.

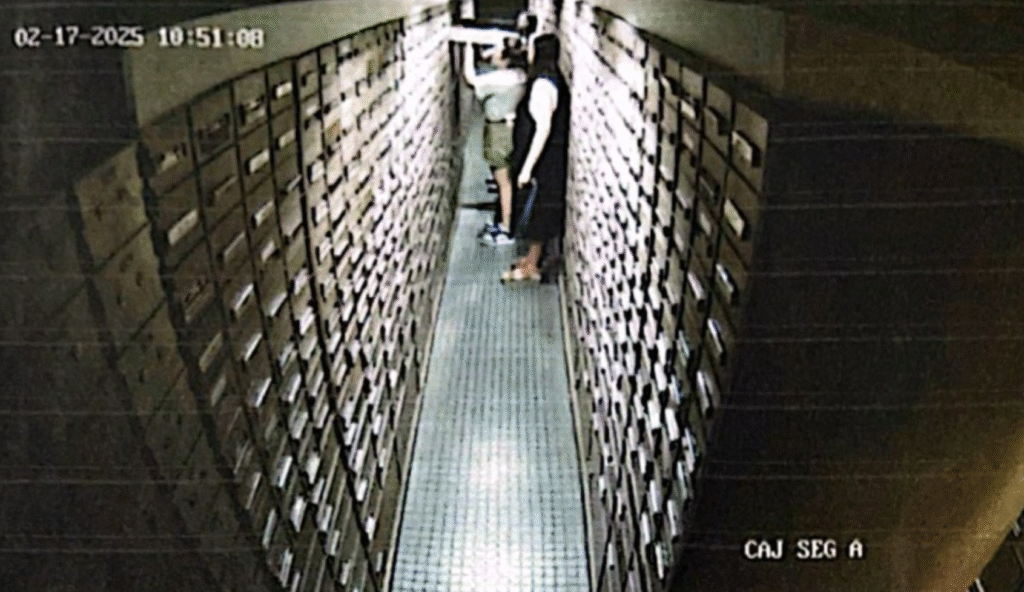

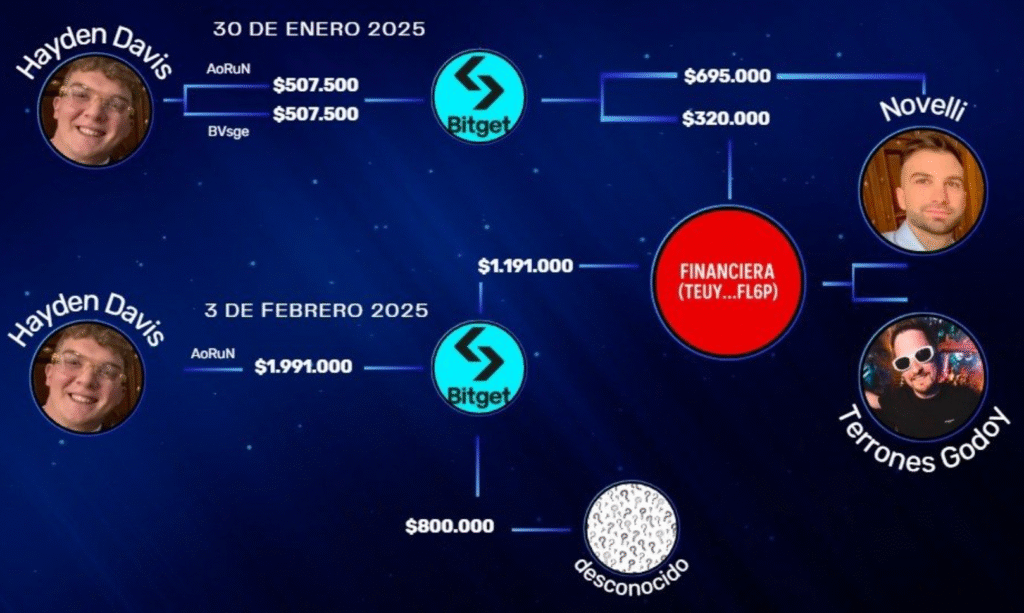

Blockchain analysis reveals American investor Hayden Mark Davis transferred an amount exceeding $3 million in USDT to accounts associated with Novelli and Terrones Godoy through Bitget around the time of Davis’s meeting with President Milei.

Read also: Ai16z Debuts ‘Anti-Pump’ AI Token Platform to Combat Crypto Speculation

An Examination of Responsibility

The expanding LIBRA scandal represents a critical test for Argentina’s crypto regulatory framework and political accountability. The congressional committee has issued formal summons for President Milei, his sister Karina, and the two advisors, all of whom have evidently ignored attempts to testify.

As investigators stitch together the financial trail from exchanges including Binance and Gate.io, the case demonstrates how blockchain transparency has the potential to uncover connections that traditional finance would instead obfuscate.

FAQs

What is the Argentine LIBRA scandal about?

The Argentine LIBRA scandal involves a crypto token, categorized as memecoin, launched in February 2025 that collapsed shortly after, with investigations uncovering suspicious financial transactions between presidential advisors and an American investor before the launch, and far more Argentine victims than officially acknowledged.

Who is facing potential arrest in the LIBRA scandal?

Presidential advisors Mauricio Novelli and Manuel Terrones Godoy face arrest requests for their alleged involvement in irregular crypto transactions connected to the token launch, with plaintiffs arguing they pose flight risks due to foreign citizenship.

How does this affect President Javier Milei?

While not directly accused, Milei faces scrutiny for promoting the token and dramatically underestimating its impact. A congressional committee has formally summoned him to testify about how he obtained the token’s contract address before it was publicly available.

For more crypto scandals stories, read: Vietnam Shark Tank Investor Arrested in $34M Crypto Fraud Scandal