On-chain analytics company Parsec shuts down after 5 years of operation, citing that the market has undergone fundamental changes that its analytics platform is no longer able to help businesses track effectively. CEO Will Sheehan stated, “The market zigged while we zagged a few too many times” regarding the reason for closing its doors.

Why Parsec’s Focus on DeFi and NFTs Became Unviable

Parse shuts down primarily because the leverage dynamics it was created to report on have since disappeared post-FTX collapse. Sheehan stated that “the DeFi spot lending leverage never really came back in the same way.” He went on to say that “the onchain activity changed and morphed into something we understand less about” regarding how to perform an analysis using their platform.

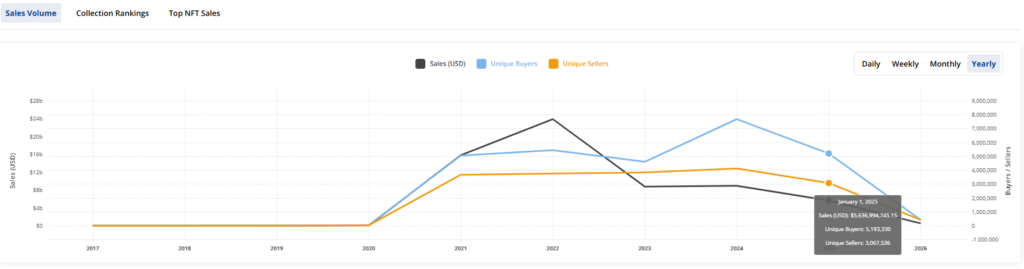

So far, the primary reason why the company was not able to pivot when market conditions changed was due to their narrow focus on the decentralized finance (DeFi) and non-fungible token (NFT) sectors, and these have drastically decreased in use due to an overall decline in trading volume. For example, NFT sales in 2025 dropped 37% to $5.63 billion (CryptoSlam) with the average price declining from $124 to $96.

Doors and More Closed

Parsec shuts down amid broader industry consolidation. This story follows Entropy returning investor funds, Polymath discontinuing its platform, and ZeroLend closing just days ago due to “continual periods of loss in the protocol.” Even some of the successful attempts to pivot, like Parsec’s election dashboard with hundreds of thousands of hits, were not enough to change the underlying problem.

Parsec, funded by Uniswap, Polychain, and Galaxy Digital, had raised expectations that they would be different than other crypto projects. Unfortunately, they fell victim to the rapid evolution, volatility, and risk of crypto.