Melbourne-based Forex and Discounted Cash Flow (DCF) brokerage firm Pepperstone has launched its own spot crypto exchange globally, moving into digital assets. Australian customers can now buy and hold crypto directly for the first time, beyond the previous offerings of legacy CFD products.

Details About the New Pepperstone Crypto Exchange

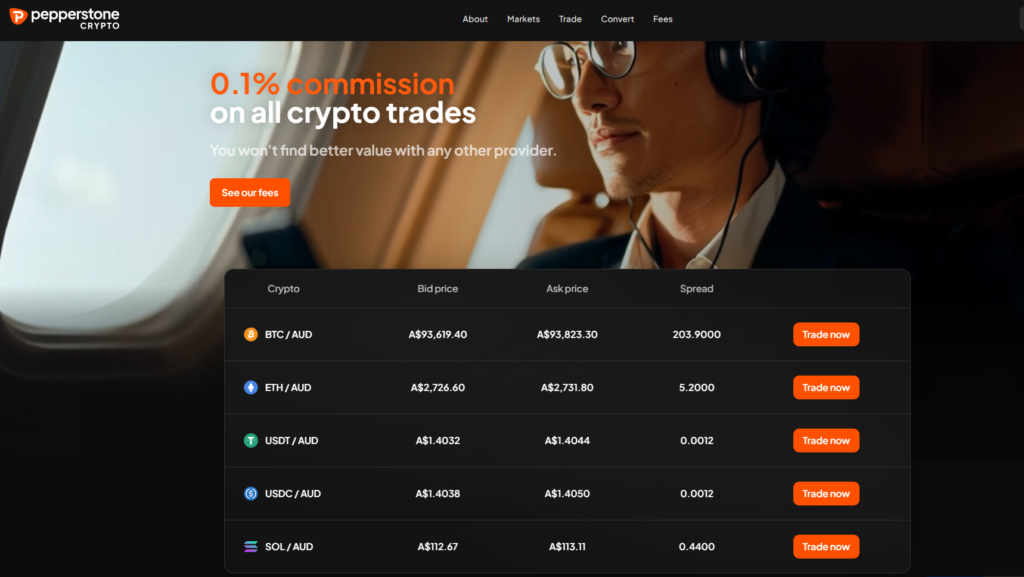

The new spot crypto exchange has launched with five major digital assets (Bitcoin, Ethereum, Solana, USDC & USDT) all paired against the Australian dollar. The firm came out with an aggressive flat fee of 0.1% per trade. The infrastructure took over 12 months to build in-house (using up many internal resources). This approach was backed by the CEO, Tamas Szabo, who stated that they will maintain “full control over execution quality, liquidity depth, and security of the system”.

Recently, the platform was named Best in Forex and CFD in Australia at the TradingView Broker Awards 2025, an award that recognizes the effort and commitment to the Forex and CFD trading overall experience, as well as outstanding technology, low-cost spreads, and excellent support.

Why a Traditional Broker Wants to Compete Against Crypto Brokers

Szabo has made it known that Pepperstone is looking to compete with existing crypto platforms. He has indicated that there is “a bit of fat to be cut off of the exchanges.” The launch of a Pepperstone crypto exchange demonstrates the ongoing convergence between CFD brokers moving into spot crypto trading and crypto exchanges such as Kraken looking for traditional broker registrations.

For Pepperstone, which processes approximately USD 6 billion of crypto CFD volume monthly, the exchange creates a natural on-ramp for its existing client base seeking direct exposure.