Key Takeaways

- RedotPay has integrated Ripple Payments to launch a new “Send Crypto, Receive NGN” service.

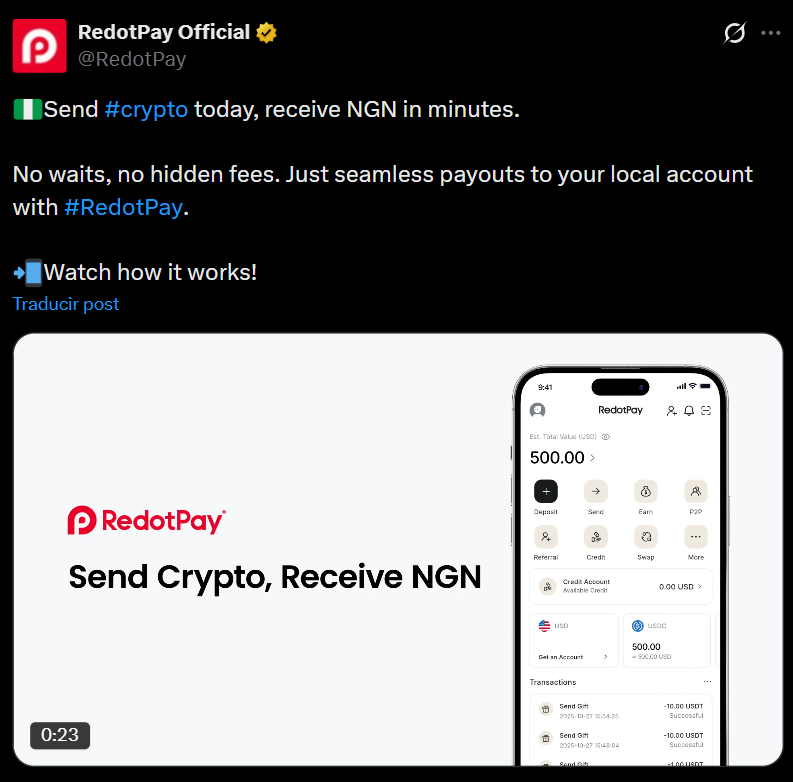

- The feature allows users to send XRP or stablecoins and receive Nigerian naira in local bank accounts within minutes.

- This partnership directly tackles the high cost and slow speed of traditional remittances to emerging markets.

Table of Contents

A Direct Shot at Costly Remittances

RedotPay, a fintech company that supports remittances for people in Nigeria, has integrated Ripple Payments, creating an innovative way for people living abroad to send money back home. Via RedotPay’s “Send Crypto, Receive NGN” feature, verified users can send crypto assets such as XRP, USDC, and USDT to be converted directly into Nigerian Naira (NGN) and deposited into their local bank account, usually within minutes.

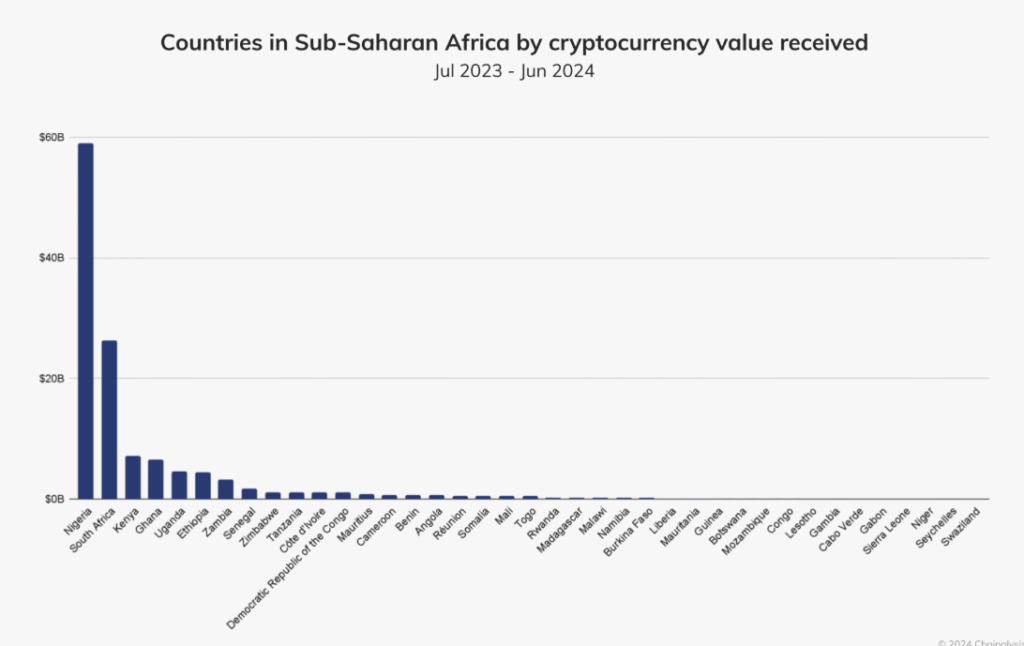

The integration of Ripple Payments into RedotPay’s platform is a direct response to the shortcomings of the existing remittance model used for sending money to sub-Saharan Africa. Currently, sending money to this region via most traditional remittance services incurs fees exceeding 6%, takes days to settle, and does not offer the benefits of blockchain technology.

Read also: Bealls Retail Crypto Payments Launch at 660+ Stores Nationwide & 99+ Cryptos Accepted

Leveraging Blockchain for Real-World Utility

The collaboration between Ripple Payments and RedotPay is a prime example of how blockchain infrastructure can be used as a practical solution to address a long-standing financial problem. By utilizing Ripple’s enterprise blockchain solution for settlement purposes, RedotPay will be able to provide its customers with faster, cheaper, and more transparent cross-border money transfers.

The service was developed specifically for freelancers, digital nomads, and international workers sending money back home, representing the next step for RedotPay following the launch of its service, which enables customers to convert their funds into both Brazilian Real (BRL) and Mexican Pesos (MXN) and make payouts in those countries.

The use of Ripple Payments exemplifies the growing trend of providing a vehicle for moving digital assets into a local fiat economy using stablecoins and an efficient blockchain network.

Read also: Mastercard Crypto Credential Expands to Self-Custody Wallets via Polygon

A Blueprint for Global Financial Inclusion

The Launch of Ripple Payments Service is not just another product update but rather a comprehensive framework/blueprint for growth in crypto utility. This partnership specifically highlights multiple systemic inefficiencies found in today’s high-volume international remittance corridors by demonstrating the potential of blockchain technology to accelerate global financial inclusion.

Additionally, as RedotPay prepares to integrate Ripple’s new RLUSD stablecoin on its platform, this partnership foreshadows a future where digital assets can be transferred instantly and converted to the local currency of choice, providing a completely different paradigm for global value transfer.

FAQs

Which cryptocurrencies can I send through the RedotPay App?

The service currently supports a wide range of assets, including XRP, USDC, USDT, Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Toncoin (TON), and others.

How fast are the payouts with the introduction of Ripple Payments and blockchain technology into RedotPay’s infrastructure?

Payouts to Nigerian bank accounts are typically completed within minutes, a significant improvement over the 1-5 business days normally required by traditional remittance services.

Who is this service for?

It’s designed for anyone who needs to send money to Nigeria, particularly tech-savvy workers like freelancers, digital nomads, and overseas employees seeking a faster and more affordable alternative to traditional wire transfers or money transfer operators.

For more blockchain payment integration stories, read: Revolut Free Stablecoin Conversion Launches with 1:1 Fiat-to-Crypto Trading