Key takeaways

- A study by Flipside reveals that most new blockchain users become inactive within months

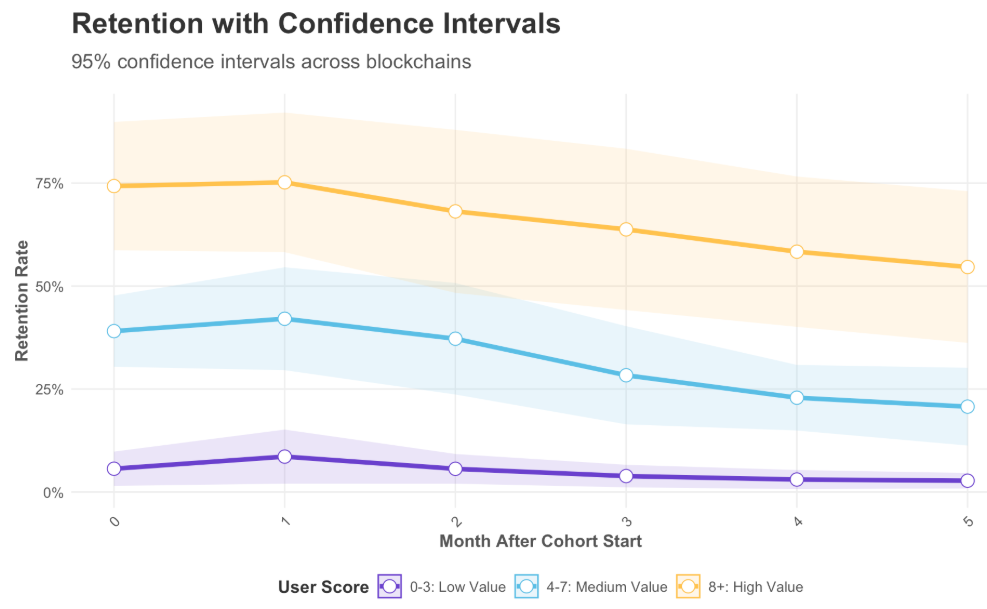

- Users were divided into low, medium, and high-value tiers based on prior activity. Low-value users showed a 95% drop-off within six months, while high-value users had much better retention.

- Ethereum and Avalanche had the best retention rates for high-value users (35–38%), whereas Solana and newer chains showed weaker long-term engagement despite rapid initial growth.

- The study criticizes the industry’s focus on inflated metrics like total wallet count.

- Flipside urges blockchain projects to redesign incentive models to reward long-term engagement rather than one-time interactions, fostering more meaningful and durable user participation.

A ground-breaking new study from blockchain analytics firm Flipside reveals a troubling reality for blockchain ecosystems: many users are not sticking around.

The research, which scrutinized user behavior on major networks including Ethereum, Solana, Arbitrum, and Avalanche, reveals a widespread “retention cliff,” indicating that the vast majority of new participants quickly become inactive, often within just a few months.

Most New Blockchain Participants Disappear Quickly

This trend challenges the common narrative of explosive user growth, suggesting that “airdrop hunters” and one-time users constitute a significant, yet fleeting, portion of new activity.

Flipside embarked on a detailed six-month observation, categorizing users into three distinct tiers based on their prior on-chain engagement: low-value (minimal activity), medium-value, and high-value (extensive prior involvement). The findings from this categorization paint a stark picture of user churn rate.

High-Value Users Show Staying Power

“Our data shows an alarming drop-off, especially for low-value users,” a Flipside representative explained. “Over 95% of these individuals, those with little to no previous on-chain activity, disappear within half a year. The most dramatic decline happens almost immediately, with user activity plummeting in the very first month.”

Medium-value users demonstrate slightly better staying power, but their activity also shrinks significantly in the initial months before stabilizing at a lower level. Unsurprisingly, high-value users, who already possess deep engagement within their respective ecosystems, exhibit remarkably stronger retention. Their activity only gradually declines, typically losing just 5–8% per month.

When comparing networks, Ethereum and Avalanche demonstrated superior retention among high-value wallets, successfully keeping 35–38% of those users active after six months. In contrast, Solana, despite its large user base, showed comparatively weaker retention figures. Newer chains, often highlighted for their rapid early adoption, consistently posted the steepest drop-offs, suggesting that headline-grabbing initial growth numbers often mask a fundamental lack of long-term user engagement.

Rethinking Metrics and Incentives for Sustainable Ecosystem Growth

The report critiques the crypto industry’s reliance on “vanity metrics,” such as total wallet counts, to signal growth. These figures, Flipside argues, frequently encompass a substantial proportion of transient participants, including bots, speculators, and those primarily motivated by one-time rewards. Such users inflate numbers without contributing to sustainable ecosystem health.

“Real growth doesn’t come from fleeting interactions,” the study asserts. Flipside strongly recommends that blockchain projects shift their focus from chasing transient users to instead nurturing high-value individuals. These are the users most likely to consistently interact with decentralized applications, participate in governance, and engage in staking protocols, forming the bedrock of a robust decentralized community.

Ultimately, the report calls for a fundamental rethinking of how blockchain networks design their incentive systems. Protocols should move beyond one-time rewards that spark ephemeral activity and instead craft tokenomics that genuinely reward consistent, long-term participation. This strategy, Flipside concludes, offers a more sustainable path to genuine growth and widespread blockchain adoption.

Read More: FIFA Partners with Avalanche to Launch Its Blockchain