Tether, the stablecoin issuer, announced a strategic investment in Gold.com worth USD 150 million for an approximate 12% ownership stake. The expected outcome of this collaboration is to combine both digital and physical gold markets by adding Tether’s tokenized gold product (XAU₮) to Gold.com’s existing infrastructure while also exploring opportunities for customers to purchase physical gold using Tether’s stablecoin.

What’s Behind the Gold.com Investment

By making this investment in Gold.com, Tether is making a tactical and calculated decision to diversify away from its core business (i.e., issuing and selling stablecoins). Tether will also use its large reserves and market position to build up access to “durable financial infrastructure” around the real-world assets (RWAs) sector, previously unavailable to traditional retail or institutional consumers.

The company feels that integrating its XAU₮ token into an established precious metal marketplace will provide the best opportunity for Tether tokens to be adopted by mainstream consumers rather than crypto-focused consumers. Tether’s objective here is to make gold as “accessible, transferable, and usable” as contemporary digital currencies.

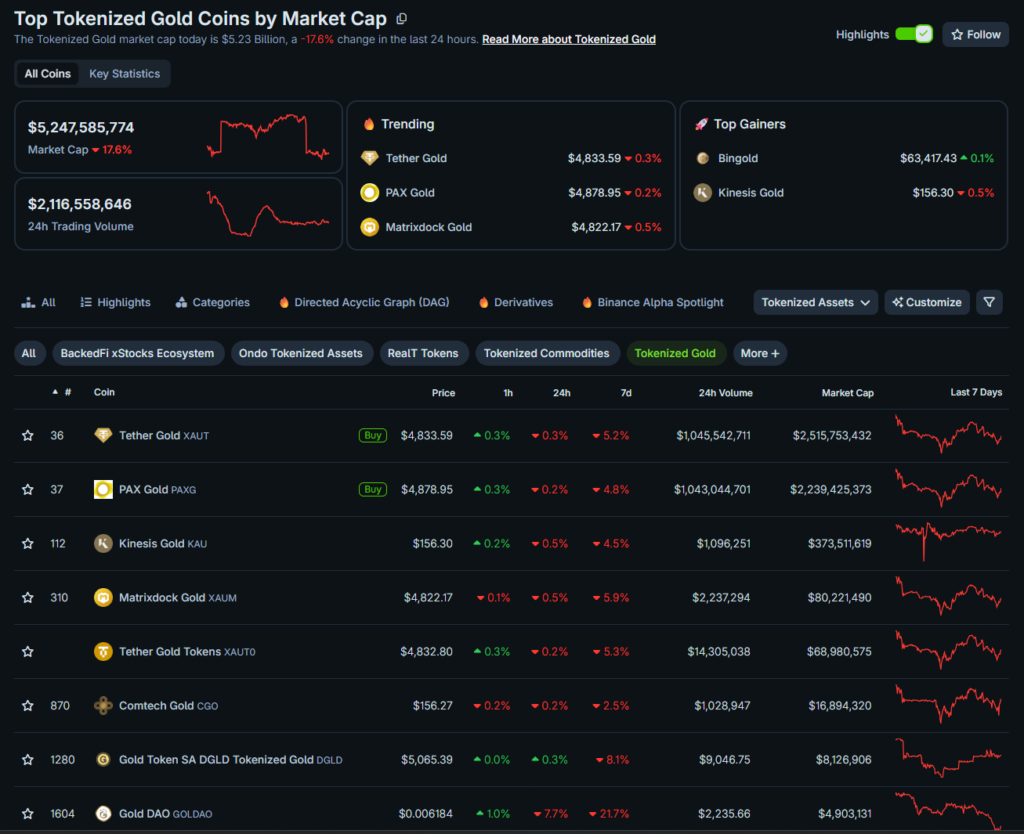

These investments are timely following the significant increase in gold prices, as well as the explosive growth of the tokenized gold industry, which has expanded from USD 1.3 billion to more than USD 5.5 billion within just one year.

The Importance of this Move for Crypto and Commodities

This Tether’s investment is another step toward the merging of the digital asset infrastructure with traditional commodity markets. This also creates a direct on-ramp for Gold.com’s customer base into tokenized assets and, conversely, a trusted off-ramp for XAU₮ holders into physical gold.

Tether’s partial acquisition of Gold.com sets a strong support for gold-backed RWAs as a primary piece of the on-chain economy within the crypto ecosystem. To this point, Tether is strategically positioned to get value from both the digital currency and commodity safe-investment categories, particularly during periods of macroeconomic uncertainty like the current one.