Key Takeaways

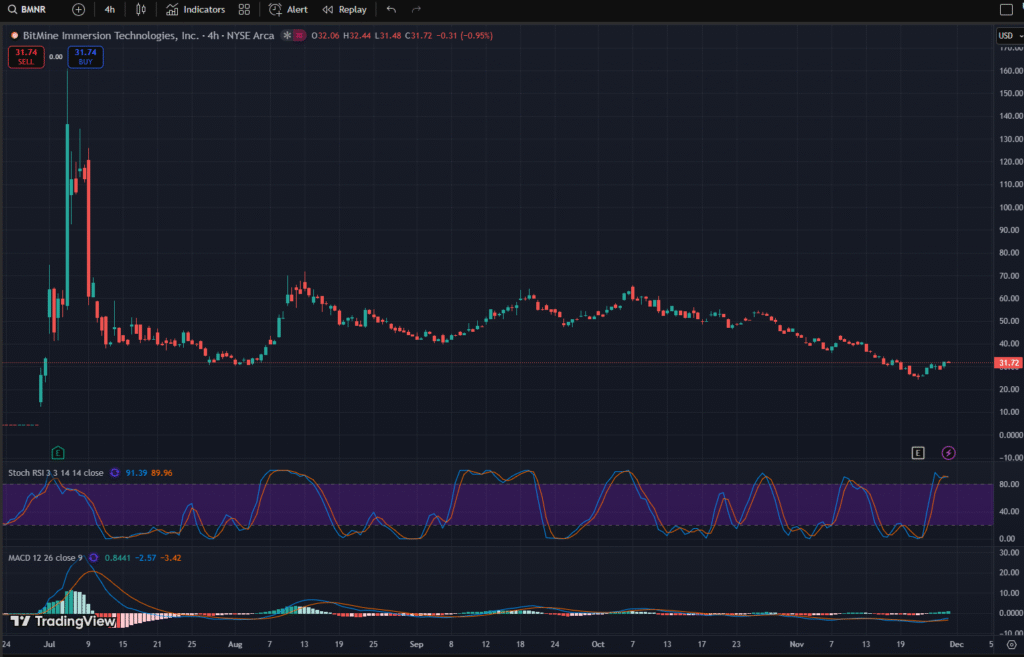

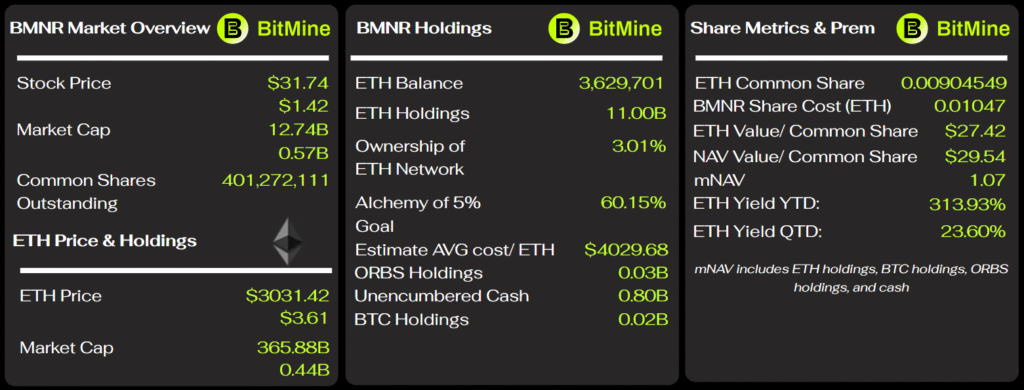

- BitMine holds a massive 3.63 million ETH (3% of supply), but its stock (BMNR) has plummeted 81%.

- The decline is driven by $4 billion in unrealized losses, shareholder dilution, and a flawed treasury model.

- Analysts believe BitMine’s recovery is entirely tethered to a sustained Ethereum price rally.

Table of Contents

A Failed Speculation by a Treasury Fund

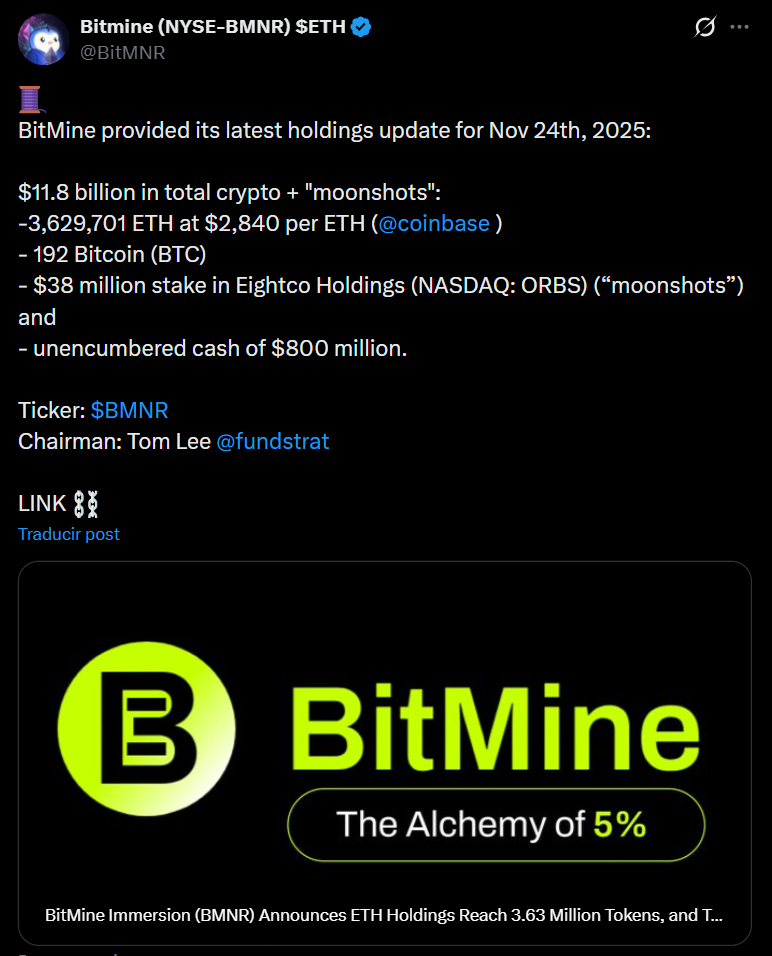

BitMine Immersion Technologies (NASDAQ: BMNR), the Ethereum treasury firm championed by Wall Street analyst Tom Lee, is in a dramatic slump. The company is now in an extreme state of decline after it managed to obtain 3.63 million ETH (roughly 3% of the entire circulating supply). There has been an 81% decline in the company’s stock value since its peak.

The incredible disparity in prices demonstrates that the company’s crypto strategy is overly reliant on acquiring assets without any ongoing ability to generate income; as such, BitMine has succumbed to the total wrath of a bear market.

Read also: Ethereum Interop Layer (EIL) Proposal Aims to Unify Fragmented L2 Ecosystem

How Did This Happen?

Events that occurred between March 2025 and November 2025 that led up to the firm’s Ethereum treasury business model:

- March 2025: BitMine pivots to become an ‘Ethereum Super Treasury’. The stock price increased by over 200% following this announcement.

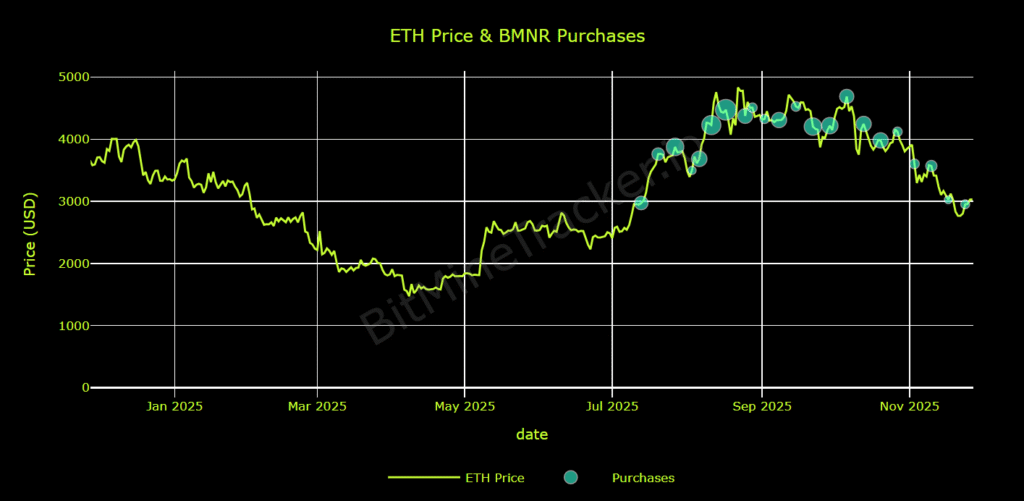

- April to June 2025: the firm makes the aggressive purchase of 1.5 million ETH based on a cost basis of $2,800 to $3,000.

- July 2025: Tom Lee becomes the chairman of the company, leading to maximum investor confidence.

- August 2025: An ETH price drop of $3,400 to $2,600 leads to a 35% decline in the company’s stock, exposing its vulnerability.

- November 2025: At a near $2,250 price level for ETH, the firm faces unrealized losses of $4 billion and an 81% decline in the price of its stock.

Read also: Justin Sun Bets Big: Stakes $154M in Ethereum, Now Holds More ETH Than TRX

A Larger Issue with the 3 Elements of Collapse

There is more to BitMine than just its loss of value due to the decline in the price of Ethereum. The collapse can be attributed to three main structural issues within the enterprise’s business model:

- First, a purchase of ETH at very high values and subsequently incurred high paper-based losses from this investment.

- Second, the firm funded the purchase of the majority of its ETH by consistently creating new shares and significantly reducing the ownership of existing investors in the company.

- Third, they employ a treasury-for-digital-assets method for investing, which yields minimal return. For example, staking yields in the range of 3% do not offer sufficient incentive to take on such a great risk with an asset.

Read also: The Staggering Cost of Illegal Crypto Mining in Malaysia Creates a $1.1B Black Hole

Possibility of Remount by Bitmine, Based on Ethereum’s Rise

Even though the future looks bleak for Bitmine, if Ethereum rises as a currency, it opens up an opportunity for the stock to recover due to its leverage on the rise of ETH. For example, if Ethereum rises 1%, it is reasonable to expect BMNR to increase by almost 2%.

Some of the primary reasons why Ethereum’s value may increase include the decreasing issuance and utilization of blockchain products by Ethereum (and many other projects), as well as the growth and expansion of the Ethereum Layer 2 Project, which has improved the utility and value of the underlying blockchain.

Read also: Ethereum Foundation Launches dAI Team to Power AI Agent Economy

A High-Stakes Proxy Bet

The value of Ethereum will determine the fate of BitMine. To investors, BMNR is offering nothing beyond a high-risk bet that Ethereum will recover from its current state. If the crypto market does not recover significantly, the large treasury owned by the firm may ultimately be viewed as a liability rather than an asset.

FAQs

If BitMine holds so much ETH, why is the stock down?

The stock reflects investor sentiment about the company’s execution, not just the asset value. The firm bought high, diluted shareholders, and has no other significant revenue, causing a crisis of confidence.

What does BitMine actually do?

Its primary business is accumulating and holding Ethereum as a treasury asset, similar to how Strategy holds Bitcoin. It has begun staking its ETH to generate a small yield.

Can BitMine’s price recover?

Yes, but its recovery is almost entirely dependent on Ethereum’s price rising significantly above BMNR’s average purchase price of approximately $2,800 to $3,000, which would erase its unrealized losses and restore investor faith.

For more crypto treasury-related stories, read: Jiuzi Holdings $1B Crypto Treasury Strategy Approved