In an expansion move for real-world asset (RWA) tokenization, Matrixdock Group has launched its institutional-grade tokenized gold on Solana. The token, XAUm, now live, physically-backed, vaulted gold on one of the industry’s fastest and most scalable blockchains.

What XAUm on Solana Offers

XAUm is not a synthetic financial product. Each XAUm token represents one troy ounce of gold that is 99.99% pure and vaulted in a secure facility regularly audited by an independent third party and accredited by the London Bullion Market Association (LBMA). By using Solana as its deployment network for XAUm, Matrixdock is taking advantage of Solana’s fast throughput and low transaction cost to provide quick, efficient, and cheap trading and settling of gold.

The programmable liquid asset provided through XAUm will provide participants with an outstanding digital store of value, as well as the possibility to participate in the decentralized financial (DeFi) ecosystem through XAUm’s initial liquidity available on the Raydium decentralized exchange (DEX).

Why the Expansion is Offensive in Nature

Matrixdock’s launch sets a strategic focus on Solana as the most attractive blockchain possible to support the development of RWAs, primarily for institutional applications. The firm is already established in this area as the tokenization technology provider for Bhutan’s sovereign gold-backed token (TER), also deployed on Solana. By moving its flagship gold product offering onto the same blockchain, Matrixdock creates a single high-performance ecosystem for tokenized commodities (gold being one of many).

To have in mind, for institutions and traders, Matrixdock’s tokenized gold on Solana creates a compliant and audited asset that will allow these users to conduct their transactions with the speed and flexibility available from a modern blockchain, thereby closing the gap between the “old” (gold bullion) and new (decentralized finance) ways of investing in commodities.

Gold Price Overview

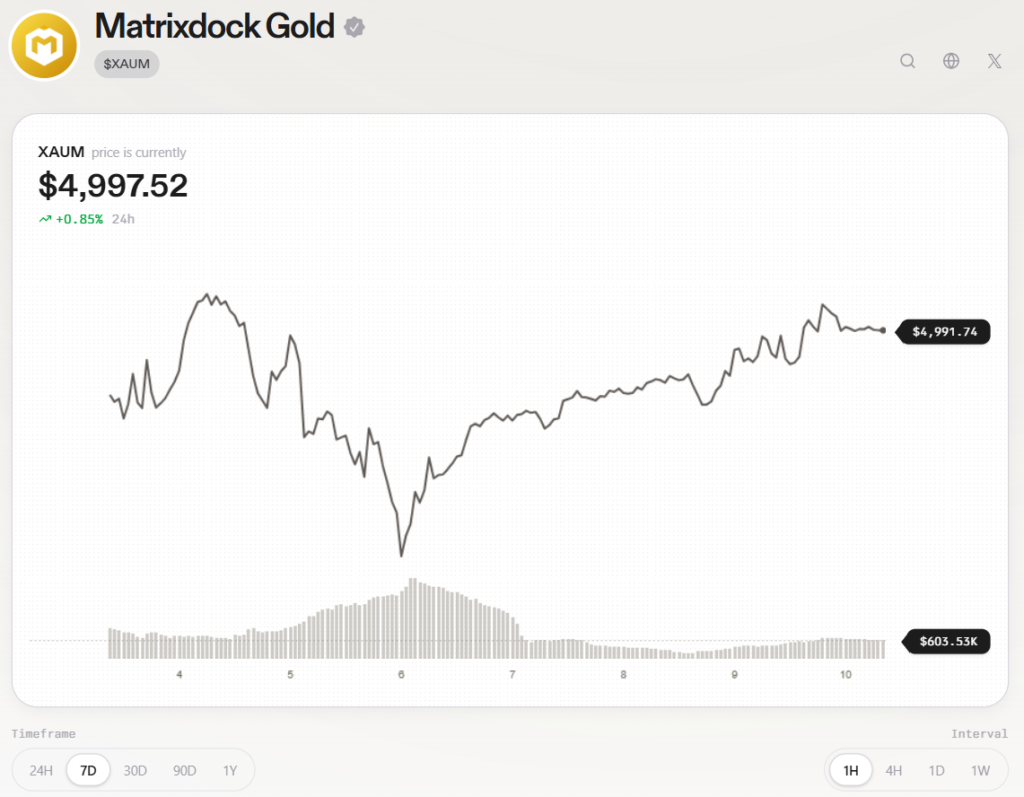

The price of gold, just in the last week, had an unprecedented swing, trading above the USD 5,000 at its all-time high (ATH), draining liquidity from other risk markets like the crypto one, to drop around USD 500 in 24 hours. Today, with markets in relative fear, the precious metal is trading back to its previous high levels, as seen in the image above.