VanEck, the asset management firm, has introduced the first U.S.-listed spot Avalanche exchange-traded fund (ETF). The VanEck Avalanche ETF (ticker: VAVX) began trading on January 26, 2026, and provides investors with direct exposure to the price of the AVAX crypto token and potential staking rewards through a familiar exchange-traded product structure.

What the VanEck Avalanche ETF Offers Investors

The Avalanche ETF has been established under a grantor trust and contains an inventory of directly owned AVAX. The launch of the VAVX will waive all of the sponsor’s fees for the first U$D 500 million in assets under management (AUM) or until February 28, 2026, whichever occurs first. The annual sponsor fee for the ETF will be 0.20% after this period.

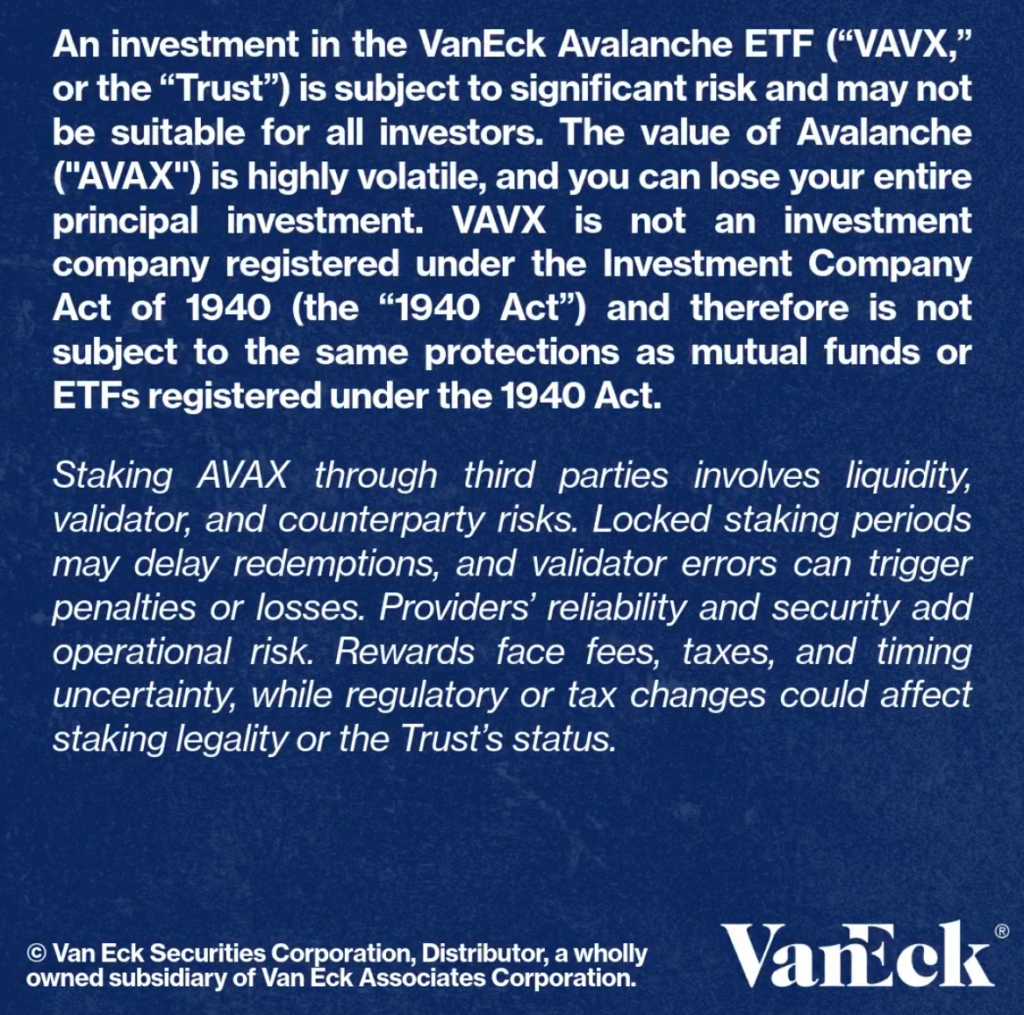

In addition to providing access to the Avalanche ecosystem, the VAVX plans to stake some of the assets held in the fund, which may offer staking rewards; however, such activity carries risk due to lock-up periods and the performance of the validators.

The introduction of the VanEck Avalanche ETF provides an alternative, regulated, and also a transparent way for institutional investors to gain exposure to the Avalanche Network. There has been growing institutional demand during 2024/25, driven by its customized blockchain capabilities from companies such as Citi and FIFA.

Why This ETF Is a Vote of Confidence for Avalanche’s Ecosystem

VanEck is an established company giving a vote of confidence to the Avalanche ecosystem. To this point, the firm has created an ETF product specifically for AVAX investments, confirming that the Avalanche blockchain has expanded from a developer-focused network to an enterprise-grade ecosystem with perceived long term growth potential at the institutional and corporate level.

Additionally, because the ETF structure allows retailers to invest in VAVX without the need of managing private keys or other complexities associated with crypto exchanges, making it possible for anyone to easily access the Avalanche ETF through a standard brokerage account.

The success of Bitcoin and Ethereum ETFs has opened the door for a variety of new types of crypto assets being made available to traditional finance (TradFi) as “blue chip” investments. Furthermore, Avalanche is uniquely positioned as a consumer and enterprise blockchain solution for the tokenization of real-world assets (RWAs), which is an important trend among institutional portfolios.