The XRP Ledger Permissioned Domains feature has been activated on the mainnet with over 90% validator consensus. An important step forward in capability for XRPL, Permissioned Domains allow for the creation of “controlled environments,” in which only wallets that contain established on-chain credentials (issued by reputable parties) are allowed to participate.

How Permissioned Domains function within the XRPL

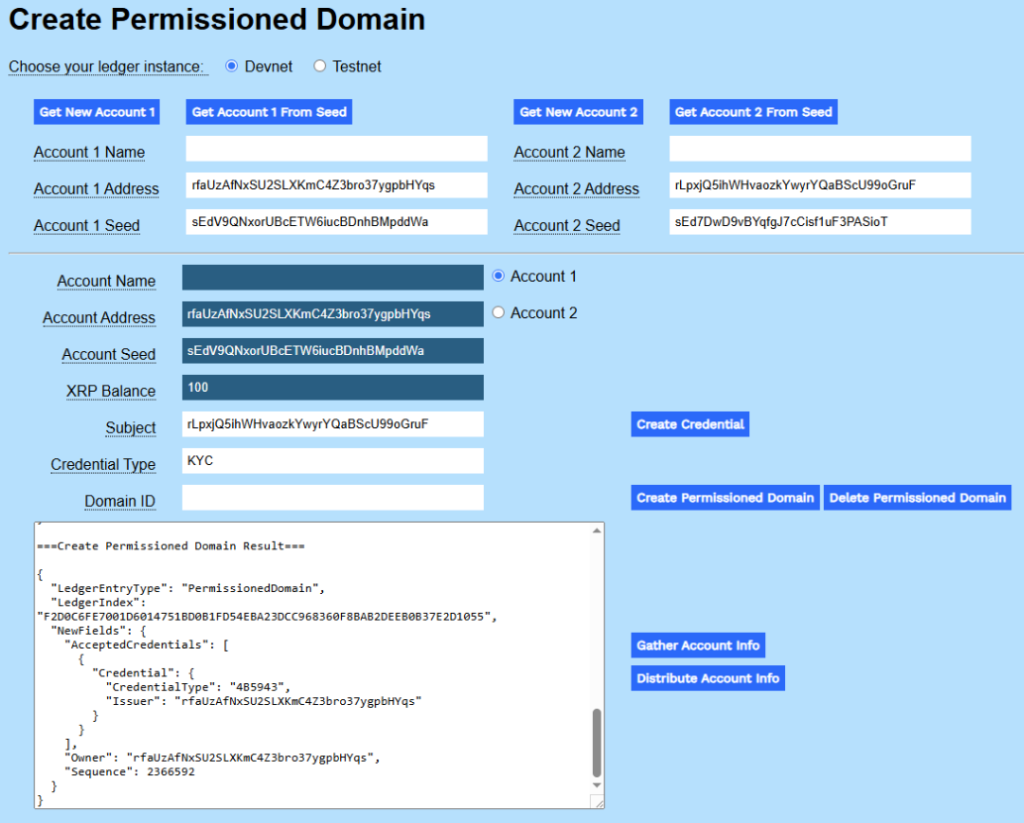

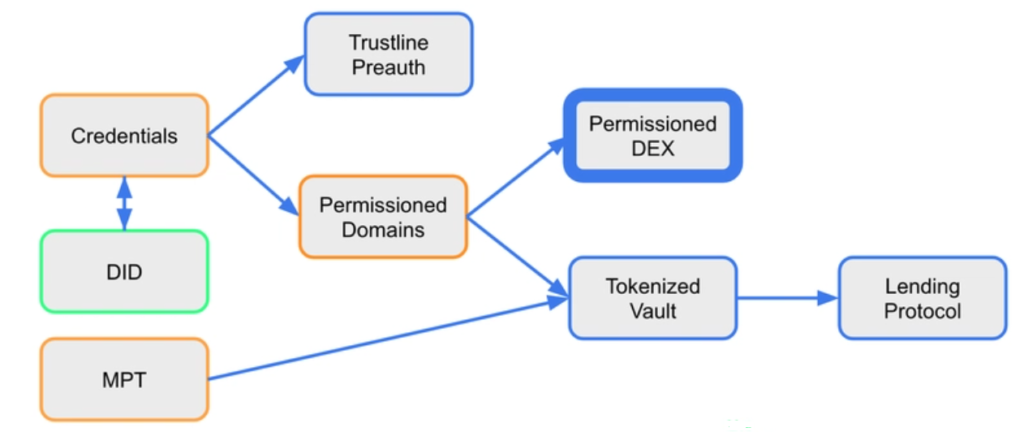

A XRP Ledger Permissioned Domain is a simple on-chain object that lists accepted credential types [for example, Know Your Customer (KYC)-verified and/or “accredited institution”]. For instance, when a feature like the upcoming Permissioned DEX references a domain, it automatically restricts activity to wallets holding such credentials. Importantly, the ledger only verifies the existence of a valid credential and not the underlying personal data, balancing compliance with privacy.

This approach allows regulated firms to trade and settle assets within a public ledger, ensuring they only interact with other regulated organizations and are therefore safe from their counterparties.

Rationale for Ripple’s Strategic Approach to XRP Ledger Permissioned Domains

The activation of the XRP Ledger Permissioned Domains is Ripple’s direct play for the exploding institutional tokenization space. It provides the compliance layer missing from Ripple’s more than 300 institution partners (particularly banking and payments) when using XRPL directly for trading Real-World Assets (RWAs) and for settling stablecoins without counterparty risk.

With embedded protocol-level rule enforcement, the XRP Ledger ultimately steps hard as a public settlement rail with optional compliance gates; thereby providing a key differentiator for attracting regulated capital.