Key Takeaways

- Ethereum (ETH) rose over 3%, breaking multiple resistance levels and setting the stage for a potential rally.

- If ETH holds $4,070, it could soar to $4,300 in the coming days.

- Traders and investors remain bullish, opening long positions and accumulating tokens amid the recovery.

Gold’s historic price crash has sparked optimism in Ethereum (ETH), which jumped 3% and triggered a bullish breakout today. According to recent reports, gold recorded its largest single-day drop of 6.3% since 2013, which not only fueled a notable rally in Ethereum but also boosted the broader cryptocurrency market.

Current Price Momentum

According to the latest data, Ethereum (ETH) is currently trading at $4,100, marking a price jump of over 3%. Meanwhile, traders and investors have shown massive participation, as the asset’s trading volume surged by 15% today to reach $4.21 billion.

Ethereum (ETH) Technical Outlook: Upcoming Levels to Watch

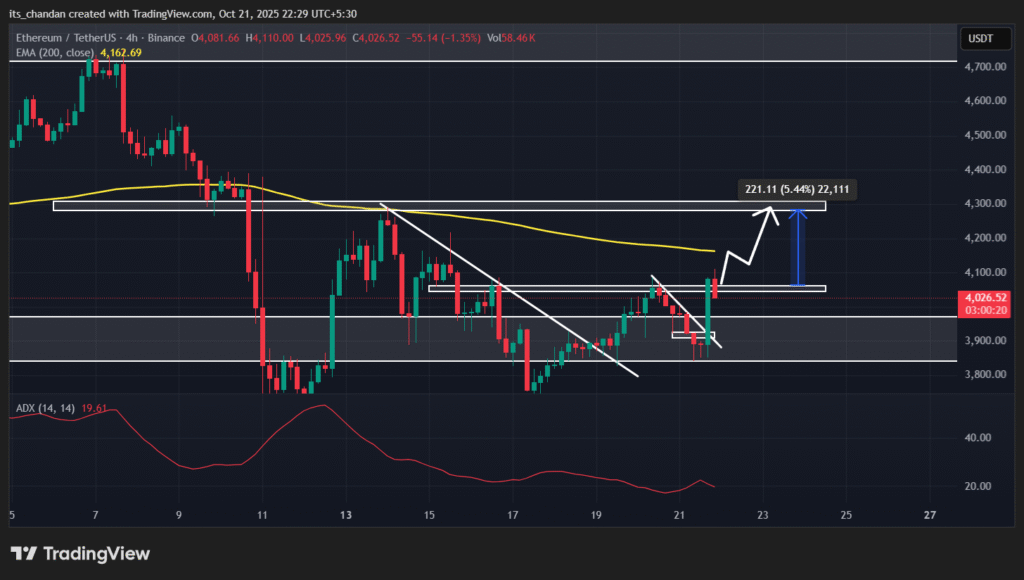

On the daily chart, Ethereum’s recent price uptick appears to have triggered multiple breakouts, from the descending trendline to the key horizontal level at $4,062. According to TimesCrypto’s technical analysis, this breakout has opened the door for ETH to continue its upward momentum in the coming days.

Based on the recent price action, if ETH sustains its rally and closes a daily or four-hour candle above the $4,070 level, it could soar by 5.5% and reach the $4,300 mark.

On the other hand, if the momentum fades and the price fails to close above the resistance level, it could either move sideways or drop toward the $3,900 level in the coming days.

Despite today’s gains, ETH remains below the 200-day Exponential Moving Average (EMA), indicating that the asset is still in a downtrend. Meanwhile, the asset’s Average Directional Index (ADX) value stands at 19 below the key threshold of 25, suggesting weak directional momentum.

Whale Activity Suggests Strong Bullish Outlook

Given the current market sentiment, it appears that traders are following the prevailing trend, as multiple whales have opened long positions.

According to the latest report shared by on-chain analytics platform Lookonchain, Machi Big Brother has increased his existing long positions and currently holds 2,575 ETH worth $10.14 million, with a liquidation level at $3,847.56. Meanwhile, another trader with a 100% win rate and a total profit of $3.20 million has just opened a 4x long position on 9,082 ETH worth $35 million.

Adding to the bullish outlook, whales and institutions have continued accumulating millions of dollars’ worth of ETH. Lookonchain revealed that the whale wallet address 0xAeA5 added 7,527 ETH worth $29.09 million from the OKX exchange, while Bitmine acquired 63,539 ETH worth $251.6 million from Kraken.

Looking at this whale activity, it appears that Ethereum has a bullish outlook in both the short term and the long term.

Also Read: BitMine and Strategy Defy Sell-Off with 202K Ether and 220 Bitcoin Purchases