Key Takeaways

- Pyth Network (PYTH) has broken out of a bullish pattern, with trading volume surging by 140%.

- PYTH’s price action hints at a potential 30% rally if it sustains the $0.174 level.

- On-chain metrics reveal strong bullish sentiment among traders and investors.

PYTH, the native token of Pyth Network, has been making waves in the cryptocurrency market with its impressive performance. On September 10, 2025, with a 12% price uptick, PYTH was spotted on the top gainer list while outperforming major assets.

Moreover, this rally has opened the door for PYTH to continue its upside momentum.

It all started on August 28, 2025, when the United States Department of Commerce began publishing GDP data on-chain via Pyth Network, which propelled the PYTH token by 110%.

However, since then, the asset has undergone a price correction and continues to show downside momentum.

PYTH Price Rally and Trading Volume Surge

But for the past few days, bullish sentiment around PYTH has strengthened as it rallied 20% and formed a bullish cup-and-handle pattern, which broke out today and signaled a potential reversal. Moreover, investors’ and traders’ interest in the asset has also skyrocketed.

At press time, PYTH was changing hands at $0.182, with strong participation from traders and investors. Data from CoinMarketCap reveals that over the past 24 hours, PYTH’s trading volume has soared by 140% to $316 million.

This notable surge in trading volume, as the price climbs and breaks bullish patterns, hints at strong interest from crypto participants and indicates strong upside momentum for the asset.

Price Action and Crucial Levels to Watch

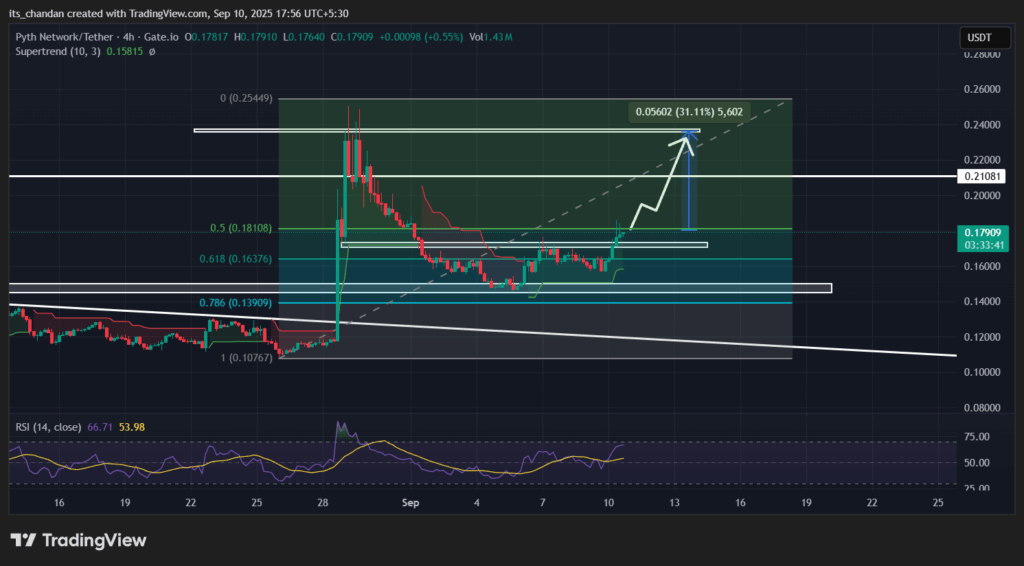

According to TimesCrypto’s technical analysis, PYTH has turned bullish, and its price action suggests the asset is now poised for a potential 30% rally. This bullish thesis can only be validated if the price sustains above the $0.174 level, otherwise, it may fail.

The reason lies in a bullish breakout and a successful retest of the 61.8% and 78.6% golden Fibonacci levels during the dip.

At press time, the Supertrend technical indicator has turned green and is hovering below the asset’s price, suggesting a strong bullish trend.

Meanwhile, the Relative Strength Index (RSI) stands at 64, indicating that the asset remains below the overbought territory but still has enough room to continue its upside momentum and price gains.

Bullish On-Chain Metrics Support PYTH

Nevertheless, strong interest and confidence have also been recorded in investor and trader activity, as they appear to be betting and accumulating.

Data from the on-chain analytics tool Coinglass reveals that over the past 48 hours, $2.522 million worth of PYTH has left exchanges. This outflow signals strong accumulation and appears to be strengthening PYTH’s bullish outlook.

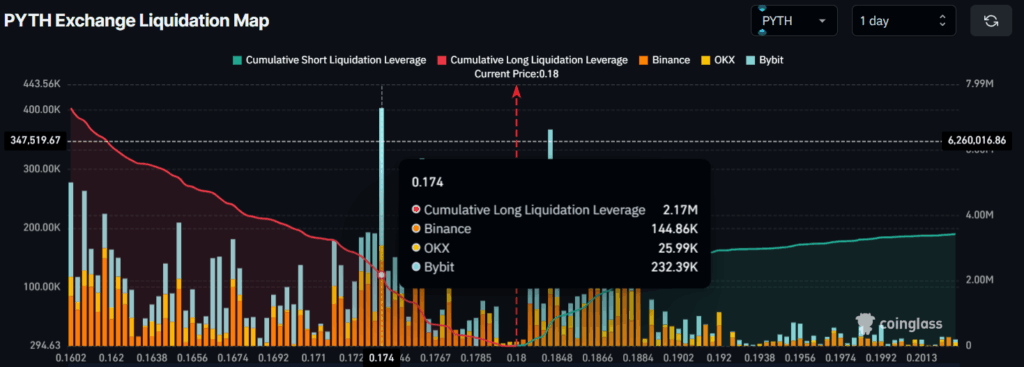

Conversely, traders also seem to be following the current trend by betting on long positions. At press time, PYTH’s major liquidation levels are at $0.174 on the lower side and $0.1845 on the upper side.

At these levels, traders have built $2.17 million in long positions and $677k in short positions, reflecting strong bullish sentiment.

Taken together, these metrics suggest that bulls are dominating and may continue to support PYTH’s upside momentum.