Key Takeaways

- Cardano (ADA) price action hints at a potential 10% price crash if the asset fails to reclaim the $0.80 level.

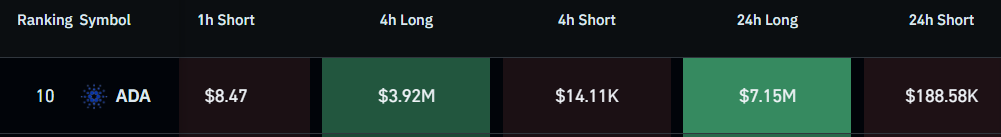

- On-chain metrics reveal that $7.15 million worth of ADA long positions were liquidated over the past 24 hours.

- Exchanges recorded an outflow of $26.66 million worth of ADA, hinting at potential accumulation.

With an 8% price dip, Cardano (ADA) has breached the key $0.80 support level it held for over six weeks. Market participants are now wondering whether this signals a red flag for ADA or if the price could see a pullback.

Cardano (ADA) Price and Long Liquidations

At press time, ADA is trading near $0.76, with a 60% increase in trading volume, indicating heightened participation from traders and investors.

With this fall in the ADA price, traders holding long positions were hit the hardest. Data from the on-chain analytics tool Coinglass reveals that over $7.15 million worth of long positions were liquidated amid the price dip, while only $188.58k worth of short positions were liquidated over the past 24 hours.

The majority of the liquidation occurred in the last hour, with $3.46 million in long positions and only $8.47 worth of short positions liquidated.

ADA’s Major Liquidation Levels

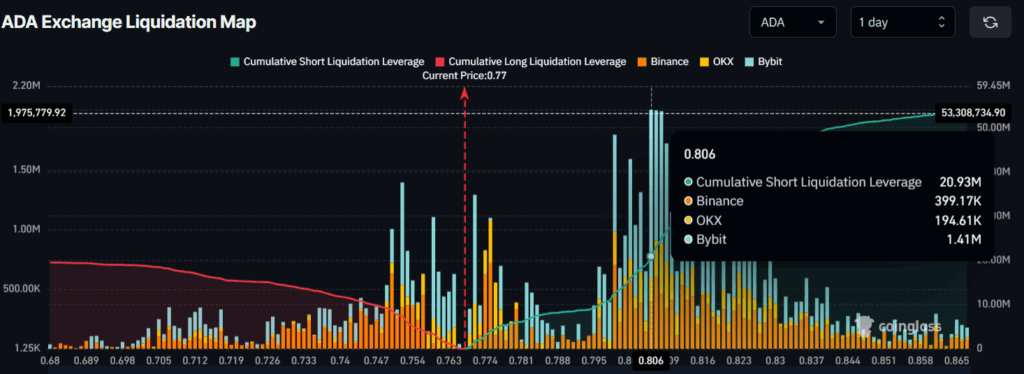

At press time, traders appear to be following the current trend by strongly betting on short positions. Data from Coinglass reveals that ADA’s major liquidation levels, where traders are over-leveraged, stand at $0.752 on the lower side and $0.806 on the upper side. At these levels, traders have built $7.29 million worth of long positions and $20.93 million worth of short positions.

If the current momentum continues and ADA hits the $0.752 level, approximately $7.29 million worth of long positions would be liquidated.

Technical Outlook and Key Levels to Watch

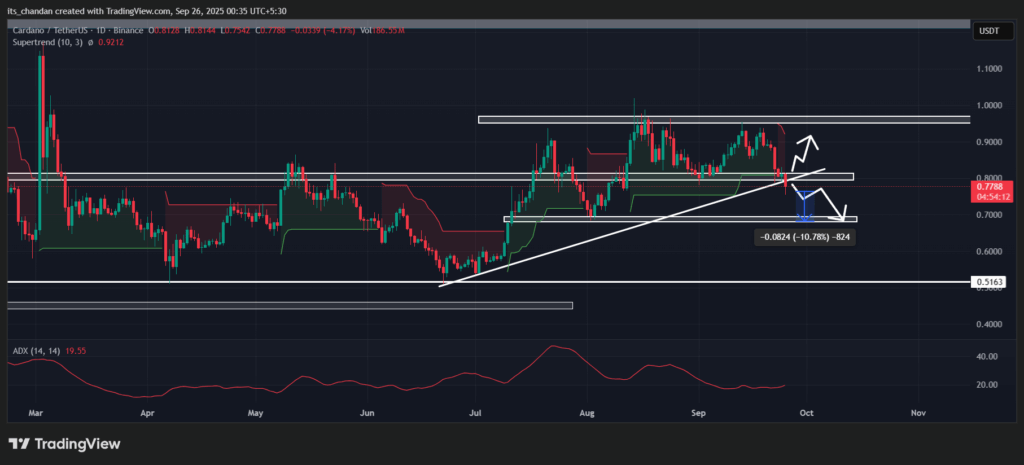

According to TimesCrypto’s technical analysis, ADA appears bearish on the daily chart as it breaks down the key $0.80 support and the ascending trendline it had held since June 2025.

However, the asset hasn’t yet closed a daily candle below this level, which would potentially confirm the breakdown. If it does, there is a strong possibility that ADA could see a further price decline of around 10%, potentially reaching the next support at $0.68.

With the price decline, ADA’s Supertrend has turned red and moved above the asset price, suggesting that the asset is in a downtrend with strong selling pressure.

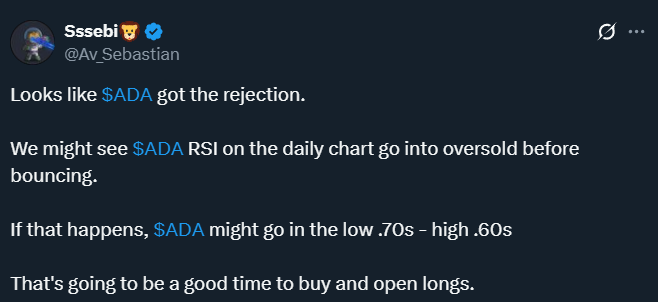

Looking at the current market sentiment, a crypto expert shared a post on X stating that ADA faced rejection and its daily RSI is heading into oversold territory. The expert highlights that if this happens, ADA’s price might fall to the low $0.70s, which could present a good buying opportunity to open long positions.

$26 Million of ADA Outflow,

Looking at the current market scenario, investors and long-term holders seem to be accumulating ADA tokens. Coinglass’s spot inflow/outflow data reveals that over the past 24 hours, exchanges have witnessed an outflow of a significant $26.66 million worth of ADA.

This indicates potential accumulation and suggests it might be a good time to buy the token.