Key Takeaways

- Crypto whales are on a buying spree, with a newly created wallet withdrawing $16.9 million worth of Chainlink (LINK).

- LINK’s exchange reserves have been continuously falling, indicating mass accumulation.

- Price action suggests that if LINK holds the $17.25 level, it could soar to $22 or even higher.

Chainlink (LINK) has once again started showing strength, thanks to its recent price action and massive whale accumulation. Today, the asset posted a 2.85% uptick, which triggered whale interest, leading to a newly created wallet address “0x8879” withdrawing 934,516 LINK tokens worth $16.92 million from Binance.

This move has sparked optimism among market participants that a major rally could be on the horizon.

Chainlink (LINK) Current Price Momentum

The whale accumulation was recorded when the price was hovering near the key support level of $17.25 following yesterday’s decline. According to the latest TradingView data, LINK has jumped 2.85% today and is currently trading at $18.55, appearing to form a bullish candlestick pattern at the support level.

Whales and Institutions Activity

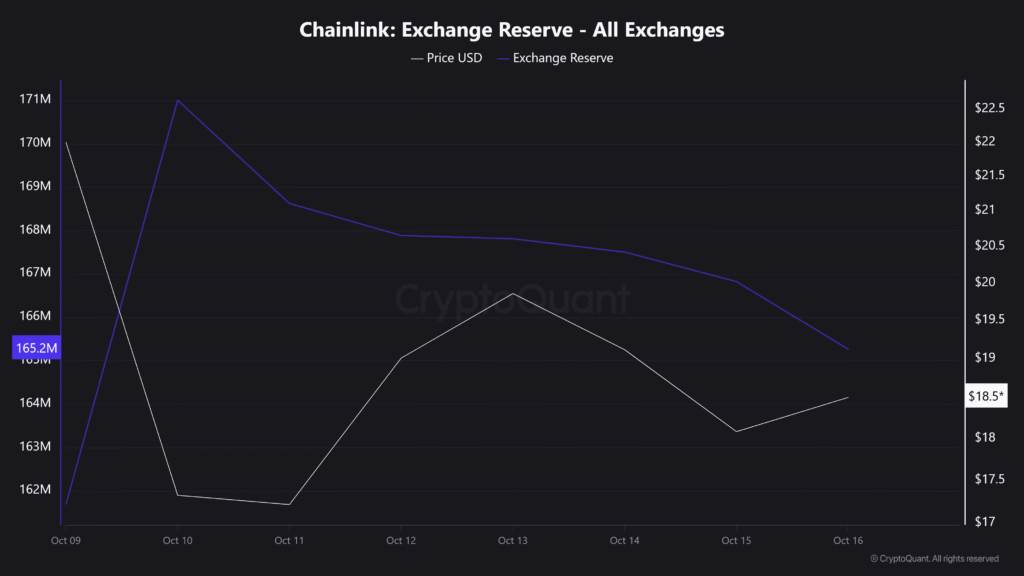

The on-chain analytics tool CryptoQuant further reinforces LINK’s bullish outlook. The platform reveals that the LINK exchange reserve across all exchanges has fallen significantly by 5.731 million LINK since the historic crypto crash on October 10, 2025.

This mass exit of LINK tokens from exchanges in less than a week indicates that whales, investors, and long-term holders have seized the price dip as a buying opportunity, following the buy-the-dip strategy.

The metric also shows that over the past 24 hours, exchanges have recorded 1.52 million LINK exits, hinting at potential accumulation by market participants.

Adding to the bullish sentiment, CaliberCos Inc. (Nasdaq: CWD) recently announced a $2 million LINK purchase. With this move, the firm added 94,903 LINK tokens at an average price of $21.07 per token. Following the acquisition, Caliber’s total LINK holdings have grown to 562,535 LINK, worth approximately $10.1 million.

Caliber is the first Nasdaq-listed company to publicly adopt a treasury strategy anchored in LINK. According to a recent report, the firm intends to build one of the largest LINK treasuries held by a publicly listed company.

LINK Price Action and Potential Upcoming Levels

TimesCrypto’s technical analysis on the daily chart reveals that LINK is in a downtrend, moving within a descending channel pattern between its upper and lower boundaries. Currently, the price appears to be at the lower boundary, forming a bullish candlestick pattern, which suggests that LINK could potentially head toward the upper boundary.

Based on the current price action, if buying pressure continues and LINK holds above the $17.25 level, there is a strong possibility that the asset could gain upward momentum and reach the $22 level in the coming days.

At press time, the Average Directional Index (ADX) has risen above 33, indicating strong bullish momentum that could support LINK’s continued upward movement.