Key Takeaways

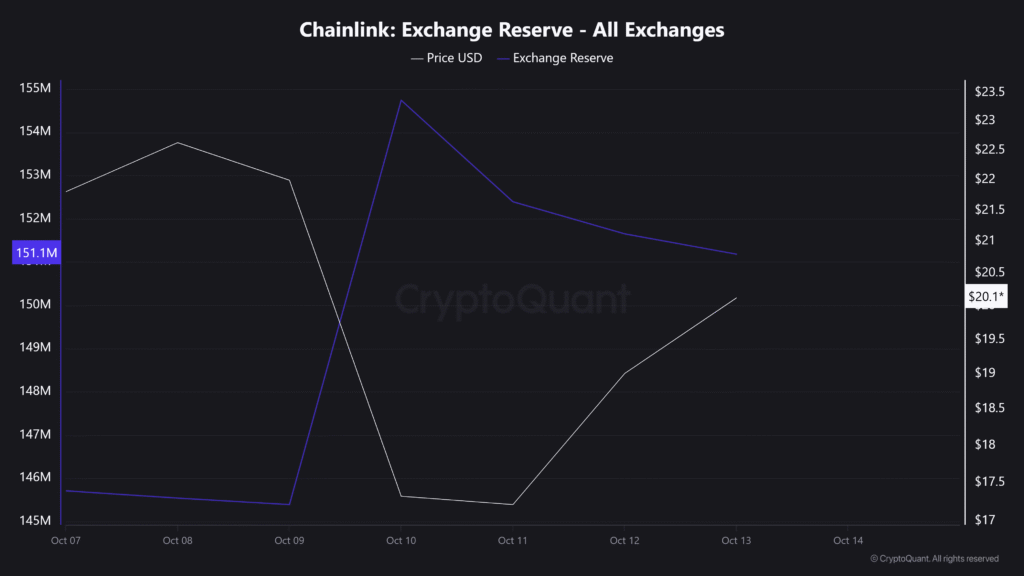

- Chainlink (LINK) exchange reserves have dropped by 3.74 million over the past week, indicating potential accumulation and strong long-term potential.

- Price action suggests that LINK could rise by 9.50% and reach the $21.85 level.

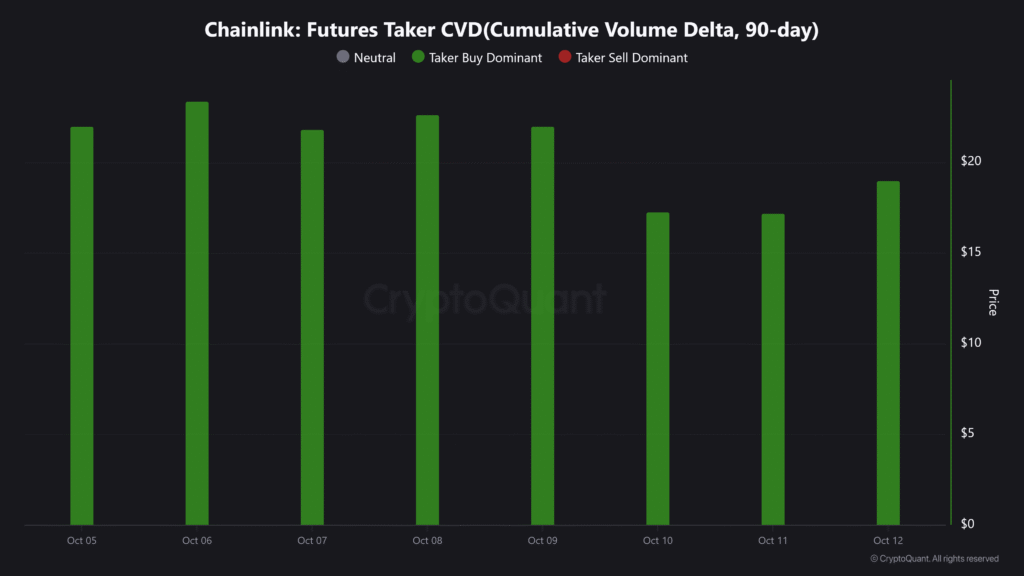

- LINK future taker CVD shows strong and aggressive buying activity over the past few days.

Following Friday’s crypto market crash, Chainlink (LINK) exchange reserves continue to decline, signaling ongoing accumulation. Data from the on-chain analytics platform CryptoQuant shows that over the past three trading days, LINK exchange reserves have dropped by 3.74 million tokens.

LINK Exchange Reserve Decline Hints at Potential Accumulation

A decline in exchange reserves typically signals potential accumulation by whales/investors as they move funds from exchanges to their wallets. This is considered bullish, not only because of potential accumulation but also because it reflects strong market confidence in LINK’s long-term potential.

Adding to the bullish outlook, the futures market for this asset showed consistent buying dominance throughout the week, from October 5, 2025, to October 12, 2025.

The on-chain metric, Future Taker CVD (Cumulative Volume Delta), indicates that LINK has experienced aggressive buying activity over the past few days. The data further reveals that, during this period, the market did not witness a single day of selling pressure.

Chainlink (LINK) Price Action and Upcoming Level

The impact of these bullish on-chain metrics is evident in the asset’s price, which jumped over 5.50% today. The asset is currently trading at $20, with strong market participation recorded. CoinMarketCap data reveals that LINK’s 24-hour trading volume has increased by 22%, reaching $1.65 billion.

Also Read: BitMine and Strategy Defy Sell-Off with 202K Ether and 220 Bitcoin Purchases

TimesCrypto’s technical analysis reveals that LINK is in an uptrend and is poised to continue its upward momentum in the coming days. On the daily chart, the asset appears to remain intact within its bullish flag and pole pattern. The price is currently trading within a descending channel, also known as a flag, and is heading toward the upper boundary.

Based on the current price action, if the upward momentum continues, there is a strong possibility that LINK could see a price increase of 9.50% and may reach the $21.85 level in the near future. Meanwhile, if this momentum persists and the asset breaks out of the flag and closes above $22, it could experience a massive price jump of 55% and potentially reach the $34.50 level.

TradingView’s daily chart shows that LINK’s Average Directional Index (ADX) has soared to 27.53, above the key threshold of 25, indicating strong directional momentum. Meanwhile, the asset’s 200-day Exponential Moving Average (EMA) remains below the price, indicating that LINK is in an uptrend.

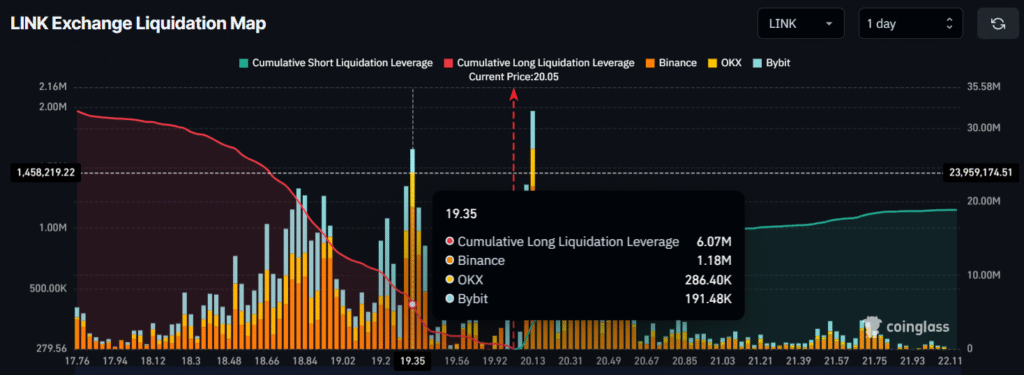

LINK Major Liquidation Levels

Looking at the current market sentiment, it appears that intraday traders are closely monitoring the market trend, as bets on the long side continue to rise.

Derivatives platform Coinglass reveals that LINK’s major liquidation levels stand at $19.35 on the lower side and $20.13 on the upper side, which are near the current price.

Data reveals that at these levels, traders have built $6.07 million worth of long positions and $3.47 million worth of short positions. However, the $20.13 level indicates that the $3.47 million short position is on the verge of liquidation and will be liquidated if the price crosses $20.13.

Read More: Will Bitcoin Price Crash Again? Whales Place Millions in BTC Shorts