Key Takeaways

- Crypto whale dumps 276,000 Chainlink (LINK) ahead of Fed meeting.

- LINK price action flashes a bullish signal, with a potential 11% price uptick on the horizon.

- Traders appear to have a bullish outlook, with $2.79 million worth of short positions on the verge of liquidation.

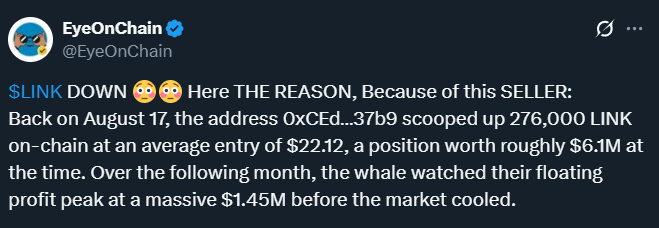

Bearish sentiment around Chainlink (LINK) is heating up ahead of the Fed meeting. Recently, blockchain transaction tracker EyeOnChain reported whale activity, revealing that a Chainlink whale has dumped its entire holdings, which were purchased just last month.

Whale Dumps $6.38 Million in Chainlink (LINK)

According to a post on X, the whale wallet address “0xCEd” scooped up 276,000 LINK worth $6.1 million at an average price of $22.12 on August 17, 2025. Fast forward to today, the whale fully exited by dumping 276,000 LINK ($6.38 million) at an average price of $23.1, securing an impressive profit of $270,000.

The question arises why this sudden dump? Why not when LINK reached $27.85, $27, $26, $25, or even $24? Why sell suddenly ahead of the Fed meeting at a lower level? Does this whale know something about the meeting outcome, or is the Fed meeting going to be a “sell the news” event?

Current Price Momentum and Rising Volume

At press time, LINK is trading near $23.20, down 1.85% over the past 24 hours. However, investors and traders have shown renewed interest in the token, with LINK’s trading volume jumping 15% during the same period compared to the previous day.

This surge in trading volume, while the price shows weakness, indicates that market participants are more interested in pushing the asset lower, which is a bearish signal for LINK holders.

LINK Technical Outlook: Key Levels to Watch

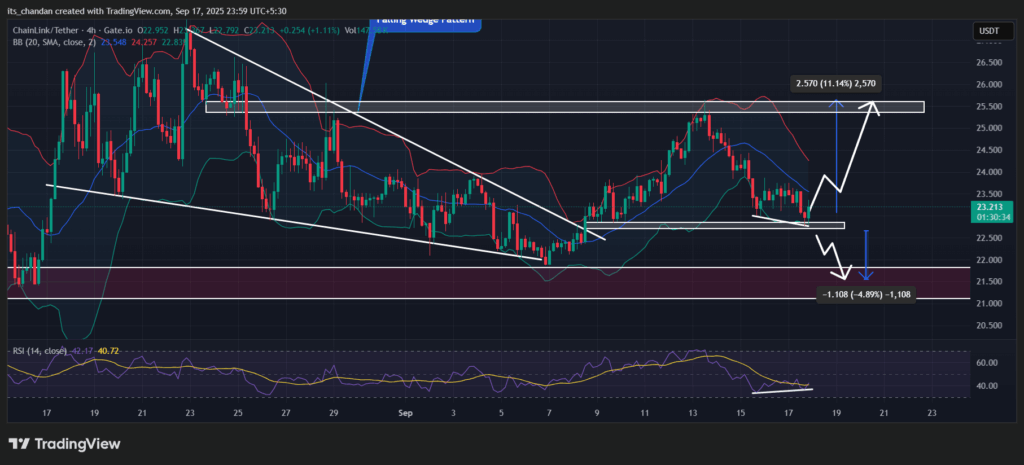

TimesCrypto’s technical analysis reveals that LINK is in an uptrend, as it still holds above the local support at $22.70, which previously acted as a resistance level. In addition, the four-hour chart has formed a bullish price pattern, hinting that a potential rally may be on the horizon.

The catalyst behind this positive outlook is the formation of a bullish divergence at a key support level. This occurs when the price forms a lower low while the momentum indicator forms a higher high, suggesting that LINK has strong upside momentum.

Historically, such patterns on the chart have often propelled the asset to higher levels, making it a bullish signal for LINK holders.

Besides this, LINK’s current price hovers at the lower boundary of the Bollinger Bands, which indicates that the token is in an oversold zone and could be primed for a potential rebound if buying pressure increases.

Based on the current price action, if LINK holds the $22.70 level, it could see a price surge of 11% and reach $25.50. On the other hand, if momentum weakens and the price falls below $22.70, a 5% dip could be likely.

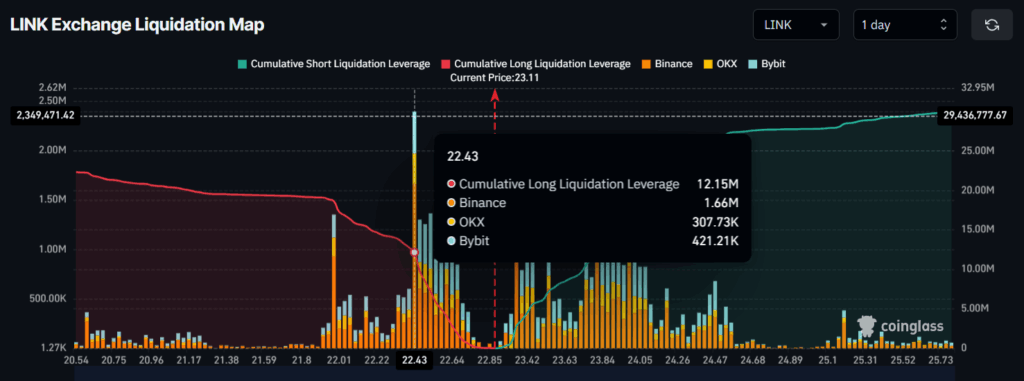

Traders’ Eyes on Long Positions

At press time, the major liquidation levels stand at $22.43 on the lower side and $23.36 on the upper side, according to on-chain analytics tool Coinglass. At these levels, traders have built $12.15 million worth of long positions and $2.79 million worth of short positions that are on the verge of liquidation.

These metrics show that traders are closely monitoring the price action and, as a result, remain bullish on LINK.